Accurate Financial Reporting Helps You Make Better Business Decisions

2020 has been full of challenges. It’s probably even more important than ever to take a look at how your property management company measured up. Analyzing your data and looking at new ways to improve your financial reporting processes now can lead to more robust returns in the coming year. Here are some tips for calculating your annual profitability and enhancing success in the coming year.

Track your expenses

Financial reporting can be time-consuming and complicated, but you can eliminate some of the frustration at audit and tax time by regularly keeping on top of your accounting. It’s important to keep track of your expenses efficiently to differentiate recoverable expenses from non-recoverable operational costs. Using property management accounting software like CRESSblue will help you automate your workflow and efficiently manage your financial reporting. It will enable you to create leases and automatically manage many (often complicated) calculations for you. This ensures that you always have the most accurate and up-to-date snapshot of your finances.

So, what do you need to track? Basically, you need to record all property expenditures in your accounting books. If you use online software, like CRESSblue, you can digitize your leases and supporting documents and automate expense tracking.

Define recoverable versus non-recoverable expenses

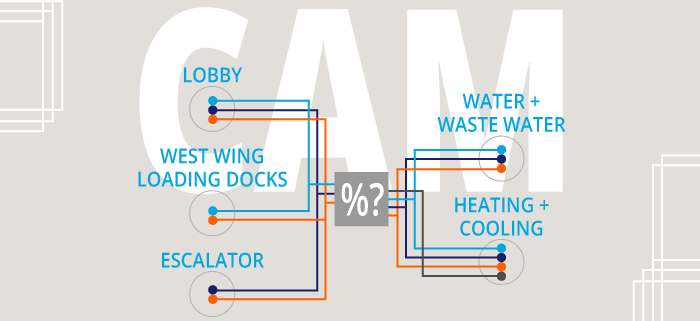

Operating expenses can be broken down into two categories: recoverable and non-recoverable. Recoverable expenses are costs that can be billed directly back to the tenant or through additional charges on top of the monthly payments. In commercial real estate, tenants are typically charged on a proportionate-share basis for their share of the costs. Recoveries are also known as TMI (for taxes, maintenance and insurance recoveries) or Additional Rent (for total cost recoveries). If the lease includes the taxes and insurance in the base rent, the maintenance portion is often called Common Area Maintenance (CAM) charges. Recoverable operating expenses can include utilities, services such as trash removal and building repairs, specific site maintenance, such as snow removal, and more.

Non-recoverable expenses are, obviously, expenses that cannot be charged back to the tenant. Non-recoverables include leasing fees, accounting and legal fees, marketing and administrative expenses, postage and courier charges, and any other costs directly associated with running the business that are typically excluded from the pool of recoverable expenses.

It is important to note that the definitions of what is recoverable for a particular property are specific to each lease. Within each lease, the definitions often change depending on what period of the lease is being reviewed.

Don’t forget capital costs and depreciation

Capital expenses are typically investments that provide a benefit for the future. For example, capital expenses include major renovations to a building or unit, material upgrades for longer serviceability, lighting upgrades, or furnace and appliance purchases. It’s also important to note that capital expenses should appear on the company balance sheet rather than as an expense line on the income statement.

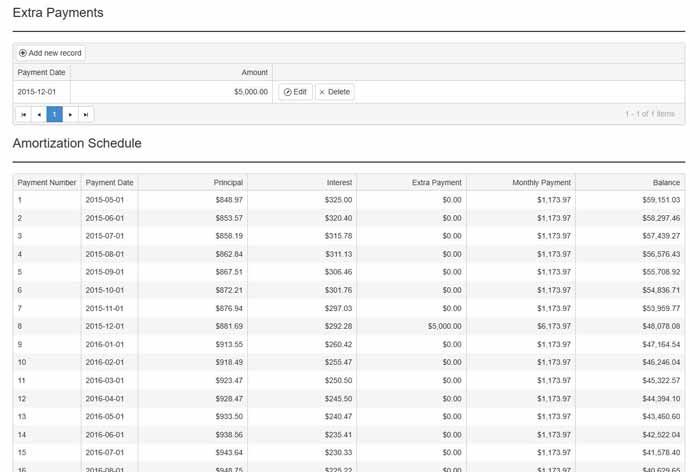

Of course, capital expenses must be depreciated (fixed assets) or amortized (intangible assets) over time and cannot be deducted all at once. It can be tricky to determine which expenses qualify as capital costs and which are operating costs, but the Canada Revenue Agency has a handy chart that might help. You can find a breakdown of U.S. capital cost allowance rates here.

How to tell the difference

There are three main criteria for differentiating capital costs from operating expenses:

- Does it provide additional benefits or functionality?

- Does it extend the life beyond the original life expectancy?

- Is it part of or separate from the original asset (i.e. does have a different salvage value)?

If you answer yes to any of those questions, it’s likely a capital cost and not an operating expense. There’s one other thing to consider. That is, whether the expenses were done at the time of, and for the purpose of, a purchase or sale. If they were, then they are deemed to be capital in nature. Another indicator is the cost of the work in comparison to the original cost. A rule of thumb is that repairs over 10% of the original cost are likely to be capital in nature, but this isn’t a reliable indicator on its own. Make sure to consult with your accountant to determine which expenses to deduct.

You must also factor the depreciation of assets into the accounting of capital costs. Typically, a property management company will only depreciate the buildings. However, certain types of equipment may also be eligible for depreciation. Rental properties may be eligible for the capital cost allowance (CCA), which is depreciation that can be claimed on your tax return. CRA groups depreciable properties into various classes that determine the deduction rate. You can find a full list of Canadian property classes here. For our U.S. readers, here is a breakdown of the IRS’s property classifications.

Some commercial leases allow for the recovery of amortization and depreciation of assets serving the premises. To recover these expenses, you will need to track those assets and their expenses as well. CRESSblue includes this functionality in its asset management and lease administration workflows.

See the big picture

Many property managers only track rental income and some expense recoveries, but there’s a lot more that commercial property managers need to review regularly. You may be able to make improvements in certain areas by analyzing your data and implementing new processes in your workflow. Here are some areas that you may not have previously considered in your financial reporting that could help you improve your profitability.

Analyze your expenses

Apart from tracking income, you should also take a long hard look at your monthly expenses. Look for ways you can maximize efficiencies by reviewing your costs versus revenue. For example, can you automate workflows to reduce administrative costs? Are you paying for online subscriptions you don’t use or use infrequently? Are you paying for services that can be moved in-house for more significant cost savings? Talk to your employees as well. Chances are they can highlight workflow, communication and other pain points, and offer valuable insights into critical areas for improvement.

Manage your budgeting

Vendors provide contracts and quotes that are the basis of the budget numbers. Property managers can take the time to use general ledger (GL) accounts to prepare budgets. Unfortunately, this forces you to manually calculate and allocate the budget amounts correctly to the chart of accounts. This is a big dive into the unfamiliar realm of accounting.

The property budgeting process in CRESSblue is unique in that it uses vendor and office expense accounts directly to prepare a budget. Accounting personnel simply set up the vendor and office accounts to automatically link to the GL accounts for budgeting, transaction expanse allocations and the additional rent reconciliation process. It’s another area of property management where CRESSblue stands out. It makes the financial reporting workflow more natural and intuitive for all user groups while also eliminating whole areas where errors can be introduced.

Review your lease clauses

Do your standard lease template clauses need to be updated to the current industry standards? Are all of the lease terms actually being correctly enacted? Do your signed leases have handwritten modifications that introduce liability-creating confusion and contradiction?

Another area to review is the rent provisions clause. Most commercial leases have provisions for rental increases during the term of the lease. Increases may also be based on annual adjustments for inflation or additional percentages triggered at various intervals. Without a regular review of the leases, these increases may be applied late or missed entirely. Using industry-specific accounting software such as CRESSblue can help you stay on top of potential increases by providing notifications of these increases or automatically applying preset rent adjustments.

If you haven’t reviewed your leases in a while, it’s time now. Ensure that you have the best leases when renewing existing tenants and signing on new tenants. CRESSblue provides implementation logic for industry-standard clauses and terms to help you bring your lease compliance up to current industry standards. Our team of commercial property management professionals are also a great knowledge resource.

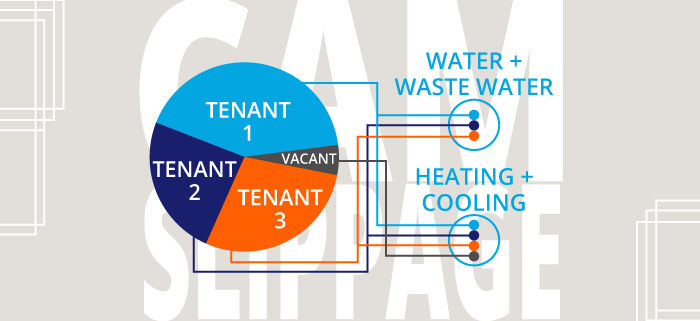

Beware of slippage

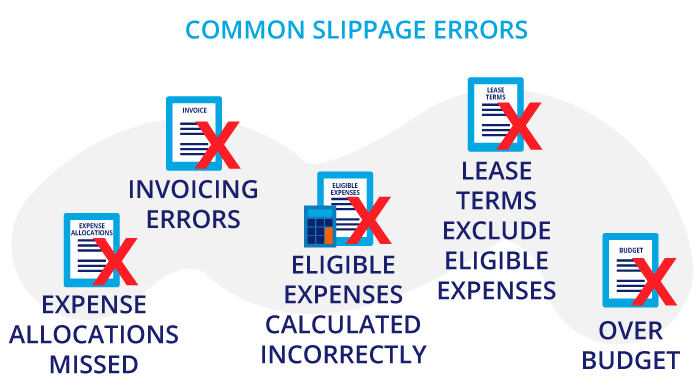

Slippage is defined as additional rent that would be otherwise recoverable if all vacancies were leased, plus costs not recovered for various reasons. Let’s consider several examples of where slippage is triggered. First, expense allocations were accidentally missed and not added to cost recovery calculations. Second, invoicing errors made them ineligible to be allocated and collected. Third, eligible expenses are too difficult to manually calculate correctly and are purposely omitted from the reconciliation. Fourth, lease terms exclude expenses that are normally eligible for recovery, such as fixturing or free rent periods. Fifth, going over budget can also lead to slippage, especially on leases with expense recovery caps.

Automation that eliminates all guesswork

Using CRESSblue can help avoid these mistakes with the following automation:

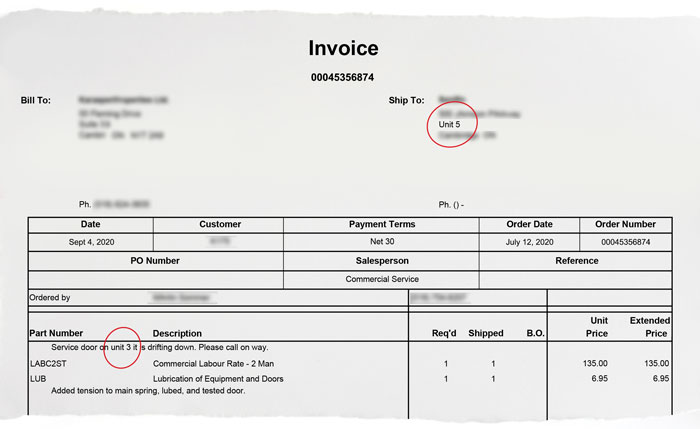

- CRESSblue automatically allocates ALL expenses—whether from vendors or internal expenses—to specific categories at the invoice creation level. There are no separate processes to be run later that might allow an expense to be missed.

- Additional rent categorization occurs as the invoices are entered. Thus, invoicing errors, discrepancies and inconsistencies are identified before the invoices are paid. Invoice corrections can be requested immediately.

- Cost allocations are calculated automatically—including common area gross-up factors and vacancy or overuse gross-up factors—without requiring any math skills or spreadsheet manipulation.

- Automatic cost recovery logic is present for every individual period of the lease term and any extensions when the lease is created. As a result, all eligible costs are recovered automatically, even if they span multiple lease periods. Per diem calculations are done automatically to split the expenses accurately.

- The default cost recovery method uses proportionate share calculations for all selected premises. Alternatively, you can use an equal share calculation method. Costs can be allocated to common areas and automatically allocated to the leases with access to those common areas. A Building Transaction report will list all the transactions tagged to the building and also all the recoveries and the unrecovered slippage amounts. On the transaction level, the Additional Rent Distribution report will break down the cost allocation in detail and specifically identify the amounts and reasons for each allocation based on the property and lease period settings.

For a more in-depth overview of slippage and how to avoid it, read this article.

How much is that vacant property really costing you?

When an investment property or unit sits empty, it is not generating income. But you still incur other expenses while the property remains vacant, such as utilities even though no one is there to use them. For example, in winter, you must keep the heat on to avoid freezing pipes. In addition, insurance can be significantly higher when properties remain empty. Factor these expenses into your financial reporting to ensure you have a clear picture of where your business stands from a revenue perspective.

What is the current average vacancy rate for similar properties? Are you within range, or is your vacancy rate higher than the market rate? If so, it’s essential to understand why.

Vacancies may be due to economic conditions, such as the current pandemic. The economic downturn has created a lack of demand for some retail spaces. However, other industries have had an uptick in need, such as healthcare and warehouses. Is there a way you can repurpose your vacant premises to better suit one of these types of tenants?

Vacancies may also be due to poor property management or overpriced rent. If you see an ongoing vacancy pattern, consider taking a survey of your current tenants to assess whether they feel there could be improvements to the services you are offering. Ask a realtor to walk your property with you to get expert feedback from a fresh set of eyes. Determine whether your rents are pricing you out of the market by doing some market research and competitive benchmarking. To improve the situation, try to determine which factors are driving your vacancy rates.

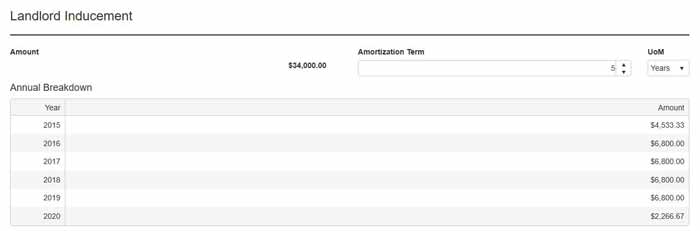

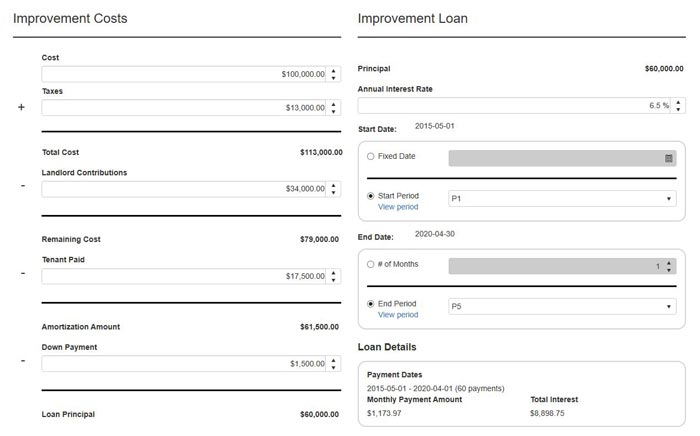

Tenant improvement allowances

Tenant improvement allowances are often incentives for commercial properties to encourage prospective tenants to lease a space. Tenants usually prefer to customize their offices to ensure the property suits their needs. As such, the improvement allowance provides an opportunity to make the space their own and create a fully functional space for them to work in. However, these allowances may end up being costly for property managers.

Alternatively, some tenants may request a turnkey buildout instead. In this case, the property owner is responsible for both financing and completing the negotiated improvements before the tenant moves in. This arrangement is often negotiated with a higher lease rate, which can help offset some of the renovation’s upfront costs. This article has a good explanation of how it works in Canada. Details on the U.S. tangible property regulations are available on the IRS website.

Leasehold improvements are accounted for differently depending on who pays for the upgrades and who owns them. There are several ways to assign costs, as well as numerous potential issues. For more detailed information about this subject, read this article here.

If you own the building, you may be able to claim these expenses as capital costs. Maintaining detailed financial reporting will ensure that you have the information you require to back up your expense claims. Software like CRESSblue makes financial reporting easy.

Tenant defaults

There are many reasons why a tenant may default on rent. Even a strong performing tenant may suddenly experience a downturn in business. And as we’ve seen throughout the pandemic, more and more companies have been forced to shut down due to drastically decreased income.

In normal circumstances, after a tenant misses several payments and communication breaks down, a landlord may decide to either enact distress or forfeiture.

However, with the unusual circumstances around the pandemic, you might wish to exercise more leniency and compassion for tenants, especially for small to medium-sized business owners who may end up losing their livelihoods as a result. As a temporary measure, you can seek out rent assistance.

The Canadian government established an emergency rent assistance program that benefits both tenants and property owners of commercial properties. The program will run until June 2021. A previous program, the Canada Emergency Commercial Rent Subsidy, was administered by CMHC but has since closed. To determine whether your business is eligible for the subsidy, visit the CRA website. Currently, there is no emergency assistance program for property owners in the U.S. that we are aware of.

Utilize financial reporting features

Most accounting software packages provide reports that you can use to analyze your data. Reports can show you profit and loss at a glance, cash flow trends, as well as where you stand with accounts receivable and accounts payable.

Review reports monthly to ensure that you stay on top of your financial situation and make any necessary adjustments. For example, you can also identify how much you spend monthly and identify areas that should be scaled back or cut altogether if investments do not provide a solid return on investment as expected.

Critical report types

Beyond this basic accounting reporting, commercial property managers need comprehensive lease administration reporting. Report types that enable property managers to make better decisions include:

- Budgeting reporting that delivers accurate projections based on vendor and office expense accounts.

- Building transaction reporting that lists all transactions related to the building and both recovered and unrecovered slippage amounts.

- Additional rent distribution reporting that breaks down cost allocation in detail and identifies amounts and reasons for each expense based on property and lease period settings.

- Additional rent annual reconciliations with automated reporting and invoicing. Never leave properties unreviewed and unreconciled again.

- Leasing status reporting that provides data on leasing activities and building vacancies.

- Rental advisory reporting that combines information on base rent, additional rent, property details, loan repayments and lease information.

- Lease abstract reporting that provides lease details in a snapshot format.

CRESSblue delivers this financial reporting automation and more. It provides several data areas and reports that collectively describe a comprehensive workflow and reporting process. With it you can eliminates the reasons for voluntary slippage and, as a resultant, avoid all avenues of accidental slippage. Also, CRESSblue can be customized to distribute reports automatically on any schedule. Establishing best accounting practices and financial reporting processes will help you stay organized and informed. Leveraging property management software like CRESSblue can help you capture all expense recoveries, increase productivity and reduce errors. Take the time now to review your finances and build a stronger, more resilient business in the coming year.

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.