When Should You Hire a Commercial Property Manager?

Owning commercial properties is an excellent investment, but managing it can also be a lot of work. Some owners prefer to manage their properties themselves, but you may find it makes sense to hire a commercial property manager to help you out once you scale up. When does it make sense to take that next step? We’ll take a look at some of the factors you should consider before making your decision.

Factors to consider

Can you afford to hire a commercial property manager?

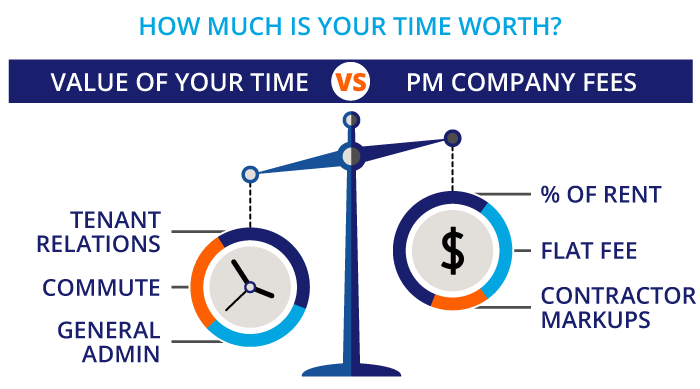

There is no set formula for commercial property management fees, but there are several ways that property management companies may charge for their services. For example, they may charge a percentage of the total collected rents. The percentage will depend on the company’s services—the more services, the higher the rate. Or, they may charge a flat monthly management fee for larger buildings and charge any on-site salaries and expenses back to the owner.

Fees may also be higher for properties that require more intense compliance and regulation, such as medical offices or food processing facilities. An older building with outdated equipment may also warrant higher fees as it is more likely to need more frequent repairs. Property managers may also mark up the cost of contractors’ prices by 5% to 15%. Be sure to get a breakdown of costs to get a clear picture of how much you will need to budget for property manager costs. You can find more details on commercial property manager fees here.

Do you have too many properties to manage on your own?

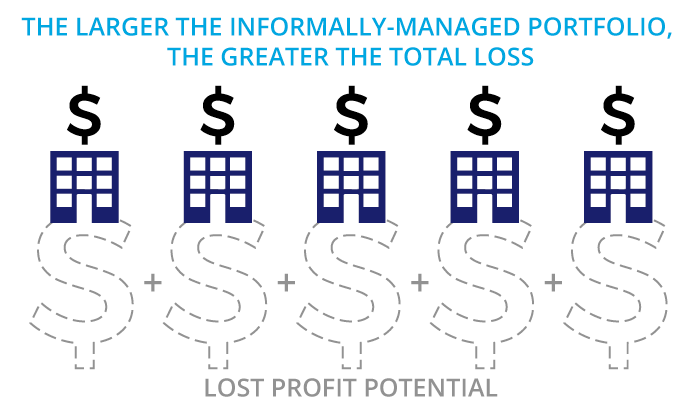

How many properties do you own? Are you able to give each one enough attention, or do you feel like you are always shortchanging at least one property? If you manage multiple properties at once, you could likely benefit from hiring a property manager. The more units you own, the more tenants you handle and the greater the responsibility. Each tenant may also have their own unique lease terms and agreements, making it critical to stay on top of various obligations.

Are you short on time?

Is your office staff working overtime to manage your properties? When was the last time you had a vacation? Hiring a property manager to take care of the day-to-day tasks can free up your time for other things. A property manager is dedicated to servicing properties as a full-time job and has much more flexibility to meet with tenants and perform repair work and other essential tasks.

Do you live near your buildings?

Tenants expect a quick response in the event of an emergency or issue. If you are not able to get on-site quickly, your tenants may become frustrated and angry. It’s one thing to make residential tenants wait for repairs or maintenance, but for commercial tenants, it’s their livelihood that’s at stake. Leaks, plumbing issues, HVAC failures can all lead to a loss of revenue or even a loss of inventory. A locally-based property manager can be dispatched swiftly to sort out any problems in an efficient manner.

Also, consider the amount of time you are spending commuting from home to your units regularly. Even living just 30 minutes away takes at least an hour out of your day, plus the time you spend on-site. Not only will you waste time driving back and forth, but you will also spend more money on gas and incur more wear and tear on your vehicle.

Do you want to hire and manage staff?

You can hire staff to manage your properties, but you may need several different positions to cover the same tasks a property management company can provide. You will also need to oversee those employees, and you’ll need to cover benefits and other expenses incurred by having staff on the payroll. Even if you hire contractors rather than employees, you will need to source out reputable tradespeople and supervise them yourself. Property managers typically have a pool of reliable, vetted contractors that they can call on to provide various services to their clients at any given time.

Do you want to be a landlord?

Does the thought of dealing with evictions, tenant complaints and maintenance issues leave you cold? That’s okay. Not everyone is passionate about dealing with commercial tenants and the responsibilities that come with being a landlord. An experienced property manager is skilled in handling landlord-tenant issues and can do so on your behalf. They are well-versed in enforcing lease terms and legal processes, so you don’t need to be.

So what can a commercial property manager do for me?

Commercial property managers can take care of a variety of services, depending on your needs. Most property owners know that property managers take care of facilities, landscaping, upkeep of parking lots and building repairs. But many of them can offer a lot more than just maintenance.

Here are some types of support a commercial property management company can provide:

Tenant relations

A property management company can actively solicit and screen potential commercial tenants and show units to interested parties. That in itself can save quite a bit of time. In addition, they can field and resolve all inquiries and complaints from tenants, so you don’t have to do so yourself. They will be on the ground, building the day-to-day relationships with tenants, and they will be the first to know of any issues that may need to be addressed. Property managers can also coordinate move-ins and move-outs and handle the legal eviction processes. A good property manager will also provide a tenant retention plan to keep tenants happy and satisfied for the long term.

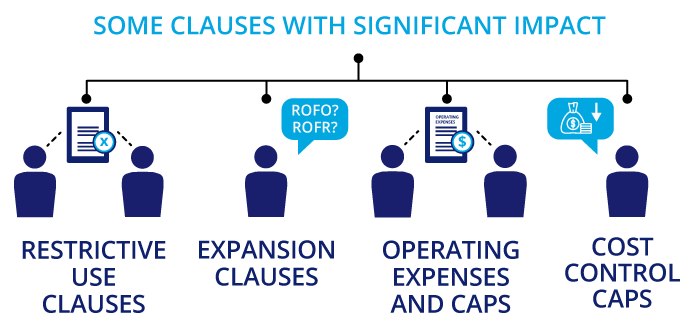

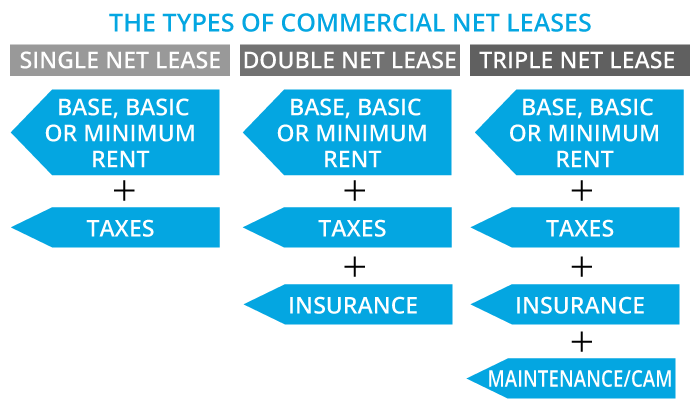

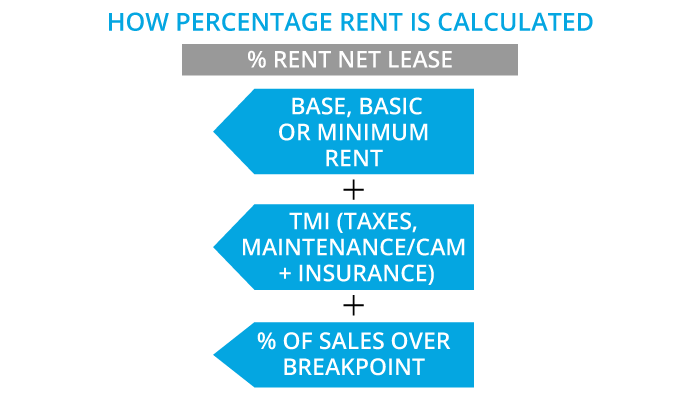

Lease administration

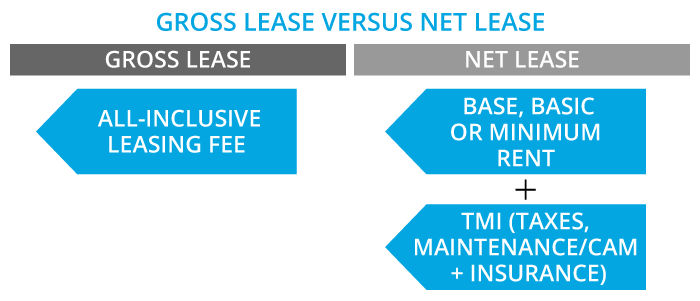

When it comes time to sign a lease, a commercial property manager can prepare documents and arrange the signing around the tenants’ schedule. They can also manage the different lease terms for each of your tenants. This in and of itself can be worth hiring a property manager, especially if your tenants all have different types of lease agreements and unique terms. They can also negotiate the lease terms to ensure that both parties receive a favourable opportunity.

Rent collection

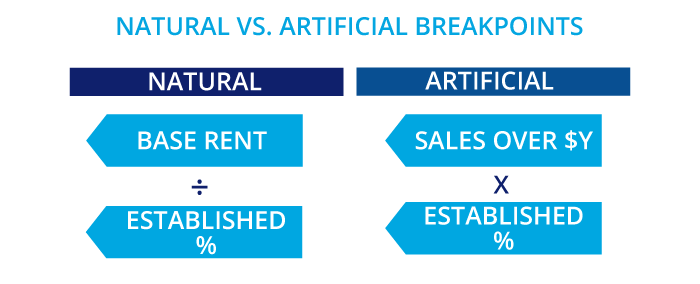

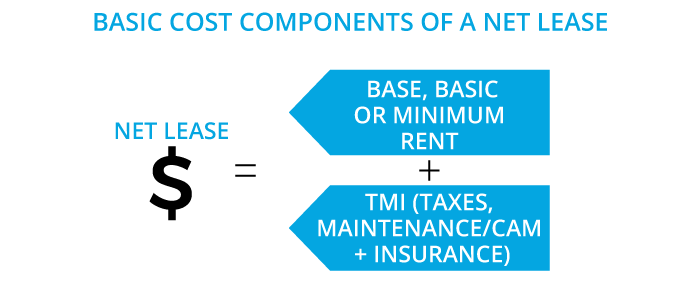

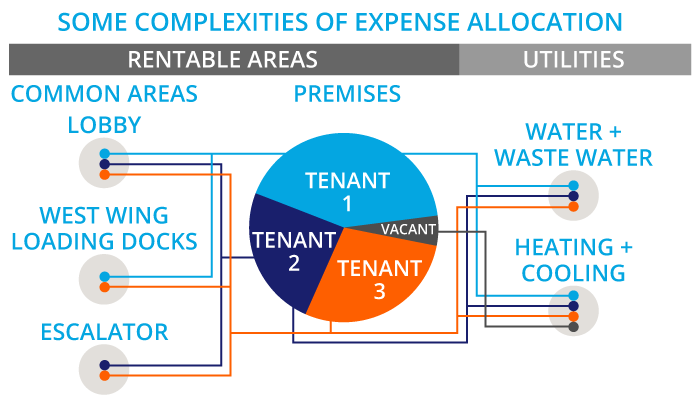

Complex leases with different rates, due dates and terms, means rent collection becomes more complex, especially in commercial properties with multiple tenants. A professional property management company can set and collect rent on your behalf. They will also handle the associated financial record keeping.

Accounting and financial services

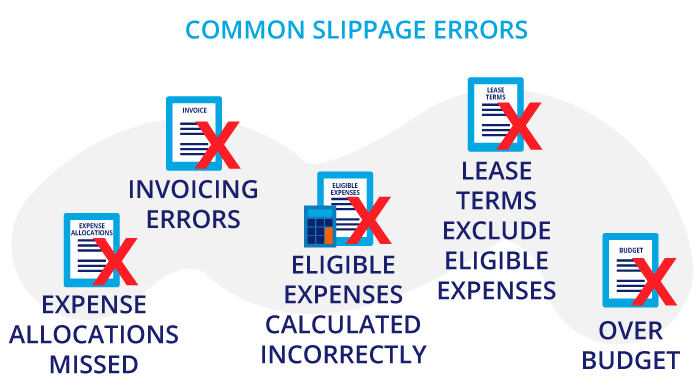

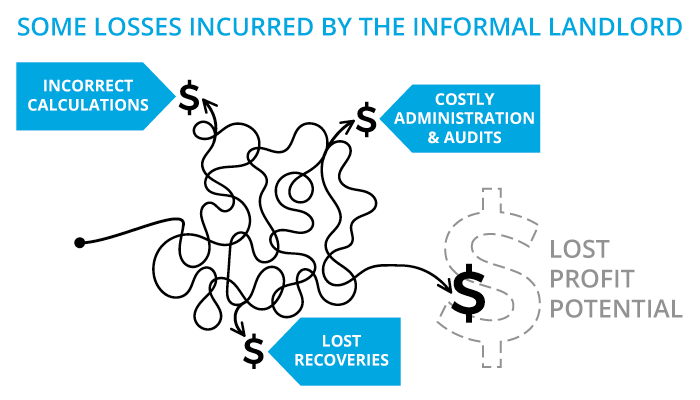

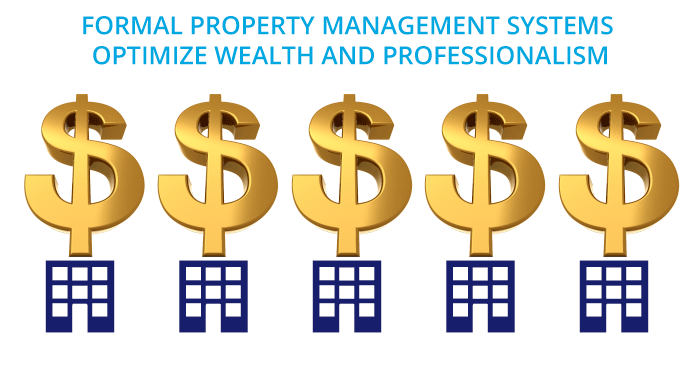

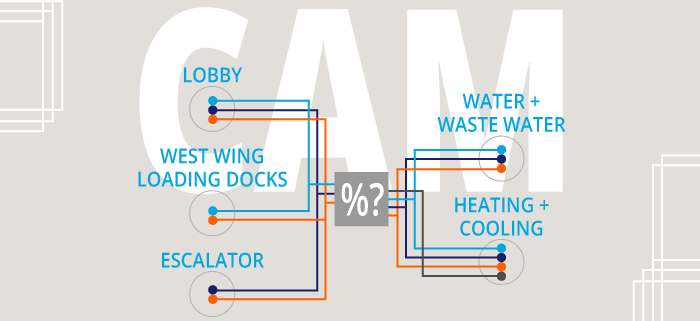

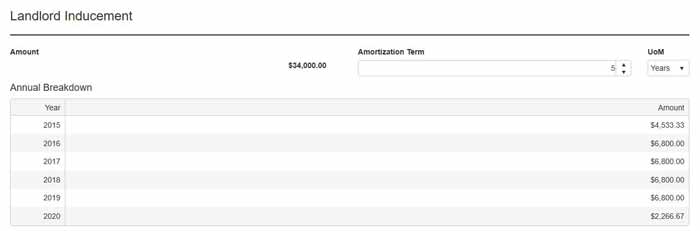

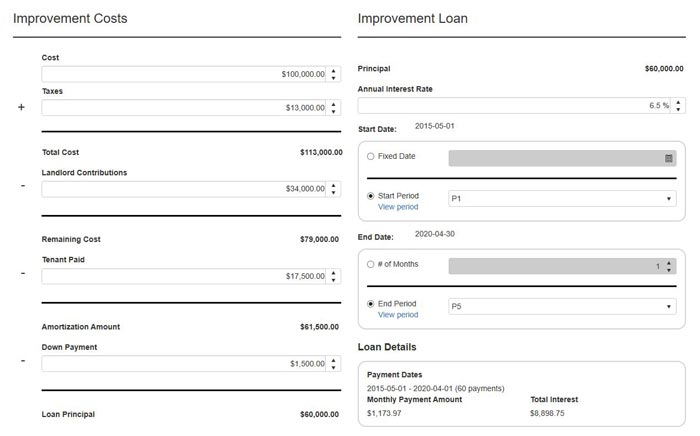

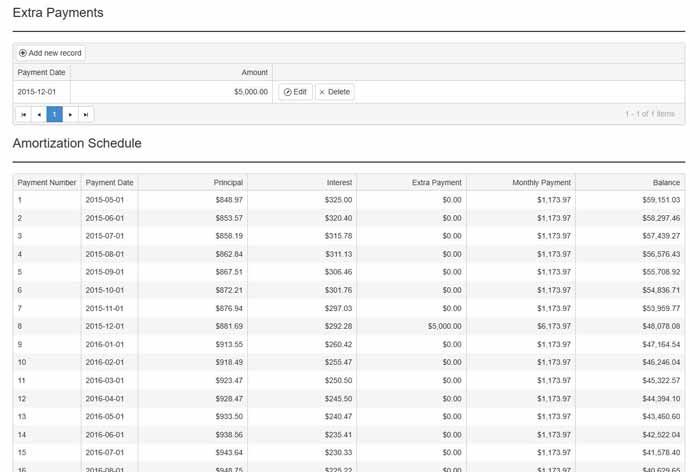

And speaking of record-keeping, another considerable benefit that some companies can offer is full accounting and financial services. Again, these services can be worth the money as commercial real estate finances and annual audits can be quite complicated. From keeping track of expenditures to identifying recoverable and non-recoverable expenses, defining capital costs and CAM charges, it can be challenging to stay on top of your accounting. And accurate financial reporting is essential to your business success. Hiring a company to take care of these responsibilities will help ease your burden.

Legal experience

Experienced property managers also understand landlord-tenant laws and can mitigate risk associated with legal processes around security deposits, terminating leases, safety compliance and more. They will also have knowledge of commercial building codes and construction standards.

Insurance

This is an oft-overlooked area of responsibility because it only shows up when it is too late to correct. A certified commercial property manager will ask about the items a tenant is storing on the property that might not be part of the approved use of the premises. Often employees bring projects to the warehouse to work on weekends with company tools. A drum of used oil leaking into the ground can lead to a surprising amount of environmental liability long after the tenant is gone. Other concerns include overloading warehouse storage, which leads to fire suppression inadequacy, or failing to perform equipment maintenance and premises inspections as required to keep the building owner’s insurance policy in force.

Marketing

A commercial property manager can also advertise and market your property to find the right tenants to fill any vacancies. They are experienced in writing compelling ads and know where to advertise to attract suitable candidates. They may already have a base of potential clients that could be interested in your properties if they are the right fit.

You may not require all of these services, but most commercial property management companies can provide assistance tailored to your specific requirements. The ideal property manager should have a good working relationship with both the tenants and you, the owner.

What are some disadvantages to hiring a commercial property manager?

Cost

Of course, the cost is an obvious disadvantage—if you do it yourself, you won’t have to pay other people. However, it makes sense to pay others who have a strong background and experience in the industry to take care of your investment. Remember—time is money! If you are spending way too much time managing your properties than you would like to, it is worth the expense. Calculate how much an hour of your time is worth, and then calculate how much the property management company is charging you. If the return on investment is high, then it is worth the money.

You may not be aware of day-to-day operations

Going from a hands-on manager to contracting out the services, you may feel disconnected from the daily operations. The idea of hiring a property management company is to relieve you of excess responsibility. However, it is natural to want to know what is going on in your own business. Ask the property management company to provide regular updates (weekly or monthly reports—you decide). Check in with your tenants as well to make sure they are happy with the contractor’s services.

No close relationship with tenants

When you take a hands-off approach to managing your properties, inevitably, you will lose connection with your tenants. The property manager will become their first point of contact, and they will regularly see the property manager depending on the services they are contracted to do. However, this may also be an advantage to anyone who prefers not to deal with tenants directly.

A property management company may handle things differently than you would

If you are very particular about how you want your properties managed, you may be hesitant to hand over the reins to a second party. However, you can interview various companies to find the right fit for your style. Prepare a list of questions to ask and understand what is reasonable within the industry.

You will have to manage the manager

To ensure that your business is running smoothly, you will need to be in constant contact with the property manager. Schedule regular check-ins and request monthly reports to stay well-informed. Ask for cash flow statements, balance sheets, profit and loss statements and any other information that can give you an overview of your financial performance. Read the reports and analyze them for any irregularities.

You may not be aware of critical data

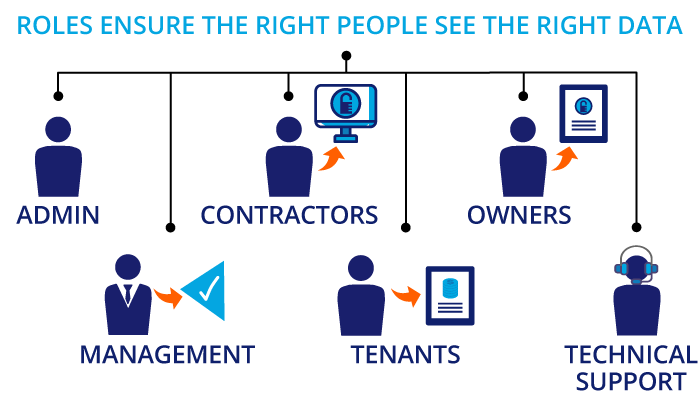

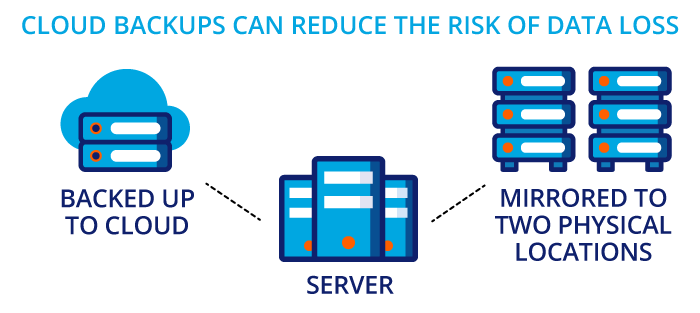

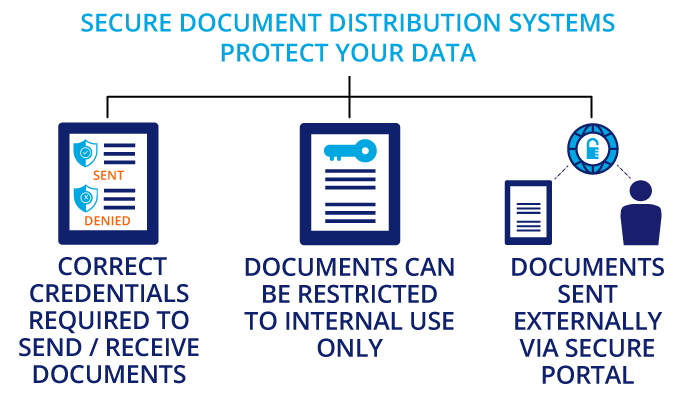

When you step back from the operations, you may not be informed of significant payments or refinancing triggers. Again, make sure you set up a system with the company to contact you when critical financial decisions need to be made. Check to see if the company uses property management software like CRESSblue. If they do, they can easily set you up as a user on the system, so you can keep yourself up to date and informed at all times with automatic owner’s reports.

Bottom line: Hiring a commercial property manager is up to you

While deciding whether to hire a commercial property manager is a personal decision, there are many advantages of doing so. Finding the right company to manage your property can save you both time and money and reduce your stress level. Look for an established commercial property management company with the knowledge and experience to help you get the most out of your investment. To find the best fit for your business, take the time to do your research and thoroughly screen the commercial property management companies. Ask your colleagues for referrals, and look for a company that shares the same business philosophies as you.

The commercial property manager represents your company and should be considered a long-term partner in supporting your business vision. A successful partnership will result in a more substantial return on your investment.

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.