The Costs of Not Moving to Modern Online Business Systems

Online business systems in the financial sector

Modern online business systems for commercial property managers? There’s a common expression in commercial property management that real estate runs on spreadsheets. It’s true. There are four major categories in the financial investment sector:

- Banks

- Investment funds

- Insurance companies

- Real estate

Of the four, real estate lags the others in available software and systems adoption by up to 15 years. The others have invested heavily in current online business systems. As a result, they have reaped the rewards in the form of higher returns and faster response to market changes.

Let’s take a look at the ways this lack of digital sophistication has impacted the real estate management companies. Most importantly, let’s get clear on how smart executives can lead the way out of the digital dark ages.

The cost of time

The most readily observed, and perhaps resignedly accepted, is the length of time it takes to use patchwork software systems. To illustrate, imagine a business that allows the use of generalized software such as spreadsheets and word processors to be the core of its business systems. It’s easy to perceive that it uses its people to repeatedly design and maintain micro solutions to digital problems on an ad hoc basis. Obviously, this ad hoc process results in insanely inefficient use of time. Imagine trying to run a production line of cars where one person does the majority of the build on their own with hand tools and personally built fabrication jigs. Sure, a limited-run, high-end car might return value from a process like that. However, there isn’t a single real estate leader that would brag about hand-crafted, individually-constructed property reports based on the skill of individual property managers.

Workflow efficiency is a competitive advantage

There is an excellent opportunity to increase the efficiency in the preparation of reports, budgets, approvals and document travel through the use of software specific to the workflow of each sector of the real estate industry. Labour costs are one of the largest overhead costs in property management. Clearly, it’s time to move on to digital workflows that efficiently promote consistently better results while reducing individual effort.

One of the topics that come up is that of employee job security. “If I switch to an integrated system, I’ll have to lay off half the people.” That is seemingly a valid sentiment. Who wants to be responsible for half the staff losing their jobs to software?

However, that thinking has a critical flaw, and it is this: inefficiency does not secure jobs. All that does is make the company worse than the competition, and the whole company will eventually go under or be taken over. No other company is going to hang around with you in the digital dark ages for the sake of your employees. The choice isn’t between all or some; the option is between some or none of them.

Online business systems empower your staff to do more

On the contrary, if you want to save jobs, it is done by being the most efficient firm in the industry. Therefore, switching to innovative online business systems is one way to achieve time efficiency. It results in higher margins overall. Plus, it generates higher revenue per person. That is the only way to secure employment long term, and it also creates more valuable employees. Secure jobs with better pay. Use that extra employee capacity to take more market share.

Data management and document control

The typical scenario with small and even mid-size property management firms is every-person-for-themselves when it comes to maintaining a set of documents for each property and each position. Data resides on the computer hard drives of the building manager, the property manager, the portfolio manager, the regional manager and so on. In fact, it’s unlikely that a complete set of data for each property even exists in this fragmented storage system. After all, no one person has the ability to see the entirety of it.

Seeing the entire picture

There tends to be a serious lack of consistency and transparency when it comes to fragmented and siloed data filing systems. It leads to reporting with very little supporting data included. Numbers in isolation lose their credibility and reliability as there is no way to verify their accuracy or the completeness of the calculations. Warren Buffett is famously known for his detailed and in-depth research on his planned stock purchases, right down to the notes in the margins in the raw data. How can someone effectively manage their investment responsibilities if they cannot get a complete picture of their own business?

Instant access to comprehensive information

Centralized data storage is critical for managing property data. It contributes to the effective movement of information, the completeness of the records and the transition of people and properties. It is the only way to effectively scale a company and still know – and know quickly – what is going on at all levels and in all areas. KPI’s are just that: key performance indicators. They don’t give details on why things are changing. Fast responses head off developing problems, and that requires readily available information right through to the lower levels. Periodic individual compilations of data aren’t enough. Relying on an annual financial report from an outside accountant to find out if the firm made money that year is ineffective for strategic business planning. It’s too late to correct the course for that year, and possibly for the next year also.

Specialized online business systems give you the ultimate control over your data.

Security

Data security has several aspects to it. First and foremost, where are the files? Are they travelling around on personal phones and laptops? If so, the risk of total loss is relatively high due to device theft, failure of the storage media, accidental deletion, file corruption and malicious software attacks. Using office desktop computers can limit the device theft aspect. However, that’s not enough. Often, the other risk factors are not addressed in any significant way until a data loss or breach has already occurred, especially in smaller private companies.

Centralized data storage on a local network was commonplace a decade ago. In any event, times have indeed changed. Now it is considered an ineffective and costly way to address access, security and backup concerns. There is no guarantee that users are keeping files on the network as opposed to their local drives. Moreover, individual machines must be set to back up the contents of their drives to the servers. IT support is limited to external contracted services or internal staff. Purchased equipment asset lifecycles have more influence on upgrades than the changing security environment does, resulting in less than stellar data security.

The best business systems currently use online software hosted on large server farms. This economy of scale leads to five critical improvements.

First

The actual hardware is now in a competitive environment: Amazon, IBM and Microsoft all provide hosting services. The primary competitive edge is hardware performance vs. cost. Everything is best-of-class. Additionally, users can scale immediately based on need, not whether cash or financing is available to make computer equipment purchases.

Second

The “big 3” all provide automatic backups and data storage redundancy.

Third

There is real-time monitoring of the system health, intrusion detection and security by specialist professionals and enterprise-level software systems.

Fourth

Hosted software systems automatically centralize all data storage by default. There is no need to control individual devices to make sure files are intact and backed up.

Fifth

Access to files and sensitive information is also controlled centrally via the software system user credentials.

The right online business system reduces the non-stop burden on the internal IT department. Management of hardware performance, security and backups are professionally managed with best-of-class services and technology.

Agility

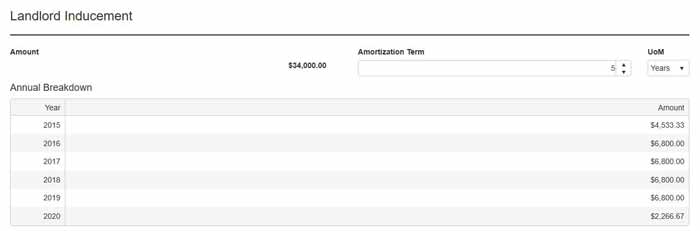

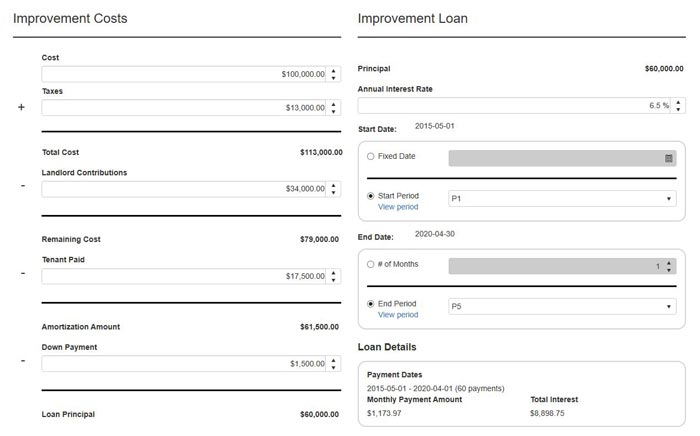

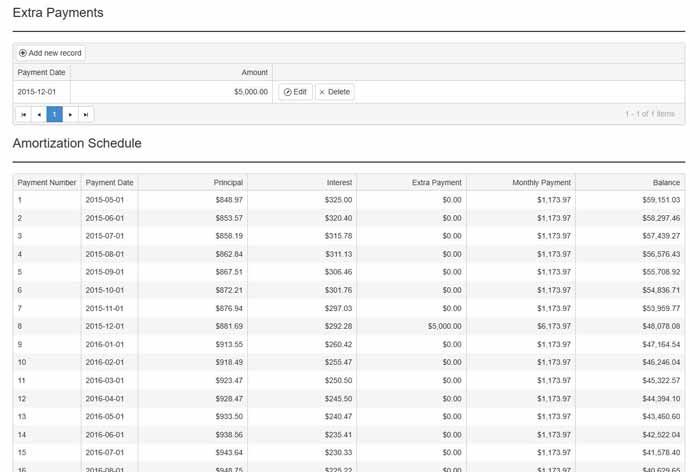

The agility to structure deals in new ways to meet a rapidly evolving real estate landscape is vital for business competitiveness. Markedly, it is an often overlooked aspect of what specialized, online business systems can offer. Previously we talked about landlord-tenant loans and how they can provide compelling advantages over traditional lease financing methods. The days of buying an accounting system and adding property management modules to it are fortunately heading into the long-awaited sunset. User experience and intuitive workflows are crucial now, making the software conform to the user rather than the user to the system.

Connectivity is the holy grail of data systems. Users can record and access relevant data from anywhere with their workflow. Plus, it is automatically accessible to others who also need it. Information becomes consistent and coherent, no longer dependent on a single individual’s performance and skill.

Opportunity costs drop to their lowest possible value with agile systems as such business systems consistently avail of the optimum response. Say goodbye to lost opportunities due to systems that cannot record the necessary information. No more missed gain waiting for software releases to catch up to what is already possible in real life. Best practices can become the default standard for a business that uses a software system optimized for their industry.

Monetary considerations

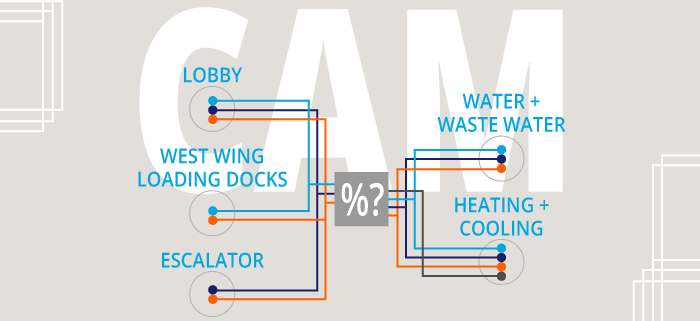

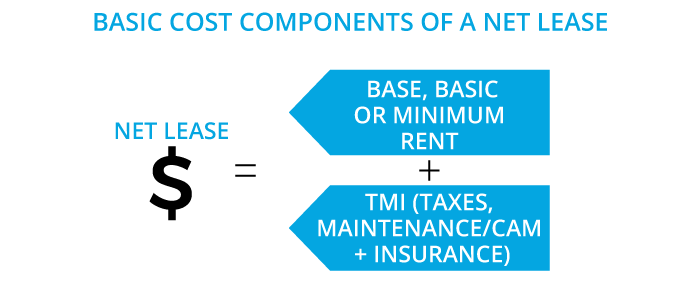

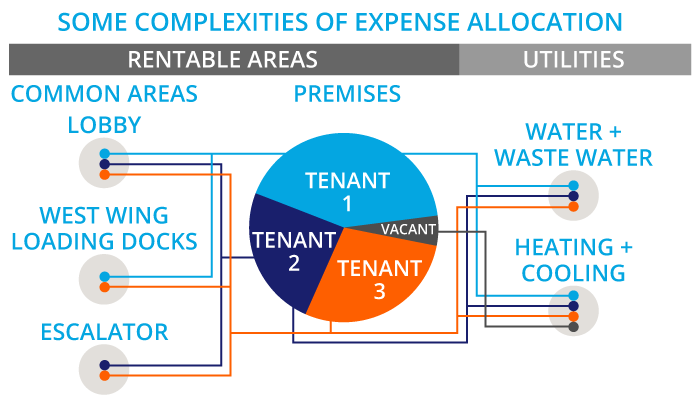

For commercial real estate management, the big one here is slippage. The inability of user-created spreadsheets to correctly handle complex cost recovery calculations isn’t the fault of the spreadsheet. It’s often simply too complicated and too time-consuming to create the correct formulas to do the math accurately. You can read more on the complexities of these and CAM calculations here. The resulting slippage is either accepted as an alternative to spending time doing the math, or as lost audit challenges from tenant lease analysts.

Other direct losses occur from insufficient management data to see developing trends and make timely decisions. There is an incorrect assumption that past data is sufficient for future performance predictions.

As an example, there was a period where the bitumen supply for roofing and asphalt paving was of low quality when prices for oil sands products rose sharply in the late 1980s. The effects were not immediately known. However, BUR (Built-Up Roofing) systems and parking lots started incurring significant maintenance issues and costs as early as 13 years into the expected 25+ year life cycle. Roof systems and parking lot replacements are the two most capital intensive prospects most properties ever face, and as a result, these costs were unexpectedly early. Aggregate information gathered from properties with this type and vintage of roofs and parking lots could have alerted property management firms of this issue. The managers could then strategically prepare to either dispose of those assets or plan for the capital expenditures.

Professionalism

One of the most significant benefits of adopting advanced business software systems is the substantial increase in professionalism. Due to the consistency and detail that is readily available in such systems, there is a marked increase in reporting speed, authority and accuracy. Internal audit capabilities can prove that accounting documents comply with the lease documents terms. Consequently, the company can be confidently transparent in its dealings with tenants.

The move to current online business systems

Staying in the digital dark ages will put real estate management companies out of business. Real estate is big business and forms a significant part of the financial investment portfolio. All of the other three sectors of banking, investment fund management and insurance have surged ahead with sophisticated software systems. Inevitably, the real estate management sector will also experience the same changes to software systems. In fact, there is much evidence that the change is already occurring. There is a rise in the number of available software systems for the residential, multi-tenant management companies. Commercial net lease real estate management systems have been much more challenging to develop. Fortunately, newer entries, such as CRESSblue, are now forcing change into the sector.

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.