Calculating the CAMs (Common Area Maintenance)

Why is common area maintenance relevant?

Commercial net lease cost recoveries are in the same order of magnitude as the base rent. Given that fact, three things are vital to determining the value of each lease and the property investment returns. Specifically, you need to know what these costs are, how they are calculated and what categories of expenses are legitimately included.

Common area maintenance (CAM) calculations affect:

- Net lease negotiation

- Operational and capital budgeting

- Accounting

- Property and asset management

- Property owners

- Tenants

In truth, there is hardly any aspect of commercial leasing into which common area maintenance costs and recoveries do not consistently factor.

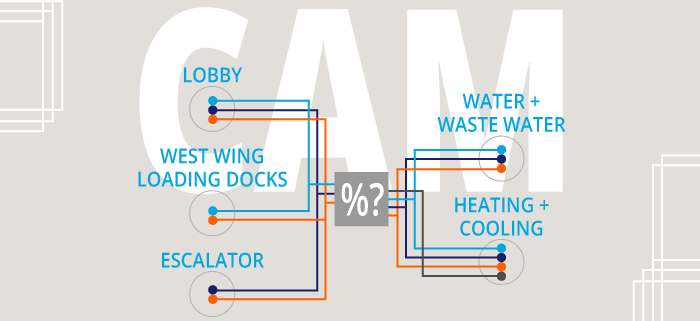

What is common area maintenance?

Common areas are portions of a property that are available to all tenants, a group of tenants, or their invitees.

It must be remembered that not all of the tenants or their invitees necessarily participate in the use of all common areas. As an illustration, an elevator system in a high-rise building provides no benefit to an outside facing street-level shop. Additionally, the washrooms on each floor of an access-controlled building are only useful to the tenants that use those levels. Under those circumstances, a limited group of tenants, as opposed to the entire rent roll, share in the common area costs.

Common area maintenance costs are the maintenance costs associated with those shared areas. For the purposes of calculating cost recoveries, other maintenance costs that are not for the exclusive use of one tenant are also grouped into the CAM as operating costs. These can include costs associated with the building walls, roof, exterior lighting and climate control systems. Commercial net leases typically list all the permitted and excluded categories of expenses. Unfortunately, most leases do so only in a broad set of terms and do a poor job of providing practical guidance in specific cases.

Can capital costs be recovered?

Often commercial leases exclude capital costs and costs that are capital in nature, from the definition of operating costs. You can read more about capital expenses and proportionate share here. It doesn’t mean that every lease excludes capital costs from recovery. On the contrary, there are other ways in which capital costs are legitimately included in a lease for recovery as an expense.

If capital costs are recoverable, the lease should clearly describe the method for calculating the portion that is recoverable in any one period. Typically, the preference in this case is the straight-line amortization method. It may or may not include interest on the unamortized portion. The lease schedule should include the amortization period for each classification of asset for clarity.

What about reserve funds?

Some property management firms use reserve funds. A reserve fund is money collected from tenants to be set aside for future capital expenditures. Reserve funds deserve a special mention because their deployment and use are often problematic.

Firstly, it is impossible to reconcile their use under normal methods. Obviously, the whole point of the fund is to not reconcile the account balance to the actual expenses every fiscal period. Otherwise, a regular budget and installment payments would work just fine.

Secondly, what determines how and when a fund is used rather than a budget line item? What keeps a reserve fund from being used as a slush fund to make up for sloppy budgeting? Does its designation for a particular purpose like “roof fund” lend enough meaning to keep everyone honest? What level of discretionary use is permissible?

Thirdly, what happens in the sale or acquisition of the building? Does the fund go with the building, or does the fund disappear with the prior owner? Is a reconciliation attempted at that time, notwithstanding the turnover in tenants over the long period?

Fourthly, is there a cap on the fund level or can it accrue indefinitely? Is interest paid into the fund on the balance?

Any indication of the use of reserve funds is certainly worth investigating in a net lease situation.

Cost recovery methods vary

The simplest cost recovery method for a landlord is a bill/rebill method. This works for any expense that is individually determined, such as a service call to a particular location. The landlord gets a bill and invoices the tenant for the amount, usually with an administration or management fee added to it. In the cases where more than one tenant shares costs, a multitude of different factors must be addressed explicitly for each expense.

Where tenants share variable costs over a season or fiscal period, a commercial landlord uses a system of property budgets to prepare for the upcoming expenses and charges instalment payments along with the monthly rent. At the end of the period, the manager performs a reconciliation between the actual expenses and the instalment payments collected for that period. Not all leases on a multi-tenant property will have the same anniversary date. For this reason, setting the budget period for a calendar year rather than a lease term year is typical.

Types of cost allocation calculations

The simplest type of cost allocation is an equal distribution based solely on the number of users. Each tenant pays an equal share. This method can be acceptable where the benefit to each tenant is nearly the same and is largely independent of any other factors. However, a simple equal distribution of the expense does not fairly allocate most expenses.

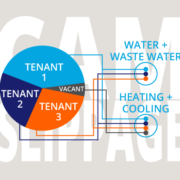

Commercial net leases use a proportional allocation of expense costs based on the rentable area of the premises. In this method, each tenant’s share is the rentable area of their premises divided by the sum of all the rentable areas. This method isn’t perfect, but it generally more accurately reflects the usage by each tenant and is a predictable and repeatable method for making the CAM cost allocation calculations.

Rentable area and area gross-ups

When using the proportional method for allocating CAM costs, the definition of the areas is vital to making the calculations. The most common standard referenced is the Building Owners & Managers Association (BOMA) standard. This standard has changed over time, and also includes different methodologies for the same class of buildings. It is vital to have the lease specify which standard it uses. Additionally, it is critical to have the lease reference track to the most recent version of the standard. Together, these allow the landlord to use a consistent standard for all property leases. Note that individual tenants cannot specify the standard for all the other tenants. In truth, it is common to find that leases reference different standards for tenants in the same complex.

Buildings with non-rentable common areas will typically have those areas proportionally allocated to the rentable areas. This type of calculated area is known as the grossed-up floor area. For example, the common hallways and washrooms on a particular floor of a building will have their floor area divided up and added to the rentable areas of each of the premises on that floor. Grossing-up areas is a means of allocating those non-rentable areas to the tenants that use them. It is important to note that the gross-up process should consider which group of tenants benefit from the common area that is shared. In other words, each of the common areas may not apply to the same group of tenants every time. There’s a good article here with an overview of how and why to implement gross-ups.

Areas can change over time

Lastly, on the subject of areas, the areas may change over time due to building renovations, area audits that result in changes to stated values, area caps specified in leases and changing measurement standards. Renovations, in particular, can affect not only the related area values but also the user groups if additional or fewer units are made and attach to existing services and common areas. Each of these can force a discontinuity into the fiscal period calculations. Resultantly, another set of calculations is now required using the new data on the effective date of the change.

Expense gross-ups

First, let’s broadly define a few terms for clarity.

Fixed costs are costs that do not vary on occupancy or usage. Examples of fixed costs are utility infrastructure charges like water and wastewater connection charges.

Variable costs are those that vary with occupancy and operations. Following the above example, the amount of water used and the wastewater generated is a direct result of occupancy and operations occurring on a property. Tenants use water for washrooms and lunchrooms when they occupy a space. Site operations like irrigation use water seasonally.

Expense gross-ups reflect variable operating expenses for buildings not fully occupied. Moreover, these may be grossed-up to accurately reflect the portion of the variable costs that are attributable to the occupying tenants.

Slippage is the difference between total property expenses and the amount the landlord can recover from the tenants. Landlords are always trying to minimize slippage, and they do this through the use of expense gross-ups.

Not everything can be grossed-up

Fixed costs are allocated to all of the premises in the user group. Moreover this allocation applies regardless of any vacancies or lease exclusions. These fixed costs that are not recoverable result in slippage. Fixed costs should not be grossed-up to the tenants.

Expenses that should be grossed-up

Operational expenses that are variable with occupancy should be grossed-up to fairly allocate those expenses to the tenants that enjoyed or benefited from them. For example, vacant units don’t use water. It isn’t reasonable to proportionally allocate the water usage portion of the bill to all of the premises if some are unoccupied during that billing period. However, not all variable costs are wholly attributable to occupancy. Even vacant units are heated minimally to prevent water and fire sprinkler pipes from freezing in the winter. Security lighting and building controls still use some electricity. In these cases, reasonable estimates or building information systems may provide reasonable guidance on how much of the expenses should be grossed-up.

Accounting for discontinuities in calculations

We have already mentioned discontinuities in area data that result from changing standards, area audits, renovations and individual lease terms capping allowable changes. These all affect the proportional allocation part of the calculations.

At the same time, variable expenses affect the way the proportional use gross-up calculations are made.

In addition to those factors, leases start and stop mid fiscal periods. Not only does this force a change in allocations to a new tenant, but the leases may also include different, previously negotiated caps and exclusions. What wasn’t recoverable under the previous tenant’s lease may now be recoverable under a new lease and vice-versa.

For all of the above reasons, expenses with billing periods often need to be reduced to per diem amounts and allocated on a daily basis. Certainly, any billing periods spanning the start and end of a fiscal period will need to have adjustments made to allocate the correct amounts to each period. Additionally, any billing period that covers one or more discontinuity events further adds complication. In these cases, the manager will need to proportionally adjust each for the specific date ranges.

How to do common area maintenance calculations

Here are the steps for manually performing CAM calculations:

Step 1

For each invoice, check if it actually is a common area maintenance expense. If it is with respect to at least one lease, check which cost recovery method is applicable.

Step 2

For each class of expenses, determine to which group of tenants the fee applies. At this point, it doesn’t matter if the lease has an exclusion on that particular expense as the denominator requires the total area. Calculate the area gross-ups. If there is a discontinuity in the area values, compile area data for each time period that is at least partially within the relevant fiscal period.

Step 3

Check the expenses to determine whether it is a fixed or variable cost. Undoubtedly, some invoices will have both types on the same invoice. Apply the correct proportional allocation to the fixed costs and calculate the gross-ups for the variable costs based on occupancy. At the end of this step, you should have the correct cost allocation for each of the premises based on the type of expenses and the relevant areas.

Step 4

Using the lease terms, determine if the expense class is eligible for recovery. For example, if the lease states that the roof membrane maintenance is the sole responsibility of the landlord, roof leak repairs aren’t allowed to be charged to that particular tenant even if it is allowed for all the other tenants. This ineligible amount is slippage to the landlord; the remaining tenants do not pay for it. The same process applies if there are limiting caps on cost recoveries for all or some of the common area maintenance and operating expense classifications.

Step 5

Perform per diem calculations for each billing period not fully contained within the fiscal period. Then, do this for each service period that spans a discontinuity in applicable areas, and every time a tenancy change occurs. Equally important, a discontinuity can arise when a period changes within a lease term, for example, at the end of a fixturing period. Often a tenant only pays CAM charges for the property tax and insurance classifications and nothing else during leasehold improvements and fixturing periods of the lease term.

@$%&!, that’s complicated!!

If this all sounds incredibly difficult, you are right. Single-tenant properties and static leases aren’t that difficult to figure out with some experience and reasonable spreadsheet skills. Once the property management company moves into multi-tenant properties and there’s some action with improvements and lease turnovers, it gets tedious and quite difficult to do the calculations correctly. Without doubt, this provides ample employment opportunities for lease analysts and accountants. On the other hand, landlords and property managers benefit greatly from getting it right from the beginning.

The time-consuming approach

One solution for property management firms is to hire lots of people to do the calculations. Let them spend plenty of time doing the calculations as best they know how. Also, hire more staff to review the results. In the end, the reports still have to go out to the tenants. The more sophisticated tenants have staff or consultants to check those reports and perform audits. Even if the reports are vague and don’t contain much verifiable information, there will be several tenants that request an audit of the statements. It’s an expensive and insecure way to run a significant part of the property management business.

The inaccurate approach with slippage

Alternatively, a lot of smaller firms without the available resources give up on making the complex calculations. Consequently, they accept thousands of dollars annually in slippage in what are otherwise legitimately recoverable CAM charges.

The quick, accurate and efficient way

Is there a better way to perform CAM calculations? Yes, there is. CRESSblue commercial property management software has automation systems that perform all those steps and provides an audit trail for each invoice. It’s one of the key reasons we designed it. Our software system also produces the annual reconciliation reports without the need for any math skills or spreadsheets. This is enterprise-level sophistication at an everyday price, far below the cost of doing it any other way. Confidence, efficiency and professionalism are within reach for all commercial property management companies. It’s your time to be ahead.

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.

[…] CAM calculations are very hard to do correctly using spreadsheets. The three cases we looked at all require running multiple sets of calculations within the same period. Creating spreadsheets that can handle these calculation sets requires manual work for every single property for every single reconciliation period. CRESSblue automates all of the calculations using original source data and very simple-to-use lease period recovery rules. It also provides an audit trail report on every transaction. […]

[…] of the lease agreement. There’s an excellent overview article here and a more in-depth article here to help you better understand these concepts. Your skills and performance in this area determine […]

[…] calculation, the CAM allocations are anything but. We’ve previously covered the complexity in another article. Typical complications are variable expense gross-ups, partial expense periods due to lease […]

[…] area maintenance charges, also known as CAM expenses, are the fees paid for the upkeep of areas designated for use and benefit of all tenants in a […]

[…] Even if the invoices clearly describe the work and where it was done, further complexity lies ahead. Proportional expense allocations for multi-tenant properties can be complicated, especially when there are renovations, vacancies, tenant changes and a variety of free rent exemptions during the budget period. We won’t get into the details of how to calculate the proportional cost allocations for multi-tenant properties here. We covered that in another article. […]

[…] the correct formulas to do the math accurately. You can read more on the complexities of these and CAM calculations here. The resulting slippage is either accepted as an alternative to spending time doing the math, or as […]