Commercial Landlord-Tenant Loans: Yes or No?

Landlords and property management companies don’t often employ commercial landlord-tenant loans during lease negotiations. In our experience, there are five main reasons for this. Here we break them down and investigate their validity. Additionally, we show ways that commercial landlords benefit from providing tenant financing options.

Would you give a tenant financing?

Ask commercial landlords if they would consider giving a tenant a loan to pay for improvements to the leased premises. You are likely to hear one standard response:

“We don’t do loans.”

If you press them further on why they wouldn’t consider financing landlord-tenant loans when negotiating new lease agreements, additional reasons come up. Let’s examine the logic behind the most commonly expressed justifications.

Reason #1: We’re not a bank

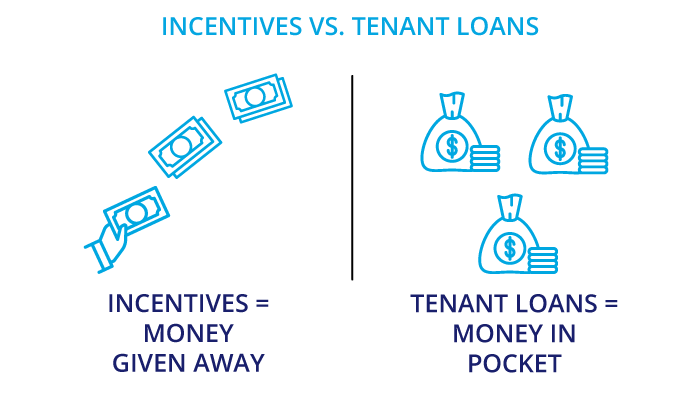

This reason is brilliant! Banks take money from clients, pay those clients some interest, and lend it out to other clients for higher interest rates. The banks profit. On the other hand, landlords usually take money as rent and give portions of that money away on various leases as incentives or allowances. In this scenario, landlords do not profit on the dispersed money. Indeed, that is not bank-like behaviour.

Banks make money on everything they offer to clients. So, it isn’t a proud moment for a business owner to give this reason for not doing landlord-tenant loans. To clarify, why would you choose to give money away rather than loan it out at interest? It’s true, your real estate company isn’t a bank. However, there is a compelling case for making loans instead of giving away incentives or allowances.

If cash flow is a concern, consider borrowing against the equity in the building. It is much more likely that a bank will lend a building owner money for property improvements than a tenant who needs business financing to scale up to a new facility. Concurrently, mortgage interest rates for loans secured against real estate are lower than unsecured loan rates. Therefore, it is easier for a landlord to secure financing, and at a lower rate, than it is for a tenant to obtain unsecured credit. This interest rate spread works to the landlord’s advantage. The landlord could not only borrow at a lower rate but also lend to the tenant for a 4-6% interest rate spread. The one-source deal for the property and funding is markedly in the landlord’s favour if the alternative is sending a tenant to their bank for a loan.

Reason #2: We don’t want the risk

Risk of what, exactly?

Without a doubt, loans have a risk factor for defaults. Although this may be true, giving money away is always a 100% loss. It’s a complete write-off every single time. There is no possibility of recovery, full stop.

To be sure, giving away money removes the ongoing risk of default. However, it is very doubtful that the incentive process was designed with this purpose in mind.

As a matter of fact, landlord-tenant loans are far less risky than any other method of getting money to a tenant. A tenant loan comes with a low risk of default. In contrast, an incentive or allowance comes with a complete loss.

Evidently then, the way to remove risk is to secure the loan through the lease agreement and not by explicitly accepting a complete loss from the outset.

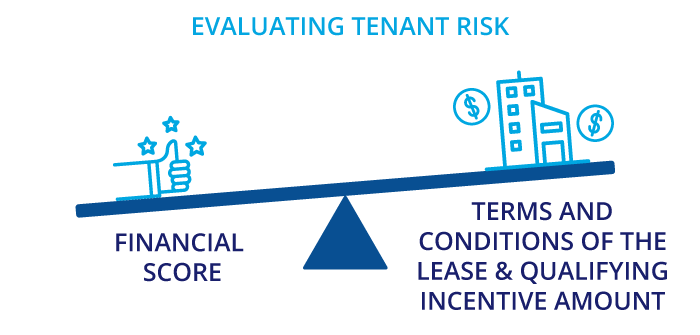

Evaluating tenant risk

Every tenant gets evaluated on their creditworthiness when they submit a lease proposal. The financial score factors into two key lease components. Firstly, it impacts the terms and conditions of the lease. Secondly, it affects the qualifying incentive amount. Tenants that have a strong financial showing receive more favourable lease terms, lower rates, and larger incentives. Regardless of how credit or monetary rewards are extended, the same type of financial analysis is performed.

Furthermore, a modified lease agreement is sufficient to secure the tenant loans. In a properly written contract, a tenant cannot walk away from the loan without also losing the premises. This provides additional security to the landlord.

Reason #3: Tenants want free things, not loans

Is there resistance to loans from the tenant side? Obviously, it doesn’t make sense to pursue the loan option if there aren’t tenants willing to take that route. But is this really the case?

Tenants want the premises optimized for their foreseeable business needs. That is the overall objective. Exactly how it is accomplished is another thing. Notwithstanding the fact any tenant would take free incentives over paying for them, it doesn’t preclude using other means to achieve their objectives.

What drives the requests for incentives and allowances?

The need for finances beyond what a tenant can carry at the time of the move drives the requests for incentives and allowances.

Firstly, moving disrupts a tenant’s income stream. Before the move, staff evaluates the amount of space needed and the type of facilities that could improve work processes. During the move, the team faces ongoing disruption from regular routines. Uncertainty slows whatever production is still able to go on. Moreover, the staff still working are doing so without the full strength of the workforce and leadership.

Secondly, equipment is often disconnected and reinstalled in the new premises. This equipment disruption additionally reduces output. All of this is happening at a time when the old facility was already inadequate for production requirements.

Only charities and non-profits work on the business model of getting things for free. Every other for-profit business operates with the assumption they will have to pay for the things they want. What most tenants need isn’t so much getting things for free as the ability to meet financial obligations during a time of reduced cash flow. For this reason, deferring payment for significant expenses during this period of unforeseen costs and low productivity is desirable. Providing financing for a tenant is an acceptable method of easing the transition to the landlord’s building.

Reason #4: We aren’t set up for making loans

Let’s break this down into two parts: internally working out how much to loan and what to finance, and dealing with the loan itself. We’ll investigate the business systems portion of how to deal with the loan in reason #5.

What to finance?

This isn’t really that difficult. As a landlord, you can start with whatever improvements that you might otherwise consider giving as incentives or allowances. As has been noted, loans provide a greater chance of getting your money back than incentives. Owing to that fact, you could consider other work the tenant would want but would be too costly to otherwise capitalize.

For example, perhaps the building really could merit the installation of two additional loading docks. The tenant may not have the cash to do the work now but could benefit from the increased productivity the docks could provide. The landlord may not be certain that the new doors would generate high enough rents in the future to cover the capital cost now if given as a free incentive. A landlord-tenant loan would enable both parties to achieve their objectives now. It’s a win-win situation.

Here is where another real benefit shows up. The tenant loan agreement has created a situation in which the landlord’s building has actually increased in desirability!

Offering a tenant loan creates leasing possibilities that wouldn’t exist otherwise in the world of free incentives and allowances.

How much to finance?

If a property management company is prepared to offer a tenant a loan, how much should it offer to finance? A risk limit was already determined during the review of the tenant’s offer to lease. The financial standing of the tenant and the proposed terms of the lease deal determine the amount of money normally allocated for lease allowances in cash or landlord’s work. Given that incentives would otherwise be given out with no expectation of a return, this amount is easily justified within the existing business decision process.

What about additional work that might otherwise be a capital expense? The landlord-tenant loan is unique in that the landlord has an amazing amount of extra control that a bank doesn’t have.

For one thing, the landlord has control over exactly what will be done. It has the right to examine the scope of work proposed, to approve how it will be done, and what materials will be used. The landlord can choose to finance work that is more generally suitable for the building and its functionality. It can opt for improvements that are likely to generate higher rental rates with subsequent leases.

As discussed in this lease improvements article, the landlord owns all the improvements made to the building. The asset’s value fully secures the loan. The fact that the landlord owns the leaseholds they financed mitigates the risk of loss. Regardless of whether the tenant defaults, the building still has the improvements.

Reason #5: Our business systems don’t support loans

Now that is a problem!

Most business decisions follow the path of least resistance to an acceptable solution. The result is generally a solution that does not deliver optimal results. If perfection takes too much time to work out and implement, then less-than-perfect suddenly becomes acceptable. Any time a business process adds too many steps to a workflow, the best solution will be abandoned for the most practical solution by those required to implement it.

As we have seen, the financial evaluation for landlord-tenant loans is the same process that is used to evaluate any tenant’s creditworthiness. The same types of improvements are available for consideration. However, the value of them can increase due to financing the improvements (rather than writing them off or capitalizing them). Clearly, the case for landlord-tenant loans is solid. On the other hand, considerable resistance exists via property management business systems that don’t support the ability to account for tenant loans.

Ideally, the system would show all aspects of the lease costs in one place:

- The total cost of improvements

- The landlord contributions via incentives or allowances

- The tenant’s contributions

- The tenant’s down payment on any excess over approved expenditures

Following those records, the business software should have the ability to:

- Generate a loan amortization table for use as a lease schedule

- Account for loan payments on the lease invoices

- Record any extra or lump sum payments and adjust payment schedules

- Keep track of the loan through any of the tenant, property, lease, and financial records simultaneously

- Adjust automatically to the lease term dates in case of delays in the lease commencement

Does such an ideal business solution exist? It exists in CRESSblue. Register for your discovery demo today.

Making the case for landlord-tenant loans

Indeed, making loans available really helps smaller companies with limited cash get into a lease agreement. A loan creates possibilities that wouldn’t otherwise exist for both the landlord and the tenant.

Additionally, it can be an easy revenue source for landlords. The legal cost combines into the existing lease agreement setup. It’s a natural source of extra income derived from a property.

A tenant loan offer can significantly lower the amount of incentives a landlord would otherwise give away. Tenants ask for landlord incentives because they don’t have the cash flow or ability to finance the work themselves. Landlord-tenant loans can work out very well for both the landlord and the tenant.

It doesn’t create any extra work in evaluating the loan risk or scope of work. It’s all within the original capabilities and expertise of the persons already making those decisions.

As a property management company, you want your business software systems to support the best business practices. If your systems make the ideal outcomes the easiest outcomes, you will get better results as the default workflow. Limited software systems not only waste efficiency; they also waste opportunities. In contrast, ideal systems create opportunities to allow competitive advantages others cannot match.

Effective leadership is about seeing opportunities and enabling others to seize them. Add landlord-tenant loans to your toolbox and get the business systems in place to implement your new best practices. Make the path of least resistance the optimum outcome.

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.

[…] alternative to tenant improvement allowances is the landlord-tenant loan. While there is some default risk here, it is far less risky than essentially giving away money in […]

[…] aspect of what specialized, online business systems can offer. Previously we talked about landlord-tenant loans and how they can provide compelling advantages over traditional lease financing methods. The days […]