Commercial Leasing 101: Here are the Industry Terms You Should Know

Whether you’re a first-time investor or a veteran looking to brush up on your commercial leasing terms, we’ve got you covered. This article defines the various lease agreements and industry jargon to help you better understand what they mean to landlords and tenants – and the relationships between them. In the simplest terms, a lease agreement is a document that lays out the allocation of risk and responsibility for the use of property in exchange for money. Now, let’s dig into the terms and definitions.

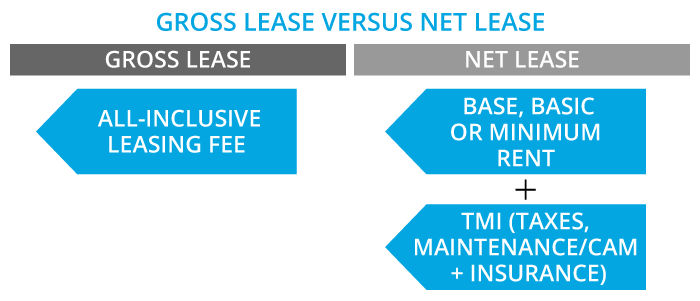

Gross lease vs. net lease

There is no one-size-fits-all approach to commercial leasing. Lease agreements between landlords and tenants can take many different forms. To start, let’s define the difference between a gross lease and a net lease.

Gross lease

A gross lease is a lease in which the landlord pays all (or most) expenses associated with owning and operating the property. This ‘all-inclusive’ lease agreement is sometimes perceived as the most tenant-friendly lease type as the tenant can budget for a regular flat fee. However, the gross lease may be higher than necessary in order to protect the landlord from cost increases over time.

Most often used in office buildings, industrial and some retail properties, a gross lease eliminates tenant responsibility for the variable expenses associated to the property. Typically, gross leases are easier for small spaces, very short lease terms or unsophisticated tenants where convenience is paramount. However, there are instances when an overconsuming tenant may be on the hook for overage charges. For example, if a tenant exceeds electricity consumption beyond building standards, additional fees are often charged back to the tenant.

So, what is a net lease?

A commercial net lease, or N lease, is a lease agreement in which the tenant pays base rent plus additional expenses such as insurance premiums, maintenance costs and property taxes.

From a landlord’s perspective, the advantage of a net lease is that it offsets the variable costs of property ownership to the tenant. For example, if property taxes increase by 2% next year, it is the tenant’s responsibility to cover the additional rate in a net lease arrangement.

At the same time, net lease agreements can also be risky for the landlord if the tenant is responsible for making all the net lease payments. Let’s imagine the tenant fails to keep their property tax payments up to date; this may result in additional fees and fines that the landlord is responsible to pay. Even public utilities are often charged against the property title if the tenant defaults on the payments, resulting in an additional surprise for an unaware landlord. Therefore, most landlords prefer to file their own property taxes to ensure payments are made on time and in the correct amount.

Net lease tenants typically have the advantage of lower rental rates than that of a comparable gross lease. This is true even when factoring in the taxes and other operating expenses. Since the tenant is accepting a higher risk level, the compromise is that the commercial leasing landlord accepts a slightly lower income in exchange for consistency.

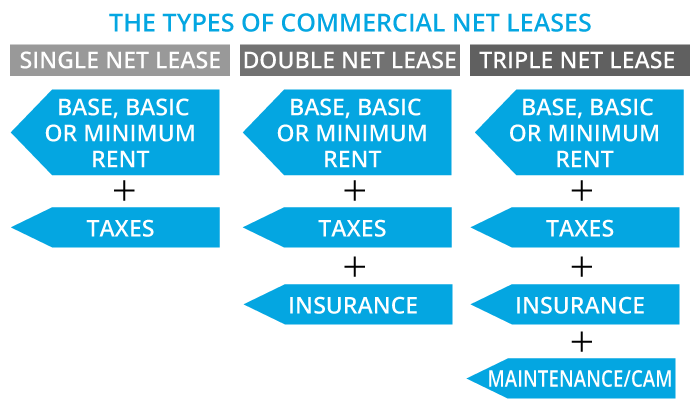

Single, double and triple net leases

Let’s dive deeper into the different types of net leases. As a disclaimer, it’s important to note that net lease terms are often used interchangeably. Commercial leasing landlords and tenants will want to avoid making any assumptions based on how a lease is characterized. Lease documents should always be carefully reviewed to understand the obligations and the expenses for which each party is responsible.

Where net leases can differ is dependent on how the operating costs and expenses are allocated. This presents landlords and tenants with an array of choices for various scenarios (we’ll cover more about operating costs a little later in the article).

There are three basic types of net leases: single, double and triple net.

Single net lease

Single net lease properties are the least common of the bunch. In these leases, the tenant is responsible for paying base rent, plus all or a portion of the property taxes. In these leases, the tenant becomes responsible for the property taxes, whereas all other expenses such as operating costs, maintenance costs and insurance costs are managed by the landlord. Usually, tenants with a single net lease pay a lower base rent because of the added responsibility of property taxes.

Double net lease

Double net leases, also known as net-net or NN leases, is an agreement in which the tenant pays the property taxes and insurance premiums in addition to the base rent. All other expenses, such as maintenance and repairs, are paid directly by the property owner. Most commonly used in commercial real estate like shopping malls or expansive office complexes, landlords will charge double net lease expenses proportionally to the size of the leased space. A single or double net lease may also be called a semi-gross lease.

Triple net lease

A triple net lease removes the landlord from the equation entirely, as tenants pay most if not all property expenses. Much different than the ‘all-inclusive’ gross lease agreement, under a triple net lease the landlord is ‘hands-off’ as the tenant is responsible for all property taxes, insurance, maintenance and repairs in addition to the base rent.

Historically, triple net refers to leases where one tenant rents an entire commercial building and pays all property expenses for a longer-term (ten years or more). As leasing practices have evolved, the term triple net lease now also describes leases for a multi-tenant building where each tenant pays its proportionate share of expenses.

Single-tenant and multi-tenant leases

By now, hopefully, we have demonstrated that commercial real estate can offer opportunities in a variety of arrangements. Whether an investor is looking to establish a single-tenant net lease property or a multi-tenant net lease property, both types of options have their pros and cons.

First, let’s enhance our understanding of single-tenant and multi-tenant net leases.

Single-tenant net lease

A single-tenant net lease is a rental agreement between the one sole occupant of a space and its owner or landlord.

Due to their simplicity, single-tenant net leases are often a good fit for first-time commercial leasing investors. With only one tenant to attend to, the property investor encounters less of a burden in comparison to managing the needs of multiple tenants. Imagine a scenario in which an investor has a single-tenant agreement with a triple net lease; the landlord could be alleviated of almost all property obligations.

Of course, investing in a single tenant property heavily relies on the quality of one sole tenant. The investor’s primary source of income significantly depends on the occupant’s financial contribution. If the tenant unexpectedly vacates, there could be detrimental financial and maintenance implications the longer the property remains unoccupied.

Multi-tenant net lease

Comparatively, in a multi-tenant net lease the odds of total vacancy are very low. A multi-tenant net lease is a lease between a landlord and a tenant where there are also other lease agreements within the same building complex, typically in a larger commercial retail property.

Investors might favour a multi-tenant property because they prefer to manage several units simultaneously instead of several individual projects. Contrarily, it may increase duties as multi-tenant buildings usually require more structural maintenance and repairs, and additional provisions to consider.

Retail lease agreement: common clauses

Retail lease agreements have various provisions to ensure both landlords and tenants are protected. The following terms are just the tip of the iceberg when analyzing the multiple permutations that can inform a retail lease agreement.

Retail anchor tenants

For many retail tenants, success is dependent on their neighbours. Anchor tenants is a term that refers to the key retailers that play a critical role in bringing crowds and human traffic to malls. Landlords are very likely to provide favourable rental rates and terms to anchor tenants, as they help sustain the business of smaller retailers.

In some leases, an anchor tenant agrees to a “continuous occupancy clause” which is a provision in a lease that requires the tenant to stay open during specified hours and operational throughout the period of tenancy.

Strength in numbers

Another negotiable lease agreement provision for retail tenants is the “go dark” clause. Under the go dark clause, tenants can stop operations in an unprofitable space while still paying rent for it. A tenant may choose to go dark for a few hours, days or weeks. They may wish to focus their resource on more profitable locations, or they may need time to overhaul the space decor.

Consequently, if anchor tenants or multiple anchor tenants leave the retail space, it is likely to result in a drawback of foot traffic and less business for the remaining tenants. Thus, the need for a co-tenancy clause. A co-tenancy clause is a retail lease provision which provides the tenant with protection in the form of reduced rent to compensate for traffic loss.

A provision that is advantageous for both property owners and tenants is known as “percentage rent.” Simply put, percentage rent is additional rent paid by the tenant based on a percentage of gross sales. The idea behind percentage rent is to give the owner the opportunity to negotiate the placement of a retailer in exchange for a percentage of their sales. If a tenant is experiencing periods of slower sales, the rent adjusts lower to accommodate the lower cash flow the tenant is experiencing. It provides a method to make the rent representative of the value the space has to the tenant over a wide range of profitability experiences.

Percentage rent, operating costs, capital costs and CAM fees

Now that we have a baseline understanding of the various lease agreements and clauses, we’ll conclude by exploring different lease expenses and how they are calculated.

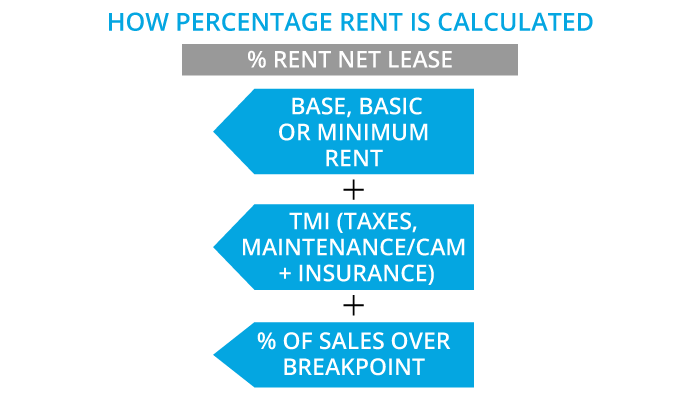

How is percentage rent calculated?

With a percentage rent lease, a tenant must first pay a minimum rent. Once gross sales surpass a specified mark known as a ‘breakpoint’ the tenant is required to pay the owner a certain percent of every additional dollar in sales as additional rent. The percentage rent is often estimated and reconciled on a monthly or annual basis and may be averaged over a period of time. In some cases, the percent is industry standard and isn’t subject to much negotiation.

Natural vs. artificial breakpoint

The breakpoint is an important negotiated method, as there can either be a natural or artificial breakpoint.

A natural breakpoint is calculated by dividing the base rent by an agreed percentage.

Whereas, an artificial breakpoint may be determined by the bargaining power of the parties or specifics of the transaction. For example, a landlord may negotiate a breakpoint below the natural breakpoint, while a tenant with more clout may be able to negotiate a higher breakpoint.

Operating costs

Operating costs are common expenses that are paid frequently as they are necessary to operate and maintain a property. As noted throughout the article, operating expenses are often tacked onto a lease agreement in various forms. Some examples of operating expenses include property taxes, property insurance, maintenance expenses, utilities and administrative expenses. Operating costs do not include capital expenditures, debt or amortized cost recovery.

Capital costs

Unlike operating costs that are frequent and relatively low-cost, capital costs in a commercial lease are intermittent, expensive upgrades to the property that provide long term value. Some examples of capital costs include the installation of a new security system, a new parking lot or HVAC repairs.

These expenses are paid by the landlord and then amortized over a period of years. Some leases allow these costs to be recovered under specific conditions and over a period that is specified in the lease agreement. Typically, the amortized amount is charged monthly along with the rent and additional rent on an invoice for a specified period after the first replacement has occurred.

Common area maintenance

Common area maintenance charges, also known as CAM expenses, are the fees paid for the upkeep of areas designated for use and benefit of all tenants in a shared space. CAM expenses are common in multi-tenant lease agreements such as shopping centers and can include charges for parking lot maintenance, snow removal, utilities and more.

There are two basic calculations for CAM fees: variable CAM fees, where the amount charged to the tenant can vary based on expenses that may fluctuate monthly, and flat CAM fees, where the fees are a fixed amount.

CAM cap refers to the maximum amount for which the tenant pays its share of common area maintenance costs, and the owner pays for any CAM expenses that exceed that amount. For larger shopping centres, the anchor tenants may negotiate a flat CAM rate or CAM cap, and the remainder of the tenants will proportionally pay the balance of the CAM charges.

Optimal commercial leasing

The best way to understand the ins and outs of commercial leasing and manage optimal lease terms is to work with a team of experienced professionals, including realtors, lawyers, accountants and tech partners. When it comes to calculating complex multi-tenant expenses, leveraging property management software like CRESSblue can help commercial leasing landlords automate cost-recovery calculations for more accurate and professional results. CRESSblue is designed and backed by experienced commercial real estate professionals. This specialized net lease software efficiently handles custom leases for various unique circumstances – from multi-tenant to single-tenant, or any combination in between.

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.