How are Leasehold Improvements Accounted For?

What are leasehold improvements?

Leasehold improvements are construction that is done to the premises a tenant is leasing to make the space functional for them. Depending on who pays for the improvements and who owns them, there are a variety of legal ways in which the costs are accounted for. Commercial tenants will want to be sure they aren’t paying for them twice.

How do leasehold improvements work?

When a tenant looks at commercial property with the intent to lease the space, there are usually things that they will need to make the space more functional for them. This might include more private offices, additional meeting spaces, separated workspaces in the open warehouse or additional shipping doors. The tenant’s broker will typically insert these into the Offer to Lease under the Landlord’s Work section. Once the landlord gets the offer, they will move many items to the Tenant’s Work section, depending on the future value of the suggested leasehold improvements.

Here is where the first important distinction appears: ownership of the leaseholds isn’t necessarily determined by who pays for the work. Payment of the leasehold improvements is a negotiated deal, but ownership is usually determined by the terms of the lease agreement itself.

Who owns the leasehold improvements?

It might be logical to think that whoever pays for the improvements would own them, but this is usually not the case. Nearly every commercial net lease makes the leasehold improvements the property of the landlord immediately upon completion.

Furthermore, the lease will still require the tenant to maintain the improvements as if they still own them. They do not become the responsibility of the landlord in any way, which includes insurance. The tenant is required to insure the leasehold improvements and to use its insurance to rebuild those improvements if the building is damaged. A lease may even require a tenant to remove or restore parts of the leased premises after the lease term is over, depending on what was negotiated in the lease. It may seem unfair, but leases aren’t inherently fair. Above all, they are an agreement for allocating risk and responsibility in exchange for money and the use of real property.

The 3 ways in which leasehold improvements are paid for

There are three main methods for handling payment of leasehold improvements. None of the three methods is inherently wrong or better than the others.

The first way of handling payment is for the tenant who is leasing the premises to pay directly for all of the work that is done to improve the space. All they seek from the landlord in the lease is the approval of the landlord on their proposed work. The tenant hires the contractors, manage the process and pays for the work. In this case, the rent is based on the premises essentially “as is”, and no account is made for the tenant’s improvements in the base rent number (also called minimum rent).

The second way is for the landlord to provide a monetary incentive to induce the tenant to make a better lease offer, which could involve the tenant doing more Tenant’s Work or staying for a longer term. This inducement amount is either a fixed amount or is given as “X” dollars per square foot to be paid to the tenant to offset the cost of the improvements. Inducements are typically incorporated into the base rent and from that perspective are invisible to the tenant. This is like a cash-back offer, for the reason that the value of the cash back is incorporated into the price. Inducements allow the tenant additional funds when cashflow due to moving disruption can be an issue.

The third way is for the landlord to do the leasehold improvements by doing the work and paying for it. This can be tricky from a tenant’s perspective because the cost of the improvements may be bundled up into the base rent number.

Leasehold improvements are accounted for differently depending on who pays for them

If the tenant pays for the leasehold improvements directly, they are categorized as CCA Class 13 on a Canadian corporate tax return. These improvements are subjected to the half-year rule and are amortized using the straight-line method (meaning the same amount is expensed in each period) over the initial term of the lease.

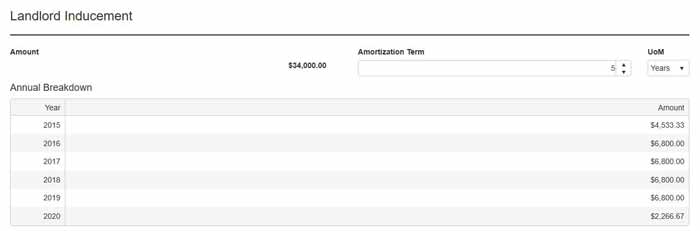

If the landlord pays an inducement amount to a tenant to offset the costs of the tenant’s work, it is considered income to the tenant. The tenant may use the inducement amount to offset the capitalized costs directly to defer the tax impact. The landlord could treat the inducement amount as a current deduction if it is clearly for the purpose of obtaining that particular tenant, but more likely will amortize the expense over the initial term of the lease.

If the landlord incurs the cost for the leasehold improvements directly and if the costs are of a nature that isn’t specific to a particular tenant, the costs can be capitalized to the building. For tax purposes in Canada, they are then categorized as CCA Class 1, and a declining balance depreciation rate of 4% is used. The base rent is considered only rental income.

What are blended base rents?

If the costs of the improvements are bundled into the base rent and recovered that way without specific disclosure, several things occur.

First of all, the base rent is still treated as income, but part of it is actually a return of capital to the landlord. It would be more accurately described as a rent payment and a loan payment combined. It often seems less confusing to unsophisticated landlords and tenants as it presents only two payment numbers: one for rent and one for the additional rent (or even just one number if it’s the tenant is paying gross rent). The problem for the landlord is that it is paying income tax on money that isn’t really revenue. Concurrently, the problem for the tenant is that it isn’t only paying base rent. Trying to simplify the rent numbers means that the tax treatment isn’t being handled correctly.

Finally, municipal tax rates are set based on the income-earning potential of the property, not the construction cost or the accounting book value of the building. If the cost of the tenant improvements isn’t properly accounted for and ends up in the base rent number, it could cause the property tax values to be higher than they should be. That makes the additional rent higher for the tenant and makes it harder for the landlord to compete in the open leasing market.

How can a tenant end up paying for improvements twice?

If the end of an initial lease term is approaching and the tenant elects to exercise an extension option, the new base rent has to be set. The lease will have language in the lease extension schedule that describes the process for determining how the base rent will be agreed upon. Many leases will have wording to the effect that “… in no case shall the rent be less than the preceding 12 months rent…” On the surface, this may seem fair, since the landlord wants to reduce its risk exposure to rental income loss. However, two important issues are ignored in these words.

The first concerns market value. If the tenant paid for the leaseholds in any way during the initial term, will the new rate be based on the premises as they were before the tenant paid to improve them, or will it be based on what the improved space could get for the landlord now? What exactly is the fair market value based on? If the new rate is based on the market value of the improved space (remembering that the landlord owns the improvements regardless of who paid for them), the tenant will be paying rent to use the improvements it already paid for.

The second issue is that both the landlord and the tenant set themselves up for conflict in the future by making things unclear in the beginning. It can be difficult to know or remember that the rate proportions of base rent and improvement costs were blended initially years earlier. If the repayment portion wasn’t defined at the beginning, it cannot be separated from the rental rate later, and there is no clear way to know what amount it reasonably represented. When it comes time to do the extension, it will be difficult for the tenant to argue convincingly what the base rent floor should actually have been if the number includes other factors rolled into it. In the case of blended base rent and improvement costs, the catchall phrase may actually have the tenant paying for the improvements again in the extended term of the lease.

Even if the tenant isn’t looking to do an extended term, the problem of unclear improvement cost allocation and recovery can show up in an early lease termination. A landlord seeking damages from the tenant will look to recover unamortized leasehold improvement costs and the tenant will not have a clear idea of what it has already paid.

With all the potential issues, why would improvement costs or incentives be rolled up into the base rent?

In addition to simplicity, there is one strong motivating factor. Limiting information in leasing is usually in the landlord’s favour, particularly if the tenant has relatively small bargaining power. It isn’t that every landlord is out trying to take advantage of tenants; it’s simply easier if tenants don’t know what questions to ask and don’t ask any. Keep in mind that leases are contracts and as such the parties can agree to whatever terms they wish – they don’t necessarily have to be fair, just not illegal.

There’s another reason why landlords roll up incentive costs into the base rent, particularly if the incentives allow for a much higher base rent to be set. The building asset value (not the accounting book value) is based on the capitalization (CAP) rate. The CAP rate is the ratio of the net operating income (NOI) to the asset value. If the operating income is inflated by adding in the incentives that are being recovered through the use of an undisclosed blended base rent rate, the value of the building can be artificially inflated above the actual market value based on typical market rents that would otherwise be expected. Some allowance is usually made for undisclosed incentives in the base rent, but large swings from “normal” can influence unsuspecting buyers.

Often the unconscious driving factor behind decisions is the desire to take the path of least resistance to the earliest results. For tenants, it’s the desire to close the deal in an unfamiliar type of negotiation to get on with the move and refocus on their business growth in the new space. For landlords, it’s the desire to limit legal costs and time in negotiation and tenant education, close the deal and start collecting rent.

There isn’t one particular skilled profession that will tackle all the risks associated with the lease deal for the landlord other than the landlord itself. A good broker or lawyer will identify most legal risks on behalf of the tenant, but the future business risks are usually up to the respective parties. Experience is vital for all lease agreements, but especially for identifying risks in negotiation positions when the impact is extended over long periods of time. A specialist lease analyst will have a good working knowledge of a broad range of the professional fields (legal, insurance, financial, construction, leasing and a host of other site specifics). Consequently, they can assist in identifying and proposing solutions to potential lease issues.

Solutions

Commercial lease tenants should insist on clarity in their rent rates. Leasehold improvements cost money and the costs will show up somewhere in the lease terms. Know what they are and where they are included. Have them specifically identified in the lease agreement, including any repayment terms.

Landlords should use systems and procedures to facilitate their record keeping. Therefore, they would use specialized commercial net lease software, such as CRESSblue, with a built-in workflow to do this efficiently and correctly.

The landlord’s process should start with accurately recording the leasing incentives, such as leasehold improvement allowances and construction costs, directly with the lease documents, and tie these to the leased premises in the property records. This allows for documentation to be found in the building history, the lease records, and the tenant records. Invoices should be identified and automatically filed on entry into the records system.

Landlord contributions to the leasehold improvements should be clearly identified. These costs can be automatically classified and added to the building capitalization, with the appropriate depreciation values calculated in a table for the annual tax returns and financial statements.

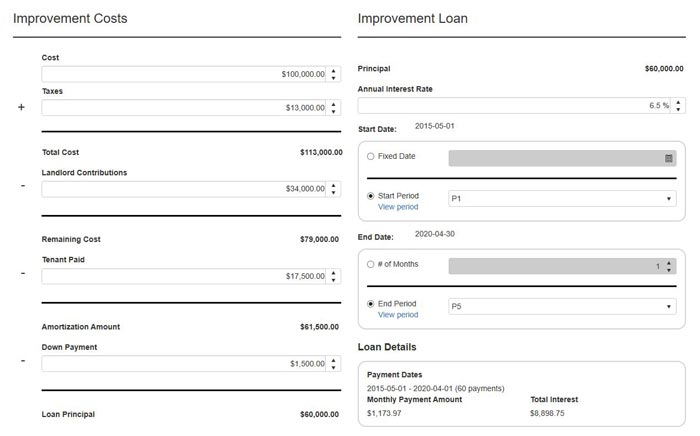

Amounts to be recovered from the tenant should be treated as a loan to the tenant. Any lump sum payment from the tenant at the lease commencement should be recorded and deducted from the outstanding amount. The balance remaining will then be the loan principal.

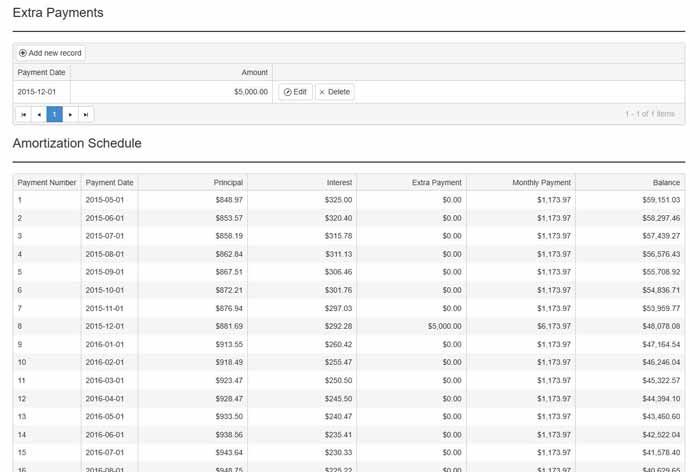

Using CRESSblue property management software, the loan terms can be entered and the loan payment schedule will generate automatically. There is a provision to enter extra payments any time throughout the term and the schedule will auto-adjust to reflect these. Furthermore, payment schedules can be tied to the lease period dates to correctly adjust to lease commencement and termination dates.

If the path of least resistance to the quickest results is driving business decisions, it makes sense to use a system that delivers the best results while doing just that. Hence, your software system can enable your team to do the right things with minimal effort. Resultantly, you will consistently have work that is accurate to the highest standard. Try the “Is CRESSblue Right for Me?” Questionnaire to get a better picture of how it can empower your business and team.

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.

[…] Tenants may require changes to the unit to make it functional for their specific purposes. These requirements should be worked into the lease in advance and clearly state which party will retain ownership of the improvements. Most commercial net leases assign ownership of the leasehold improvements to the landlord, but the tenant must still insure and maintain them. There are several ways that payment can be handled for these improvements. Further details on leasehold improvements can be found here. […]

[…] Leasehold improvements are accounted for differently depending on who pays for the upgrades and who owns them. There are several ways to assign costs, as well as numerous potential issues. For more detailed information about this subject, read this article here. […]

[…] discussed in this lease improvements article, the landlord owns all the improvements made to the building. The asset’s value fully secures the […]

[…] calculations to avoid paying income tax on money that isn’t really revenue. We covered more about leasehold improvements in a previous […]

What if for some reason the TIA Allowance exceeded the actual improvement costs? Obviously this would be rare, but if it did happen could the tenant negotiate to offset rent if its for one month or two based on the difference in cost.

Typically a lease can have two ways of dealing with the event where the specified tenant improvement allowance is greater that the actual cost of the tenant’s work. One is to limit the TIA to no more than the actual cost of the improvements, and the second is to actually specify what the TIA may be used for, including whether any overages may be applied to the rent due.

Lease terms indicate what is expected from each of the parties. A good lease gives the boundary conditions with every expectation, and what happens when events go beyond those limits.