Lease Compliance Part 3: Audit-Proof Your Portfolio

This article is part three of our three-part series on commercial lease compliance:

Lease Compliance Part 1: Understanding Lease Terms

Lease Compliance Part 2: The Tenant Audit

Lease Compliance Part 3: Audit-proof Your Portfolio

In this third article, we talk about preparing your commercial property operations for potential audit scenarios. Interestingly, always being prepared leads to several habits that essentially audit-proof your portfolio against future claims.

In Part One, we looked at setting up your documentation to have accurate lease information readily available. Then, we covered how to set up your workflows to make the best practices your default. We also talked about building your team of experts to complement the skills you bring to your leadership. Putting knowledge and information into practice leads to success.

Preparation leads to confidence. Knowing what you are required to do to maintain lease compliance is empowering.

In Part Two, we reviewed best practices of accurate calculations for expense allocations on your commercial net leases. Then, we covered area gross-ups, variable expense gross-ups and how to account for discontinuities in lease periods. In addition, we highlighted the importance of recordkeeping in controlling slippage. Finally, we touched on all the steps required to comply with net lease additional rent terms.

Accounting accuracy leads to confidence. Having the correct numbers and allocations and knowing you are compliant with the leases removes doubt. And there’s no fear of inquiries uncovering deficiencies and errors in your work.

In Part Three, we will uncover the final steps to audit-proof your portfolio. Part one was knowing and part two was doing. Part three is all about sharing information.

What is an audit?

Investopedia defines a financial audit as “an objective examination and evaluation of the financial statements of an organization to make sure that the financial records are a fair and accurate representation of the transactions they claim to represent.”

An audit isn’t something to fear. Think of it as a report of financial transactions. An audit should be smooth sailing if your business practices and documents are accurate and consistent. However, knowing what to do, doing it and then sharing the information transparently means there isn’t any need for an audit.

How can transparency help you audit-proof your portfolio?

Often an audit is requested because of a lack of information. A tenant or a property owner may want an accounting of past transactions to determine whether their loss to lease is at an acceptable level. Or, they may be looking for discrepancies caused by poor workflows or outdated business systems. Either way, there is an information problem.

By ensuring a transparent business process, you open communication with tenants and owners. When stakeholders can see accurate reporting and lease terms, they are less likely to question costs. Transparency removes the need for an audit.

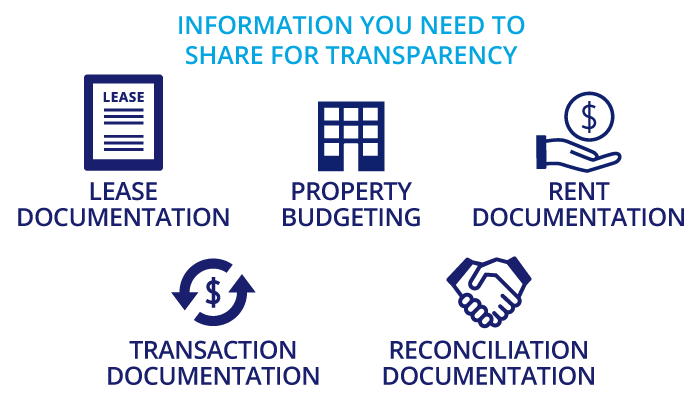

Let’s look at the information areas we need to share and how to distribute them to have transparent communication with both tenants and property owners.

Lease Documentation

The first step in achieving an audit-proof portfolio is making it easy for tenants to access and understand the lease terms.

Just as property managers and lease administrators need to know and understand the lease terms, so do the tenants. While the responsibility of understanding the lease resides with the tenant and their lawyer, we can make it easier by providing essential information to the tenant through a lease abstract.

A lease abstract is typically a one- or two-page reference document that includes a short description of the key terms and shows tenants where to find the full text in the lease.

CRESSblue has built-in lease abstracting capabilities to allow the data to be easily compiled. When a lease is executed in CRESSblue, the lease abstract PDF report is automatically generated. The abstract is automatically distributed to the appropriate tenant and owner portals, as well as to any internal leasing managers. This is just one example of how CRESSblue automates best practices into its standard workflows, allowing you to achieve optimal efficiency with minimum effort.

Property Budgeting

Preparing and using property maintenance and operating budgets is the best way to ensure your expenses are well-planned and executed. A budget does more than facilitate the property manager’s job, though. It is an excellent tool that allows you to charge accurate additional rent installment amounts with the rent during the financial period. Then you aren’t left with a large discrepancy at reconciliation. Advance notice goes a long way in smoothing PM/tenant relationships. No one likes costly surprises. Controlling this source of stress is paramount for peaceful business operations.

CRESSblue has budget functions that automatically add all existing expense accounts to the property budgets. This dramatically simplifies making a budget for those with little or no prior budgeting experience. As always, there isn’t any need for spreadsheets or calculators. We believe that computers should do the math for you.

Rent Documentation

Most tenant accountants and bookkeepers are not involved in the lease negotiation process. Neither are the accountants and bookkeepers at the property and asset management companies. As a result, property managers need to transmit the lease rent information to them simply and clearly.

Base rent is reasonably straightforward in most cases, but periodic scheduled rent increases still need to be communicated. In addition, the budgeted additional rent and any other rental charges, amortized cost recoveries and tenant loan installments also need to be shared. Finally, a Rental Advisory Notice (RAN) summarizes these amounts into a monthly payment schedule.

CRESSblue automatically creates, updates and distributes a new RAN with every new lease, lease addendum and every new or revised property budget. This ensures that tenants always know in advance what payments are required and when they are due.

Transaction Documentation

For net leases, the operating expenses, maintenance and service charges and, in some cases, the capital cost allowance is charged back to the tenants. These are collectively known as additional rent. Tenants can be charged either by direct invoice for immediate cost recovery or through additional rent installments and a reconciliation. For costs recovered from multiple tenants, special attention must be paid so that the calculations correctly allocate the costs to each tenant in accordance with the lease agreement terms.

Each transaction recorded to the additional rent will need to detail the cost allocation to each tenant and the basis for this amount. This transaction breakdown record must be available for the tenant to audit its proportionate share of the costs.

CRESSblue does this automatically for every additional rent-related transaction. In addition, a PDF breakdown report accompanies each transaction and can be distributed to each tenant (and owner) portal automatically when the transaction is posted.

If the tenant’s expense bill is immediately recoverable, CRESSblue can automatically generate a corresponding invoice for the tenant, including applicable management and administration fees. This workflow makes sure no allowable expenses are ever missed. And when it comes to an audit-proof portfolio, this is critical.

Reconciliation Documentation

The last part of the net lease journey is the period reconciliation. This is typically done annually, where the installment payments are reconciled with the actual allowable cost recoveries. A statement is produced specifically for each tenant that reflects their lease terms and where they are in the lease cycle. After the accounts are checked, and the additional rent reconciliation is approved, an invoice is generated for each account where the installment payments are less than the actual recoverable expenses and fees. In the case of overpayment, a credit memo is issued to each tenant that overpaid.

CRESSblue has a simple account approval process where all the calculations are done for you. Any non-recoverable amounts are indicated, and a drill-down report can be instantly pulled up to detail the reasons for any legitimate slippage. The entire reconciliation can be approved upon approval of all the expense account amounts. All tenant accounts are reconciled, all invoices and credit memos are created and posted to the accounting system, and all tenant reports are posted to the associated portals.

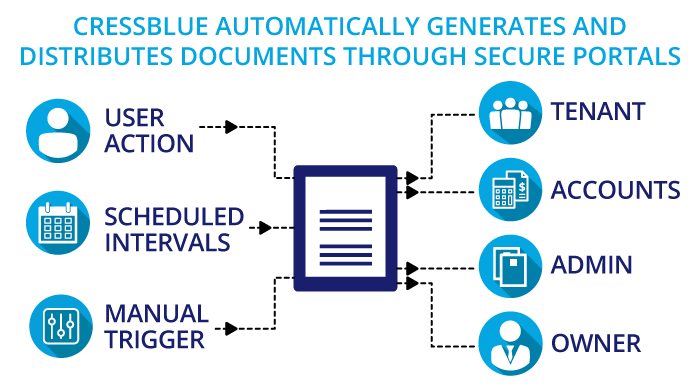

Distributing the information

Another important step to audit-proof your business is communication. CRESSblue has extensive automation for document creation and distribution internally between users and externally to property owners and tenants. Standard documents and reports can be generated based on event triggers linked to user actions, scheduled intervals or can be run manually at any time.

Secure portals are used to distribute documents to external owners and tenant users. Free tenant portals support both accounting and administration as segregated roles so that confidential negotiations can be kept separate from daily operations if desired. Owner portals are also free and allow owners to securely receive their property activity and financial reports.

CRESSblue portals are available for past, current and future tenants, allowing for confidentiality between occupants of the same spaces while documentation is opened and closed out between leases. Reports are automatically routed to the correct portals and recipients.

Audit-proof your portfolio

An audit is a request for information, not necessarily a challenge to correctness. There may still be tenant challenges about whether specific work needed to be done, a significant repair was capital in nature or whether it was simply maintenance that could be expensed. Those are different types of management and accounting issues that can still arise.

If a property manager feels threatened by an audit, they do not have the necessary confidence in the quality of their work. That is a clear indicator that business systems and workflow processes should be improved. There is logic to using CRESSblue to audit-proof your commercial net lease portfolio:

- If the work is done using CRESSblue, reporting accuracy is guaranteed in accordance with the entered lease terms

- Accurate data means there are no barriers to being transparent

- If transparency is easy, you can conveniently do it all the time

- Consistent transparency removes the need for an audit

Lease compliance gives everyone peace of mind. There’s no need for issues to escalate or result in audits with automated business systems that elevate your workflows and consistently provide accurate financial reporting. Because everyone is on the same page.

This article is part three of our three-part series on commercial lease compliance:

Lease Compliance Part 1: Understanding Lease Terms

Lease Compliance Part 2: The Tenant Audit

Lease Compliance Part 3: Audit-proof Your Portfolio

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.

[…] This article is part two of our three-part series on commercial lease compliance:Lease Compliance Part 1: Understanding Lease TermsLease Compliance Part 2: The Tenant AuditLease Compliance Part 3: Audit-proof Your Portfolio […]