An Introduction to Commercial Net Leasing & Commercial Lease Software

Why should I be concerned with commercial lease software when it comes to commercial net leasing?

Commercial lease software processes the complexities of commercial net leasing most efficiently and accurately. In this introduction to commercial net leasing, consider the challenges faced by landlords and how property management software makes them easier to overcome.

What is commercial net leasing?

Commercial leases, also known as commercial net leases, are agreements to rent space for business purposes where the rent is net of the operating costs to own and manage the building. There are different types of commercial facilities, with the four broad classifications being office, retail, warehouse and industrial. Often, components of several types are combined in one space, such as industrial with some office and warehouse components. The leases are uniquely tailored to suit the main business use of the tenant in the premises.

What makes commercial net leasing different from renting?

Typically, those new to commercial net leasing are mainly familiar with the concept of residential renting, where tenants pay one monthly rate and are only responsible for separately metered utilities and damages to their rented space. Residential tenants also have an abundance of protections and legal rights.

Commercial lease agreements are nearly the opposite, and this is often a shock to someone who has not been exposed to a commercial net lease. Below are a few of the areas in which commercial leases differ significantly from residential renting.

Legal protections and rights in a commercial lease

Commercial leasing is governed by property law and contract law. A commercial lease agreement is a blend of both of those aspects of law, and gives rights to both the property owner (or landlord) and the tenant renting space (the premises). Certain rights and responsibilities fall under property law and others are under contract law—a complicated distinction which varies by jurisdiction and case law. Protections for the tenant against eviction in the winter, utility disconnects and rent increases do not exist in commercial lease situations like they do for residential rental properties. In addition, rights can be given up in commercial lease agreements that might not be permitted in the case of a residential rental agreement.

What is a net lease?

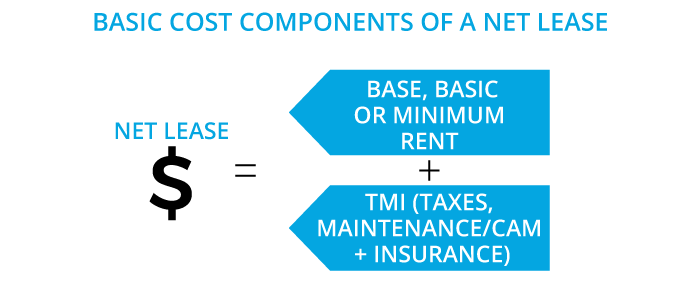

A net lease, or triple net lease, includes terms describing amounts that will be charged in addition to the rent. The rent shown on the face of the lease agreement is the base (basic or minimum) rent that will be charged. In addition to this, there will be tax, maintenance and insurance charges, collectively called TMI. The maintenance portion may also be called common area maintenance (CAM). There is no real difference between the meaning of net or triple net; both mean the lease has additional charges to the base rent amount that will be described more fully in the lease agreement. These additional charges can total as much as or more than the base rent amounts.

The TMI may be classed as operating costs or as additional rent; there’s a slight distinction in those terms and the remedies that can be used to cure a default, with the operating cost being part of contract law and additional rent falling under property law. These vary by jurisdiction, so it’s recommended to consult with a lawyer on those issues and whether it is worth negotiating one way or the other.

In rare cases, a commercial lease may be a gross lease where all charges are wrapped up into one rent payment (as in a residential rental agreement). This is more likely to happen when premises are small and the lease term is short, which can cause difficulty making additional rent calculations. It can also occur when the landlord lacks sophisticated commercial lease software that efficiently performs the required calculations.

What does proportionate share mean?

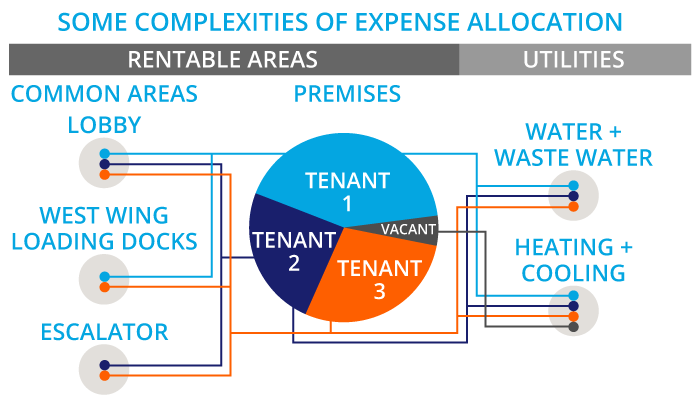

Commercial sites often have multiple tenants at the same time. In multi-tenant properties, the additional rent is usually allocated to the tenants on a proportionate share based on the rental area of the premises divided by the total rentable area of the building or site.

The expense allocation process can be quite complex when there are multiple buildings on a site, or if not all tenants have access to or use the common areas. For example, a ground floor tenant may not want to be charged for escalator maintenance, or a mall tenant for the common loading docks servicing the stores in another wing of the shopping centre. The operating costs must be properly allocated to those tenants that are in the pool of users of the common areas and services.

In the case of vacancies, a charge called a gross up factor is applied to the shared common utilities that aren’t individually metered, such as central heating and cooling, water usage, cleaning and lighting. Vacant spaces typically have a lower heating/cooling demand (around 30% less) and don’t use water or produce wastewater. The amount of a utility invoice that is based on usage is then allocated to those tenants that are using them for the period covered by the invoice. The fixed charges are still allocated to the entire area connected to the services and that fixed portion of the vacancy cost is borne by the landlord.

Rentable areas of the leased premises may also be grossed up with a proportionate share of the common areas. Base rent will be charged on the grossed up rentable area and not just the rentable area of the premises. This is further complicated when the total rentable area changes on the site or building due to renovations, additions, or temporary construction shutdowns.

Some tenants with high bargaining power can negotiate fixed additional rent rates, or different types of caps on the annual increases in additional rent that will be permitted.

CRESSblue commercial lease software is available to landlords to do proportionate share and date calculations automatically, and can report on the allocations on a per invoice and aggregate annual basis for tenant audits.

Why all the clauses about operating costs?

Commercial leases use similar wording about what is an operating expense (Op Ex) and what is a capital expense (Cap Ex), but the practical application is quite different. There are no official definitions, and so whatever is in your lease agreement regarding the additional rent will be applicable to your situation.

Generally speaking, operating expenses are those incurred in the maintenance and operation of the building to keep it in its regular state of repair and efficiency. Capital expenses are those that make improvements to the functional ability of the property, significantly extend the life of the asset, or alter its use.

Operating expenses are recovered by the landlord from the tenant(s) through the additional rent charges. Only those expenses that actually occurred are to be charged to the tenant, so this category does not include reserve funds.

Capital expenses are to be capitalized in the landlord’s books and are depreciated. Neither the capitalized cost nor the depreciation is classified as operating costs. That doesn’t mean that capital expenses cannot be included for recovery from a tenant in a lease agreement; it just means that they should not be included in the operating expenses.

The real difficulty for both tenants and landlords is the gray area between Op Ex and Cap Ex. For example, how much of a roof repair constitutes a partial replacement? If 10% of the replacement cost is used as a guideline, can 1/20th of the roof membrane with a lifespan of 20 years be replaced each year as a “preventative maintenance Op Ex”? A landlord could avoid having a major Cap Ex entirely using this approach. Would this method be acceptable if the roof was already leaking? Maybe the tenants would appreciate never having a roof that leaks due to its old age.

One approach or the other isn’t necessarily right or wrong (unless the terms of the lease already dictate otherwise). Landlords will be better off by being transparent in their decision-making process in the terms of the lease rather than relying on ambiguity and a lack of reporting details. Most of the time this isn’t deliberate on the part of landlords; it is a lack of affordable sophisticated software that would allow them to better handle the complex calculations and record keeping. Newer solutions such as CRESSblue commercial lease software have significant capabilities in automating additional rent accounting.

Percentage rents and CPI increases

Leasing space for retail purposes often brings in a type of rent called percentage rent. In retail space like a shopping mall or plaza, the number of visitors to the centre is an important driver in the sales for the tenants. To ensure that the overall performance of the site is reflected in the rents charged to the tenants, there is a minimum rent specified in the lease agreement, and above the break point a certain percentage of the tenant’s sales from the premises is paid to the landlord as rent. The list of tenant products included in the percentage rent categories, the levels of sales and corresponding percentages, and exclusions form a complex negotiation and record keeping challenge.

In highly competitive markets, base rents may also be indexed to the Consumer Price Index (CPI). This allows the landlord to be protected from inflation, and the tenant to know that the rents are adjusted based on an independent third-party. The index to be used, the adjustment periods and the location basis of the index should all be specified in the lease agreement. Wording should also be included in the lease in case the index specified is discontinued, revised or replaced.

Leasehold improvements

Leasehold improvements are at the expense of the tenant. The landlord may offer various incentives to assist either in the construction, payment or financing of the improvements. The landlord will reserve the right to approve the work planned and may also insist that its own contractors be used for portions of the project. This can be for the purposes of maintaining warranty coverages, collective bargaining agreements, or simply because the landlord wants to use contractors it has previously vetted. The landlord may charge fees for having the proposed work reviewed by its architects or engineers.

Once the work is done, the leasehold improvements become the property of the landlord (provided they are not in the nature of trade fixtures, which typically remain in the ownership and control of the tenant). The tenant will be responsible for insuring and maintaining its own leaseholds.

Insurance

The tenant is required to insure its own business, including general liability, as well as its leasehold improvements. The landlord’s insurance is normally secondary to the tenant’s insurance, and does not cover the tenant’s leasehold improvements even if the landlord assumes ownership of them upon completion. The landlord also doesn’t carry insurance for any of the contents in the premises, or for any business interruptions, however caused. It is important for a tenant to review its required coverages based on the terms of the lease, and also to ensure it is fully insured for its own needs.

Annual reconciliations

The additional rent is reconciled annually. A statement is sent out to all of the tenants for each property showing the expenses for the period, the tenant installment payments, and the shortfall or overpayment. The tenant may have certain rights in its lease to review the charges and calculations. There is typically a two year review period for either party to make an appeal or adjustments to the statement.

Why lease?

If commercial leasing is so complicated, why lease at all? Why would someone want to be a landlord or a tenant?

From the owner’s perspective, commercial property is expensive to build and to maintain. Commercial construction costs, property taxes and operating costs are higher than residential rates. It’s very costly to have vacant commercial space sit empty. Becoming a landlord and leasing the space to a tenant can significantly help with those carrying costs.

For a business owner, becoming a tenant can enable access to valuable space in a prime location without taking away from cashflow with a down payment. Having a landlord manage the building allows the tenant to focus on its business strengths without the distractions of building ownership and maintenance. It offers a more predictable way to operate a business, as well as flexibility to move and grow more rapidly.

It’s a business relationship

Lease negotiations are usually handled by commercial real estate brokers on both sides. Often, the actual tenant employees in the premises and the landlord’s property managers are not involved in the negotiation process at all.

It’s important for both sides to realize that commercial leasing is a symbiotic relationship. The landlord relies on the tenant paying rent and looking after the premises as a prudent owner would. Happy tenants stay, which reduces the broker commissions for the landlord, the incentives paid out on new leases and the vacancy rental losses. The tenant relies on the landlord to arrange for maintenance services, pay the taxes and operating bills on time, and to arrange and manage all the various contracts effectively and efficiently. If either party is deficient, the other one suffers as well. They might sit across the table, but both are on the same boat.

Commercial lease software supports good business

Clearly defined terms and expectations, effective communication and transparency are the keys to healthy landlord-tenant relationships. Efficient lease management and reporting is the basis of CRESSblue commercial lease management software.

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.

[…] Very simply, the definition of an audit is a request for additional information to verify the information someone already has. Therefore, property managers with office, retail, warehouse and industrial buildings need to know how to manage a tenant audit relating to commercial leases. For an explanation of the differences between commercial lease types, see this article. […]

[…] costs that are capital in nature, from the definition of operating costs. You can read more about capital expenses and proportionate share here. It doesn’t mean that every lease excludes capital costs from recovery. On the contrary, there […]

[…] While the coronavirus lockdown holds grip, landlords can expect to see more vacancies, tenant changes and rent exemptions. Multi-tenant property owners must prepare now for increased complexities when it comes time to calculate the proportionate share of CAM expenses. […]

[…] While the coronavirus lockdown holds grip, landlords can expect to see more vacancies, tenant changes and rent exemptions. Multi-tenant property owners must prepare now for increased complexities when it comes time to calculate the proportionate share of CAM expenses. […]

[…] Historically, triple net refers to leases where one tenant rents an entire commercial building and pays all property expenses for a longer-term (ten years or more). As leasing practices have evolved, the term triple net lease now also describes leases for a multi-tenant building where each tenant pays its proportionate share of expenses. […]