How to Ensure Accurate Property Management Accounting: Management Versus Ownership

Property owners sometimes unknowingly fall into a trap of their own making. They buy a property to house their business and rent out a portion to other companies. As a result, they get some additional revenue and build their portfolio. So, where’s the trap?

Businesses that aren’t real-estate savvy often don’t know the difference between accounting for their initial business, property investment accounting and property management accounting. However, if ignored, there are crucial differences that can cost an owner money. Or worse, it opens them up to liability and legal action.

Let’s take a look at a scenario where the business ownership and the property ownership became thoroughly entangled over the years. And what they should do to correct it.

Business owners who own their property

Tom, our fictional property owner, has accumulated a small portfolio of commercial buildings in this scenario. He owns these in conjunction with his long-time business partner, Fred. However, Fred is a silent investment partner and hasn’t been involved in the business operations. Tom and Fred have been modestly successful at Widgets, Inc., building a solid business making widgets over the last two decades.

It made sense for Tom and Fred to purchase a property for their own business needs as they started to grow. They found a good location with some extra space to lease out as a business investment. The new site gave them additional room to grow Widgets without the disruption of moving their business again in a few years. Tom managed the properties himself. This was a solid decision and served them well. Until it didn’t.

Merged property management accounting

Tom didn’t set up a property management company when he acquired his first investment property. Instead, as is typical in these situations, he had his Widgets company bookkeeper do the basic rent invoicing. Tom managed the property informally, with the building and property maintenance expenses processed and paid for by Widgets Inc. There wasn’t any formal budgeting for the property management. Instead, Tom treated it as building maintenance for Widgets Inc.

When Fred and Tom acquired another property, they followed the same management style. They did not create a formal property budget, and the realtor delivered a mix of primarily gross leases and some base-year leases. As a result, most leases didn’t require any reconciliations and the ones that could have been reconciled simply weren’t. At year-end, no one in the company knew what the reconciliation process entailed, so the property management accounting was lumped in with the business. They assumed that the corporate accounting firm would have flagged it if it were important. No one thought to ask the external accountants directly.

Years pass by, and Tom and Fred are mostly retired from the daily operations. Control has passed to Fred’s son Ben and daughter Alex who both work in management at Widgets. Both are technically savvy and have implemented digital technology into Widgets’ operations. However, Alex wants to get the neglected property portfolio sorted out and is looking for a property management accounting solution. She contacts CRESS about CRESSblue Commercial Property Management Software and arranges for a demo. Alex wonders whether CRESSblue can post transactions for the property management to Widgets’ accounting package.

Unfortunately, there is a larger issue here. The property management accounting records have become merged with the Widget company manufacturing business records. In reality, they should be two businesses with separate accounting records.

Why property management accounting needs to be separate

A single corporate structure that worked when PM operations were very limited or insignificant is no longer working effectively. While it seems that adding another corporation would entail much more work, that isn’t true. Imagine that a single folder with all your documents is the simplest file structure. Certainly, adding more folders will increase complexity, but it also makes your workflow exponentially easier! It is much less complicated to find, track and use appropriately segregated files for efficient workflows.

Corporate structures and accounting records are merely means of separating business operations. Just as you wouldn’t use one folder to organize all your files, you shouldn’t expect that one corporation is the simplest and most efficient way to organize business activities either.

Widgets Inc. is both the property owner and a tenant in its own building. As the owner, Tom will want to see the overall property and financial reports. First, however, he will have to set up Widgets as a tenant for its portion of the expenses in a multi-tenant building. That way, it will see only its proportionate share of the common area expenses, and its corporate records will accurately reflect the cost of its tenancy in the premises.

Most commercial leases require property expenses to be distributed proportionally based on rentable area. When the accounting records are merged with the books of one of the tenants (even if the tenant is also the property owner), it is easy to introduce errors that result in noncompliance with the terms of the leases. Additionally, if one of the tenants requests an audit of the property accounting records, does Widgets Inc. want to expose its entire operation to a tenant’s auditor? Tom and Fred would avoid this situation entirely by structuring the property management as a separate company.

Business Management versus Property Management

In standard business practices, a company offers property management services to the public, and owners approach them to manage their properties. This only becomes an issue when the separation between the two businesses is grey. This scenario shows up in various manifestations, but they have several characteristics in common:

- Property owners request the rents be deposited directly into their bank account, not the property manager’s bank account.

- The properties are individually owned by a corporation, and each property is a separate corporation.

- Often the property-owning corporations have the same or a similar group of owners.

- If accounting records are kept, the PM company does them in the name of the corporation that owns the property.

What is occurring here, besides a lot of confusion in accounting records and very inefficient workflows?

Business Management

What these characteristics describe isn’t property management. Instead, it is multiple business management that combines several parties in ownership and operations.

The questions potential customers typically ask that indicate this type of setup are:

- Can we link multiple accounting databases into CRESSblue?

- We use 100+ bank accounts to deposit rents—one for each property. Can we connect all of them to CRESSblue?

- It takes a very long time to process our incoming mail because we have numerous spreadsheets and accounting files. Can CRESSblue speed that up?

In theory, holding the property ownership in separate companies keeps any liability incurred on one property from flowing across to another property. It is supposed to keep the assets separated from the risk.

In practice, the owners have handed off the liability-producing activities from property management operations to a third party, who then uses the asset-holding company to run those operations. Liability doesn’t come from holding property; it comes from operations on that property that involve the public and tenants. Therefore, it doesn’t make any sense to hold property and then let a third-party property manager use that company to conduct operations. It’s now become the worst possible situation for cross-liability.

This isn’t property management in a corporate setup. This is business management, with a convoluted and labour-intensive process.

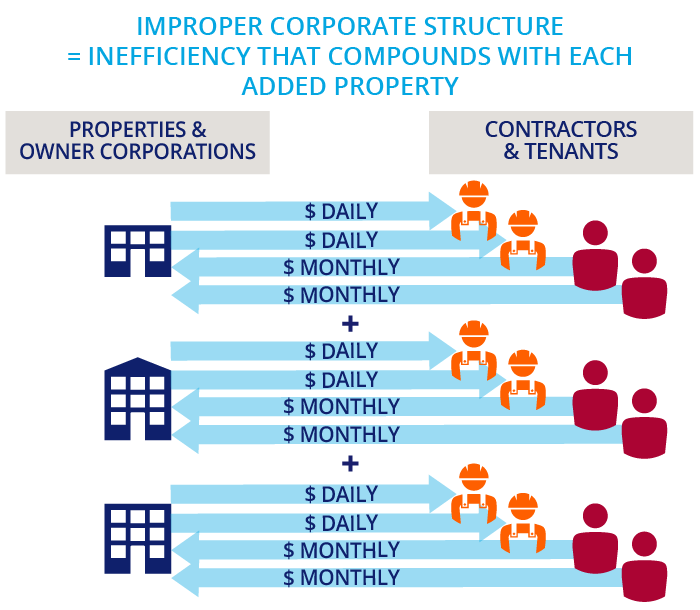

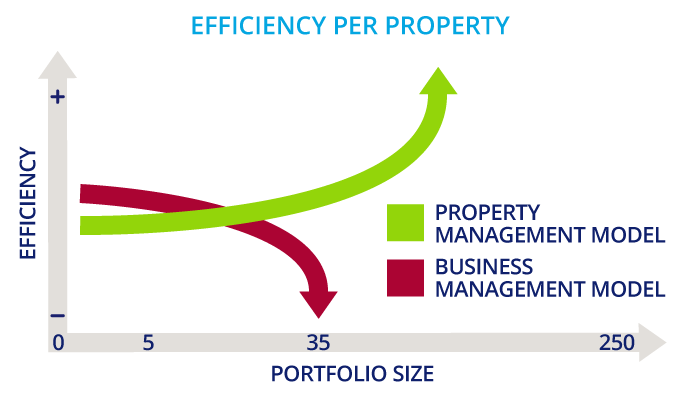

The business management model isn’t scalable. Each managed property has its own set of accounting records and chart of accounts. When the accounting is done individually in each property-owner company, the accountant must open each set of books and record each transaction. As each chart of accounts is different, it gets harder and harder to memorize the correct accounts as more properties are added to the portfolio. In fact, this business model is worse than simply additive. All familiarity present with a small portfolio is lost, and the accounting process slows for each company as more and more accounting books are added. This model only works for very small portfolios.

Each commercial property will average 70-120 vendor transactions annually per building for property management operation, depending on the PM services performed. Experience shows us that the business management model tops out at less than 35 properties per person.

Alternatively, using the extreme automation in CRESSblue, one accounts payable bookkeeper can reasonably expect to enter 100 transactions per day. There are about 250 workdays in a year. Therefore, one AP accounting person can annually manage up to a whopping 250 properties using CRESSblue!

Imagine how an improper corporate structure translates into significant revenue loss due to wasted time deciphering, recalling and correcting account transactions and workflows, not to mention the slippage due to human error. A company set up like this is impaired by the pressure to hire excess staff to compensate for inefficiency and the inability to add properties to their portfolio confidently and rapidly. The company bogs down quickly, and it is difficult to restructure when the company hits the maximum workload.

So, what is the correct way to structure property management versus property owner companies?

Property Management

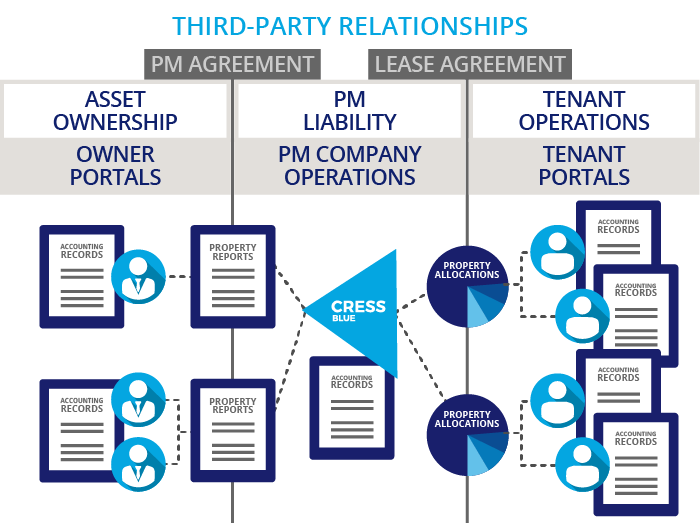

Property management should be separate from property ownership for two reasons.

The first reason is to keep the public liability from the operations separate from the asset holding corporations. This limits the risk exposure to the property asset itself. For example, suppose a tenant or visitor sues the winter maintenance contractor and property management company for a slip-and-fall accident. In that case, the property owner isn’t automatically also exposed to the claim, and therefore neither is the asset.

Secondly, they are separate businesses. There’s a reason that accounting software packages only allow one set of accounting records for each company. The companies should be kept separate. If a third party is running the property management operations for the property owners, there needs to be a property management agreement between the two independent companies. A property management company isn’t an accounting service for business owners.

Businesses need accurate property management accounting

Property management companies initiate, charge and record services such as:

- Hiring contractors for maintenance and repairs

- Processing and paying contractor invoices

- Receiving and documenting rent revenues

- Managing operating and reserve funds

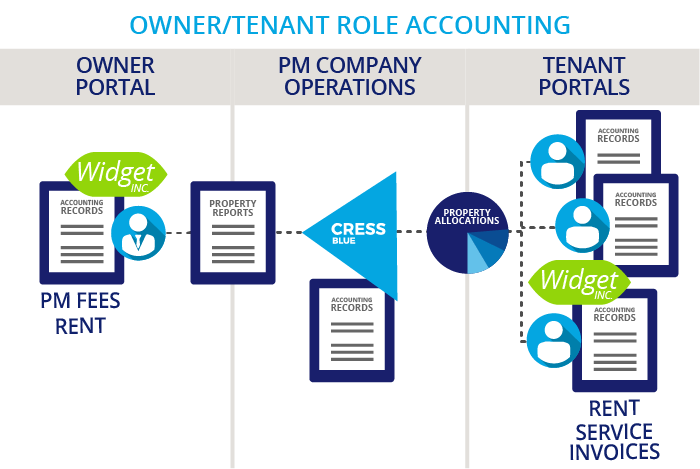

Property management software like CRESSblue is designed to manage properties. It allows for standard accounting protocols to be followed for properties that the PM company owns and operates or those it manages on behalf of a third party. It does this by separating the third-party management services from the PM company-owned management to provide accurate reporting.

With automated property management software, owners have access to their documentation and records through secure owner portals. Each month, the software generates property management invoices, automatically picking up all the tracked PM activities that generate fees for the PM company. These fees and activities include percentages of base rent or additional rent, vacancy or occupancy fees, and a PM company’s numerous services.

These PM invoices are automatically generated and provide a record of the previous period’s activities for the property owners. In addition, owners can get property and financial reports, as well as reports that are automatically triggered by specific activities such as a new lease, budget or a property reconciliation.

How to structure Property Management accounting

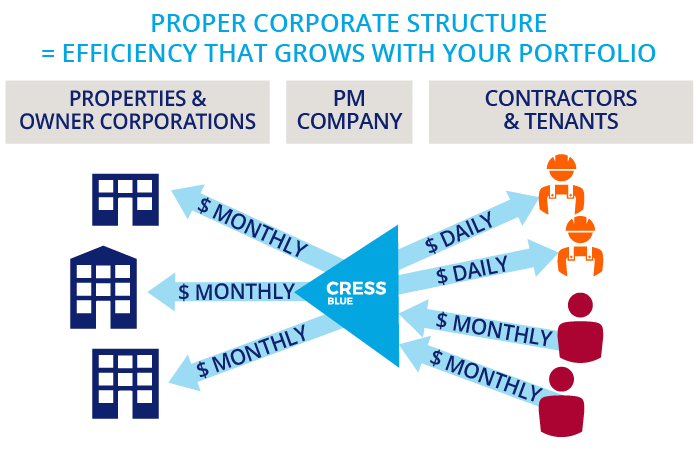

Property management operations should be conducted within one management company to limit the spread of liability and make the workflows easy to follow. All accounting entries are completed in one system and tracked to each property, tenant, and property ownership company. The accounting entries are automatically pushed to a linked accounting system. All property and financial reporting are self-contained within the integrated systems.

Property ownership remains in property-owner-controlled asset holding companies. A formal property management agreement is the contractual basis for the services rendered by the PM company. All that is recorded in this company’s accounting books are asset-related corporate accounting entries and monthly PM services invoices.

Rents are deposited into an account set up by the PM company. Owners access their property and financial reports via their secure portal. Only one accounting entry needs to be recorded in the owner’s books each month that details all activities and records the revenues and expenses, including the property management fees. The net revenue is remitted to the owner each month and deposited in their corporate bank accounts.

Sometimes a formal property management agreement isn’t enough to satisfy the property owners. In that case, a PM can use a separate bank account controlled by the property owner to hold the funds securely. These separate bank accounts can still be linked to the central property management accounting software and reconciled within that one system.

CRESSblue fully supports this property management and asset ownership business structure.

Better systems get you better business

Scaling the business management model is additive—each new client adds to the workload, and after a certain point, the sheer number of accounting books becomes overwhelming to manage. It also is unsatisfactory in separating the liability-producing operation activities from the asset holding company.

Doing all business through a PM company that uses accurate property management accounting practices reduces the work per client. The same set of operational accounting records is used with minimal additional overhead for the automated document generation and PM fees tracking in CRESSblue. The more clients you have, the more efficient CRESSblue becomes per client.

In addition, separating operational liability from asset ownership is an effective way to reduce the total risk exposure of property ownership.

As always, consult your lawyer, accountant and insurance advisers for advice specific to you.

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.

Great read!

Understanding the difference between management and ownership is key to accurate property management

Thanks for sharing these helpful tips!