Lease Compliance Part 2: The Tenant Audit

This article is part two of our three-part series on commercial lease compliance:

Lease Compliance Part 1: Understanding Lease Terms

Lease Compliance Part 2: The Tenant Audit

Lease Compliance Part 3: Audit-proof Your Portfolio

What is a tenant audit?

Very simply, the definition of an audit is a request for additional information to verify the information someone already has. Therefore, property managers with office, retail, warehouse and industrial buildings need to know how to manage a tenant audit relating to commercial leases. For an explanation of the differences between commercial lease types, see this article.

A tenant audit of landlord statements is related to the annual additional rent reconciliation process. There are a few different reactions you may have when a tenant requests to audit your records:

- Panic because you don’t trust your records for accuracy or completeness

- Fear because you know that intentionally or unintentionally, there are things amiss

- Confidence because you know you always act with integrity and you can easily back up anything you need to explain

Panic and fear are gut-wrenching emotional experiences that lead to undesirable stress and unpleasant interactions. So, let’s explore those very human responses and learn how to be more confident in your property management.

3 common reactions to audit requests

The panic response

This is the most common type of response for small or new property management companies. It stems primarily from inexperience and demonstrates a lack of confidence. Often the panic is associated with a feeling of inadequacy, particularly if the tenant is a large multi-national corporation. There is an expectation that the tenant audit will be overwhelmingly long and challenging as the corporate gears grind you up. What will they think of you when they start to dig into your statement? How bad will it be? Your confidence is at an all-time low. Should you call your lawyer to review the lease agreement?

Serious disputes resulting in lawsuits are rare. To be sure, working through an audit where your position is poorly documented and you are unsure of what your obligations are is going to be a very unpleasant experience. Even though lawyers may need to get involved, going to court to have the matter settled isn’t always necessary.

The way to overcome this is through self-education and implementing better business systems. You can read more about choosing business systems here and here.

The fear response

There are two types of fear responses in the case of intentional errors. Occasionally a big landlord feels they can bully or intimidate small tenants to get away with overcharging. Don’t be one of those. Much more common are landlords that intentionally undercharge or unintentionally overcharge due to the complexity of the lease terms and resultant calculations. Voluntary slippage and accidental errors aren’t good situations either.

Common thoughts for the fear response centre around trying to do your best but still not measuring up. Are your calculations correct? Did you classify the expenses correctly? Maybe you should have had an expert prepare your statements? Can your accountant back you up if you call them now? Perhaps you should have called them to prepare the statements rather than trying to salvage your reputation after the fact. Maybe the tenant will go easy on you because they can see that although your math is wrong, it is primarily erroneous in their favour?

These thoughts are common, so take some comfort that you are not alone in having them. We hear them from the majority of people making inquiries about CRESSblue. That doesn’t mean that it is okay—you should still step up your professionalism and understanding of your lease agreement obligations. The good news is that it is possible to do so with better workflows and business solutions. When using CRESSblue, it is easier to maintain your professionalism than you might expect.

Legal agreements are never better than the people signing them. However, you can do your part by implementing systems with workflows that produce the best outcomes by default. That will allow you to avoid the panic and fear responses to any tenant audit request.

The confidence response

This is by far the most comfortable place to run your business.

Confidently respond to tenant audits

The good news is that you can be confident when you are supported by smart, intentional business decisions and systems implementation.

First and foremost, build a professional team that you can trust to provide accurate advice. Not only will that team inform your decisions, but it will also help educate you and multiply the experience you can bring to any situation.

Secondly, take deliberate steps to direct your property management business into the confidence arena when dealing with tenant audits.

Let’s find out how!

Know what you agreed to do

If you are missing data, you need to take steps to be compliant. Talk to the tenant. You cannot comply with a percentage cap on CAM expenses if you don’t know the initial rate or base year additional rent amount. Be honest. Start from where you are and work out a lease addendum with the tenant so that you can continue in compliance from now on. Honesty and transparency might cost you a small amount now, but they can provide peace of mind to resolve the uncertainty before a tenant audit. The silver lining is that tenants are much more inclined to cooperate and stay with landlords they feel they can trust. As a result, you could save on future vacancy costs and leasing expenses.

The first step is knowing what you agreed to in the terms of each lease agreement. Find the agreements and read them. Research terms or review them with your lawyer and accountant to find out what is required. Get practical guidance from your team for leases you are unsure of so you know what to expect.

Track your expenses

Here is a handy checklist to help you complete your additional rent reconciliation:

- Have you included all the expenses? For example, we’ve seen a case where most of the additional rent was the property tax portion, yet it was missed for three consecutive years.

- Do you have copies of all invoices for expenses? Save digital copies of the invoices, preferably with the transaction record (CRESSblue has this capability), so that you can back up transactions even if the vendor account is later closed. Do not rely on the third-party’s vendor portal to save your audit records for you. You will need to retain them for several years for lease compliance and tax audits, and those portals often don’t store data for long enough.

- Do all of the invoices have the required information? This means the full vendor name and address, tax registration numbers, work location address, date or date range of the services provided, and a clear description of the work performed and the services supplied.

- Are the invoices internally consistent? Frequently, when a vendor uses an invoice template or recurring transactions, inconsistencies appear between the shipping address and line-item descriptions. See an actual invoice inconsistency in this article.

- Have you accrued the expenses to the correct periods? This applies to invoices received and paid in the current period for expenses incurred in the prior period as well as prepaid expenses. Utility invoices are for a date range and are usually not billed on the last day of the month. CRESSblue calculates the accrual on these invoices automatically.

- Have you checked the eligibility of each expense against the list of operating expenses and exclusions? Verify that you can recover those expenses during that particular lease period as there may be specified exemptions during a fixturing or free rent period.

- Have you included asset amortization and depreciation expenses as permitted by the lease agreement terms? This means that you need to track assets and the amortization amounts—something that CRESSblue can do for you.

- Have you recorded all tenant additional rent installment payments? You will also need the initial year additional rent amounts for the base year or other semi-gross lease agreements.

- Have you checked the leases for any CAM recovery caps and done the cap calculations? Do you have the initial values to make the calculations?

Keep accounting records

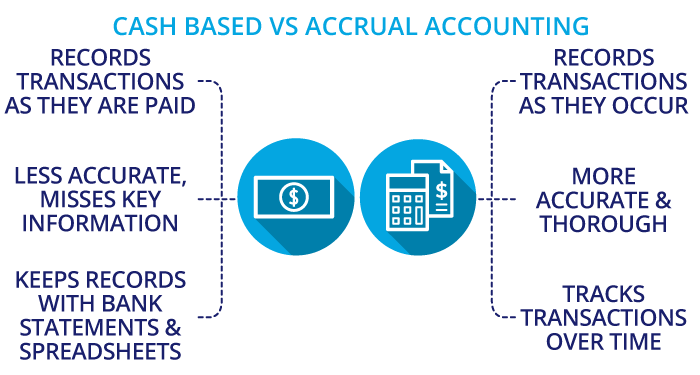

To prove lease compliance, you will need accounting records for all expenses, payments, adjustments and reconciliations. There are two types of accounting systems: cash basis and accrual basis. Accrual accounting means you recognize and record revenue and expenses when they occur, while cash basis accounting means you’ve documented these line items when cash exchanges hands.

Cash basis accounting is the easier of the two. Typically, a company using the cash basis will rely on a bank statement and spreadsheets for their record-keeping. However, this system does not capture enough information to allocate income and expenses to the correct fiscal period. In addition, utility invoices for services provided during a specified time require accrual systems for accounting. Using cash accounting when the lease terms require accrual accounting will result in an immediate compliance failure. This is an unwinnable position.

The examples above illustrate why most people use the accrual method. Accrual accounting portrays a more accurate portrait of a company’s financial position by including accounts payable and accounts receivable. It also allows for recording transactions that cover a specific period. This is what makes accrual basis the only workable method for net lease accounting.

Almost all expenses are time-period-based, and net leases require the ability to calculate expenses down to the daily level. CRESSblue specifically tracks the expense period dates so that per diem expense breakdowns can be automatically calculated and applied as per the net lease terms. In addition, accrual calculations and allocations are automatic in CRESSblue.

Annual reconciliations

Tenants on net leases pay installments for the additional rent estimates with each rent payment. Net lease agreements require that the landlord complete a reconciliation of budgeted versus actual expenses for the fiscal period. We covered the first two steps already: first, knowing what the lease terms require of you, and second, keeping accurate records of what you have done. The third step is to compare each category’s actual expenses to the amounts collected from each tenant and provide a statement to each tenant.

Getting the math right

Getting the math right is a complicated process. It isn’t just doing the areas and expense gross-up calculations; numerous factors create discontinuities in the calculations within the same fiscal period. Often changes occur within the calculations for a single month. Each change in lease circumstances, like a vacancy or free rent period, requires another set of calculations. Let’s look at three common cases.

Case 1: Area gross-ups

When tenants share common areas within multi-tenant buildings, area gross-ups become a challenge. Usable areas are grossed up with a proportionate share of common areas. Tenants are resultantly charged on a leasable area that is larger than the space defined within the premise’s walls. Calculation difficulties present when not all tenants have access to the common areas. Specifically, the percentage of the cost allocations varies depending on the nature of the allocated expense. Fixed percentages cannot accurately allocate the correct proportion of the shared costs. Calculations must be determined on an individual basis. CRESSblue dynamically calculates the allocations individually per expense account. In addition, our software automatically generates an audit trail of every calculation.

Case 2: Discontinuities

Calculation discontinuities have three sources. The first is when a change in area results in a change in proportionate shares. The second is a change in recoverability status due to a lease period adjustment, such as free rent or a fixturing period disrupting the norm. Third, vacancies resulting in different expense gross-ups create discontinuities. Each type of change requires a separate set of calculations for the relevant period. CRESSblue checks all the leases tagged in an allocation for area changes, recovery status changes and vacancies.

Case 3: Expense gross-ups

There are two types of expense gross-up. One type is the over-utilization gross-up, where a tenant consumes relatively more than its co-tenants or vacant space. Typically, this is for things like utilities where separate metering is not present or possible. In this case, a markup is applied to the cost allocation. As a result, the over-utilizing tenant pays its fair share of the costs. The second involves vacancies. A utility service usage component is allocated to only the occupied spaces, while the fixed charges are applied to all spaces, occupied and vacant. Property managers can easily configure these accounts within CRESSblue. Then the software automatically handles all expense gross-ups without any further user intervention. As always, CRESSblue fully documents every calculation for audit purposes.

Spreadsheets are hard to get right

CAM calculations are very hard to do correctly using spreadsheets. The three cases we looked at all require running multiple sets of calculations within the same period. Creating spreadsheets that can handle these calculation sets requires manual work for every single property for every single reconciliation period. CRESSblue automates all of the calculations using original source data and very simple-to-use lease period recovery rules. It also provides an audit trail report on every transaction.

Doing the reconciliations

Manual reconciliations using spreadsheets and accounting transaction records are painfully complicated and slow. Completing the annual reconciliations is the number one stressor for clients that we meet. The pain ranges from missing major components of the additional rent reconciliation for years to fearful audits and panic attacks. And, ultimately, the financial losses from voluntary slippage. They all cause significant worry and stress needlessly. CRESSblue can help you avoid all that. CRESSblue automates the entire reconciliation process, from amalgamating the source records, completing all of the calculations, processing each transaction against the lease terms, and preparing the reports and accounting entries.

As a commercial property manager, it’s your job to respond to a tenant audit. However, we dare say—with clear lease terms, transparent documentation and accurate accounting automation—it’s your responsibility to prevent them in the first place.

This article is part two of our three-part series on commercial lease compliance:

Lease Compliance Part 1: Understanding Lease Terms

Lease Compliance Part 2: The Tenant Audit

Lease Compliance Part 3: Audit-proof Your Portfolio

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.

[…] three-part series on commercial lease compliance:Lease Compliance Part 1: Understanding Lease TermsLease Compliance Part 2: The Tenant AuditLease Compliance Part 3: Audit-proof Your […]

[…] errors that result in noncompliance with the terms of the leases. Additionally, if one of the tenants requests an audit of the property accounting records, does Widgets Inc. want to expose its entire operation to a […]