Loss to Lease: Don’t Lose Out

Loss to lease is kind of like a mythical creature. It’s not an actual loss of revenue but a loss of potential revenue that a property owner or manager may not even recognize because the bottom line adds up each month. There is no impact on cash flow since it’s not expected income. There’s also no benefit from this mythical beast at tax time because it doesn’t really exist. So, how can something be called a loss if you aren’t actually losing out?

Loss to lease basics

First, let’s look at a few essential facts about loss to lease:

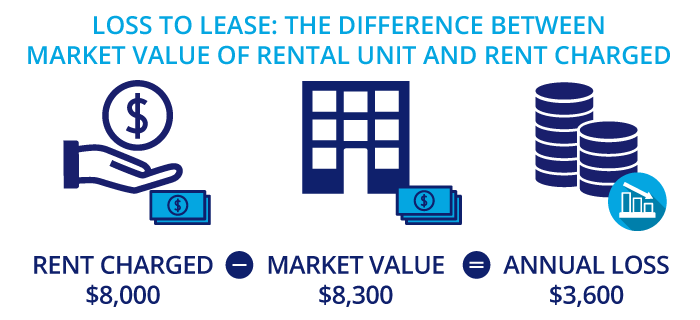

- It’s the difference between the market value of a rental unit and the rent charged.

- Its number changes as market value changes.

- It can be a good thing or a bad thing.

- It is almost impossible to eliminate it perfectly.

1. The difference between the market value and rent

The fact that there is often a difference between the market value of a unit and the rent charged for that same unit seems ludicrous. How can property owners make money if they aren’t charging market value? There are several reasons for this (which we’ll get into later), but the most common is that the market value increased during the lease period. Meaning, while a property owner is making $8,000 per month on a rental unit, if the market value is $8,300 on that unit, they could be making an additional $3,600 over the course of a 12-month lease. The extra $3,600? That’s the loss to lease. That is, the dollar amount a property owner could be making above the lease amount.

2. The loss to lease amount changes with market value

Not only can a property owner experience this potential loss each month, but the amount of that potential loss could also vary month-to-month or quarter-to-quarter. In a given year, when there are drastic fluctuations in property values—such as during a global pandemic—a unit could have a loss to lease that swings equally as drastically.

3. It can be a good thing or a bad thing

This is more than just a case of glass half-full or half-empty. It absolutely depends on your role in the property. If you’re an owner, it’s not such a good thing; you could be getting a greater ROI—but aren’t—or you may need to revisit your property management.

On the other hand, if you’re an investor looking to buy the property, there is the potential for rent escalation, increasing profitability with little-to-no financial outlay. For example, consider a case where the existing owner isn’t aware that the rates are well below market value. In that case, the building is also underpriced based on the CAP rate—a win for the investor. As a result, the rent rates can be escalated when the lease term expires—making the loss to lease doubly attractive.

4. It is almost impossible to eliminate it perfectly

While this doesn’t sound like great news, it’s not terrible news either since you’re losing imagined profit. But the reality is that, for many landlords, the market value increases faster than their leases accommodate for. But wait, the rent can be increased at lease renegotiation, right? Great! It all worked out. Not so fast—three months later, the market value rises (for example, due to low availability and resultant trending higher lease rates), putting your newly agreed lease out of sync again. Taking this a step further, not every unit will be on the same cycle, so while you may get one or two units up to market value (for a while anyway), the remaining units fall further behind.

How can some of it be eliminated?

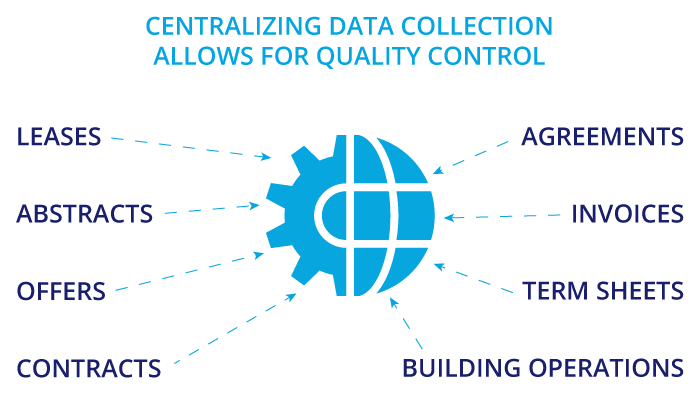

One way to minimize the loss is to use leases that can be adjusted based on a specified consumer price index (CPI adjustment). In theory, this completely eliminates loss to lease since any time the market changes appreciably, the lease rate can be adjusted to match. Practically, however, this proves to be very difficult to manage. It requires someone to monitor the CPI, make the calculations, notify the tenant in advance and then set new rental rates in the system used to calculate and process the monthly rent invoices. The small gains often just aren’t worth the time spent on this. A common workaround is to factor an average CPI into the lease rate annually or utilize shorter lease terms, which allow for more frequent adjustments than a longer lease term.

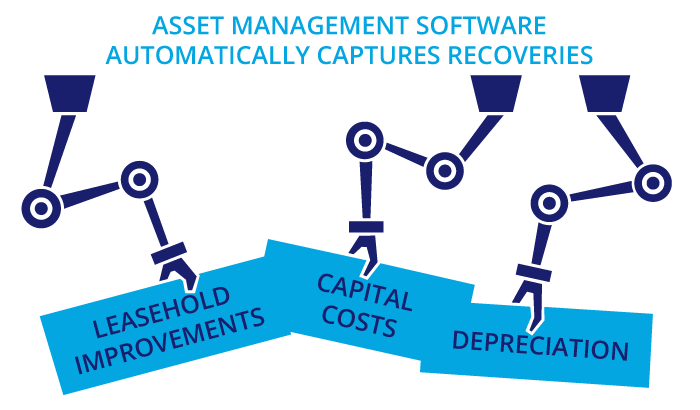

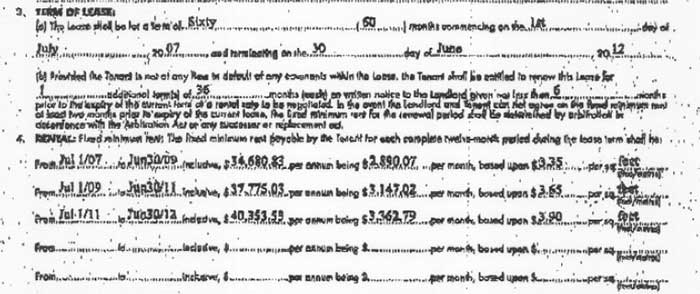

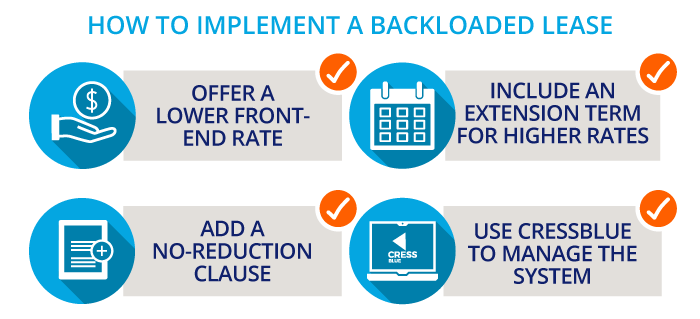

On the other hand, knowledgeable landlords can buffer this by implementing backloaded leases. Back-loading provides a lower front-end rate, which tenants appreciate during their expensive move-in period, and includes an extension term for higher rental rates aligned with market rate expectations. In addition, a no-reduction clause prevents losing rent to market down-turns at extension time. CRESSblue’s extreme automation makes all of this easy to manage, and our expert team is ready to share their best practices knowledge with you.

Other factors causing loss to lease

While the main reason a property is not making its optimal income is the disparity between market value and actual rent charged, it’s not the only reason. Sometimes, it’s pretty clear what the issue is, and other times it requires an owner to dig a little deeper.

Properties that are run-down or lack amenities are not as desirable and don’t attract high-quality tenants willing to pay higher rent. That’s a clear example. A not-so-clear example is a property manager who may not be looking out for an owner’s best interests, either intentionally or unintentionally. Does your property manager have the right connections to attract tenants willing to pay higher rates? Are they staying on top of regular building maintenance while looking at cost reductions? As an owner, it’s your job to monitor your property manager and make sure you are getting the right service for your property.

Another problematic factor is assessing the property owner/landlord. Sometimes with the best of intentions, they can wreak the most havoc on the bottom line.

Are you causing your loss to lease?

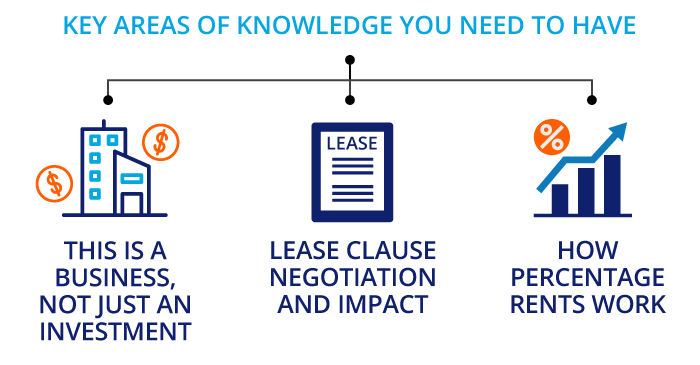

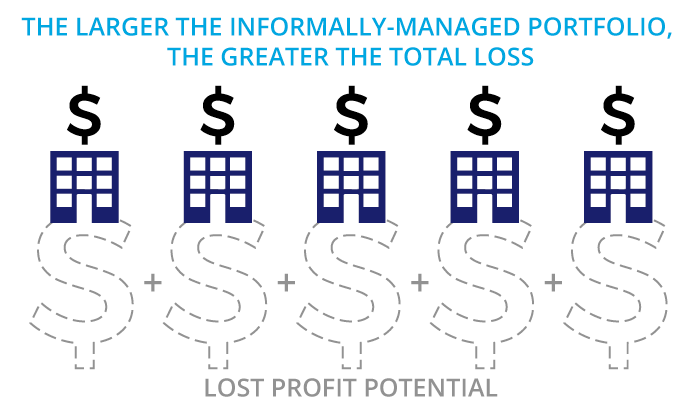

Loss to lease isn’t always caused by charging less than market value. Some property owners are the cause of their own loss to lease without even knowing it. Take the case of David, a landlord we spoke with recently. He was incredibly proud that his tenants really liked him and that he cared about each and every one of them. This may seem like a fantastic approach, but he treated his property as a hobby and not an investment. He needed to formalize his business processes because his informal management style was limiting his wealth creation.

David would adjust rent based on how his tenants were doing. So you can imagine what his rents looked like during the global pandemic. Giving his tenants rent concessions ensures they stay and continue to pay rent. But at what cost? He was so focused on keeping his tenants happy and in his units, he forgot his property was supposed to make him money, not just break even at every lease cycle.

Why on earth would a landlord or property manager charge less than market value or provide regular rent concessions?

What do rent concessions have to do with loss to lease?

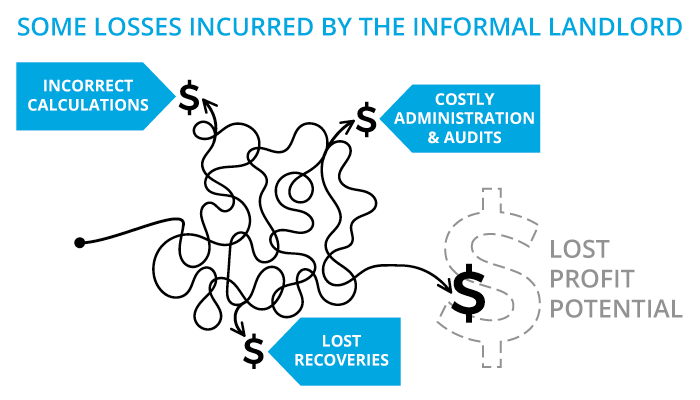

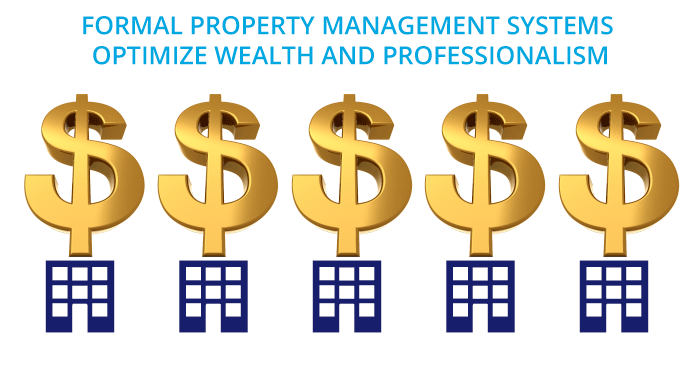

David thinks he’s doing the right thing by offering his tenants rent concessions. He didn’t believe using property management software like CRESSblue would be right for him. How could a software that calculates and tracks rent accurately work for him when he provides rent concessions based on how his tenants are doing?

Rent concessions are any form of reducing what a tenant will pay in rent. There are many reasons to do this, but they should be used as the exception and not the norm. When a landlord gives tenants a break on the rent, they lose out on real income, not the mythical potential income. But that real income loss is much more important. And that’s what David is facing. Let’s take a closer look at some examples of rent concessions.

Rent abatement

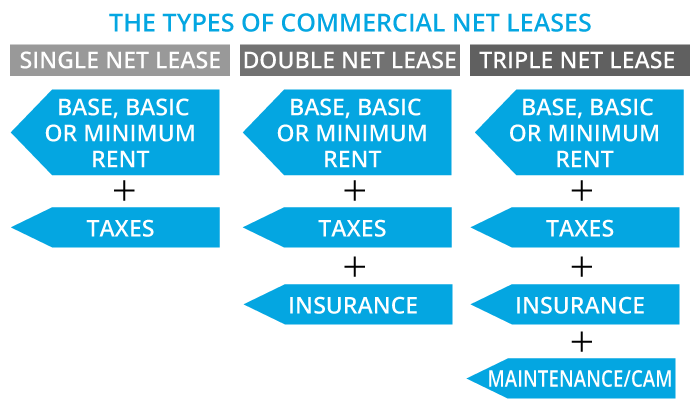

Giving some type of discount, be it rent concession, a percentage off or an early payment discount, is called rent abatement. It provides a financial break for the tenant and ensures the landlord gets early payments or keeps units occupied. To keep tenants in his units, David offered one month free during each one-year lease period. The remaining 11 months’ rent is paid in full, which is already lower than market value. By charging $8,000 for 11 months, David is only making $88,000 over 12 months instead of $96,000. Factor in the loss to lease of $3,600, and David is losing almost $12,000 a year through kindness and poor management.

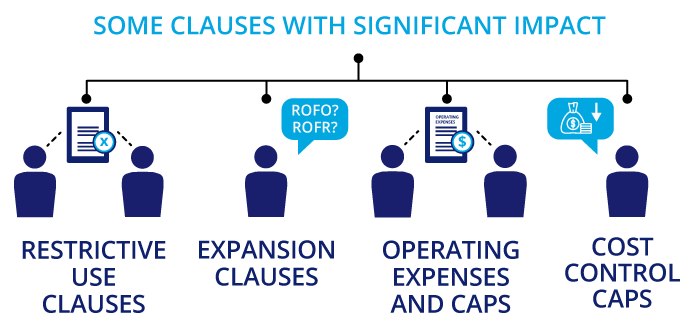

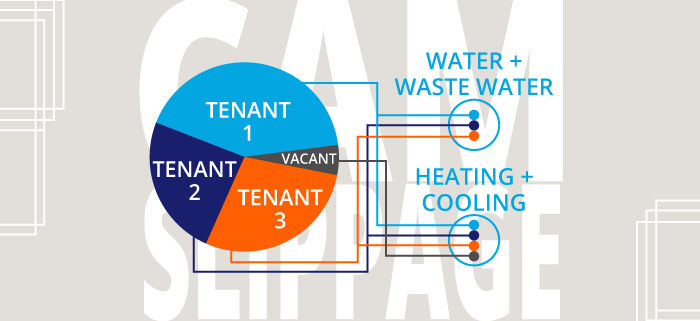

Market rates aren’t the only factor in loss to lease analysis. If the data reveals a significant difference between the current lease and market rates, the opportunity costs of a new tenant must be factored in. Vacancy, free rent, fixturing periods costs, realtor commissions and legal expenses will offset the gains in the lease rate. Often these factors result in the landlord accepting a market rate loss to lease when negotiating with existing savvy tenants who are aware of these factors and consider them in their lease term extension proposal. This shows up in lease term extension options with wording such as “Base rent to be 90% of the market rate.”

Tenant Inducements

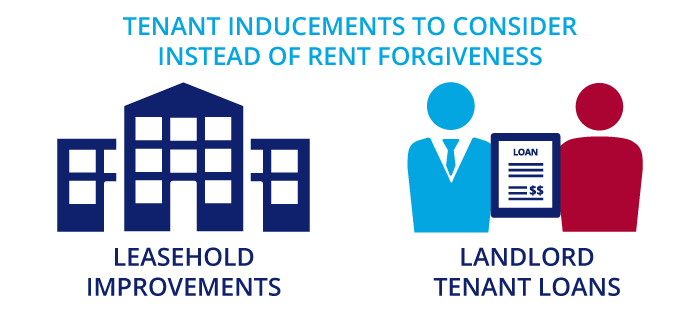

An extremely common tenant inducement is improvement allowances. Often a tenant will require improvements or upgrades to the physical space before moving in. These improvements are a condition of the lease. By agreeing to them, the landlord hopes these upgrades will be equally valuable to another tenant. The risk, then, is that the ROI on the tenant improvement allowance will not equal the cost of the allowance.

An alternative to tenant improvement allowances is the landlord-tenant loan. While there is some default risk here, it is far less risky than essentially giving away money in the form of free rent or improvements that may never be fully recouped through future rent. In addition, for tenants looking for an inducement to sign a lease, a loan from the landlord that is secured by the premises is attractive since moving a business is expensive. Securing additional financing from a traditional bank for moving expenses and leasehold improvements is much harder for a tenant to obtain, so a landlord loan can free up the tenant’s cash for other expenses.

Both improvement allowances and landlord-tenant loans allow a better chance for the landlord to recoup losses. But David prefers his way. Another way he accommodates his tenants is by offering a choice of upgrades or free amenities when their lease is coming up for renewal. David wants to make sure his tenants renegotiate their lease, so these small—to him—offerings provide great returns. Not quite. David fails to see that recouping the cost of the improvements or losing the income from additional storage and CAM fees will not be easy without rent escalations. Never mind that his rent is already below market value.

So, what can David do instead?

Making loss to lease work for you

Track market value and loss to lease as part of your regular accounting. This is the single most important step to making this phantom number work for you and not against you. If you know how much a unit could be worth, you will be able to make informed decisions about it, such as whether to proceed with leasehold improvements to a unit or rent escalation to full market value or a portion of it.

And when leases come up for renewal, there may be no way for you to escalate rent to market value and keep your existing tenants. That’s where your tracking can help. For example, suppose you know that the building is outdated and needs upgrades. In that case, you can leverage that information to decide which improvements will give you the most bang for your buck and bring in the highest-quality tenants possible at the highest rent they are willing to pay.

Your research may show that the market value far outstrips your property, and you need to invest in more creative ways to attract different tenants or keep the ones you have. Added amenities to the building? Rent increase is worth it. Should you renovate to an almost-new state? What does your data tell you about the area, the market, the tenants and their customers? Over-improvement may not allow you to recoup those costs.

Get creative with your concessions

If, like David, you feel strongly about giving rent concessions, there are ways to recoup the losses so that neither you nor the tenant feels the pain. For example, backloading the lease allows you to offer a break while ensuring you end up close to market rate expectations. Or, instead of offering free rent for one month and keeping the rest of the lease amount the same, increase the monthly lease amount to absorb the loss. In David’s case, the monthly rent would increase by less than $700 a month to spread the cost of that free rent month across the remaining 11 months. Or offer a landlord-tenant loan to bridge high expense periods for tenants.

Your research and data will tell you what you need to know to make decisions based on the bottom line and not your heart.

Getting more out of your data

Using loss to lease as a tool can also help identify issues when they happen and even before they happen. In addition, it can be a gauge of your property manager’s performance. Reviewing loss to lease regularly helps property owners set performance goals and reach new targets.

David didn’t want to hear that he was losing money. But once he started tracking his concessions and his potential income, he realized that he should be focused more on ROI and less on making the next leasing cycle. David finally understands that accurate financial reporting can only help his business grow. In a few short months, David has found numerous instances of loss to lease that he himself caused. And now, he has a plan in place to eliminate as much as possible at every lease cycle.

Loss to lease is an invisible number. It’s not real. It is a potential. Reaching that potential may not fully be possible, but you can use loss to lease to your advantage. By tracking it and understanding which factors you can affect and which are out of your control, you can lessen the gap between what you are making and what you should be making. It’s the only way to tame this invisible beast.

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.