What are CAMs and How to Avoid CAM Slippage

What are CAMs?

Before we dig into CAM slippage, let’s get clear on exactly what CAMs are. CAM stands for common area maintenance. Property managers of multi-tenant office, retail, industrial and warehouse properties typically use net leases. Such net leases recover from the tenants the operating costs for shared common areas separately from the base or minimum rent. These operating costs for shared common areas are the “net” portion of the lease. They include taxes, maintenance and insurance (TMI) that cover the property and building, as well as other overhead expenses and depreciation. CAM (again, the common area maintenance) is part of this TMI (though CAM is sometimes used to refer to TMI). While CAM costs are primarily operational expenses, portions of capital expenses are sometimes also recovered from tenants. The total cost recoveries are often referred to as Additional Rent in the lease agreement.

What is CAM slippage?

Slippage is the difference between the total operating cost of the property and the amount recovered from tenants. It represents the often-preventable losses incurred from various sources. What causes CAM slippage, and how can you avoid those losses?

There are two broad causes of CAM slippage: voluntary and involuntary. Surprisingly, much of the slippage occurs directly from voluntary actions on the part of the property manager. We will look at the voluntary reasons first.

Voluntary reasons you’re experiencing CAM slippage

1. Going over budget

Ideally, as a property manager, you want to hit your property budget exactly. That way, the annual reconciliation statement and accompanying invoice for the shortfall in their instalment payments won’t surprise your tenants. Property managers may look for ways to avoid confrontation when budgets exceed targets by large amounts. They may simply elect to not recover the excess over the instalment payments. In other cases, annual reconciliations remain incomplete. This often occurs for leases that use a Base Year of CAM expenses to determine the annual additional rent that will be typical for the lease term. While provisions are included in the lease to recover any costs in excess of the base year, very often no reconciliations are made. Leases that use a base year for additional rent invite lazy property management behaviour that is costly.

So why are budgets missed?

- No budget was made. More accurately, no budget planning was done at all.

- Budget items were missed. It’s relatively easy to miss an expense item, even if you normally incur that expense. This type of error is easily introduced when using spreadsheets; all it takes is a missed cell in a formula calculation range.

Solution

Use software that automatically builds a property budget based on previous expenses for that property. The entire budgeting process is greatly simplified, no previous expense items are missed, and no calculation errors are possible. There is no need to avoid budget excess embarrassment and take a voluntary hit on CAM recoveries.

2. Unallocated costs

Annual reconciliations of additional rent are supposed to determine the difference between the actual expenses incurred and the tenant instalment payments estimated in the property budget. So how do reconciliations expose the property manager to slippage?

Quite simply, if the expense allocations are only looked at annually, it can be difficult to figure out what the invoices are for and who should be paying for the expense. Typical examples are:

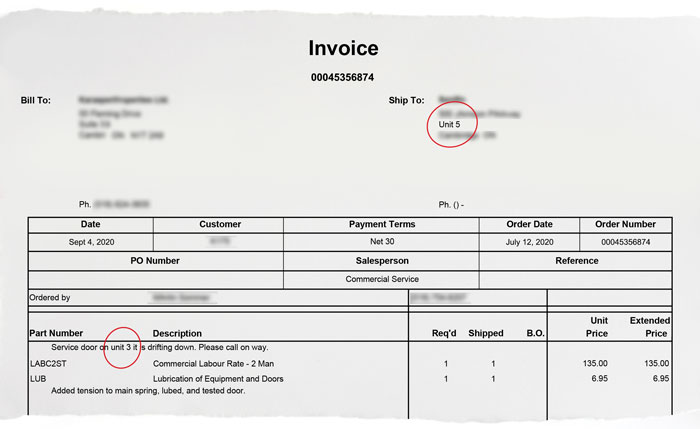

- Service invoices without a service address. This is especially problematic when a contractor provides services at more than one property. Where was the service performed? Which property does it apply to?

- Invoices with mismatched data. What happens with an invoice where the tenant name and the service address aren’t consistent? Which is correct?

- Invoices where the services description is not clear, and it cannot be determined if the cost recovery is allowed under the terms of the lease(s).

In cases like these, property management companies often take voluntary slippage on sloppy paperwork or lose out on disallowed expense claims as a result of a tenant’s expense audit.

Solution

Cost allocations should be made when the bill is entered into the Accounts Payable ledger. That is when the memories are still fresh. Moreover, vendors will correct the bills so that the information is clear before payment is made.

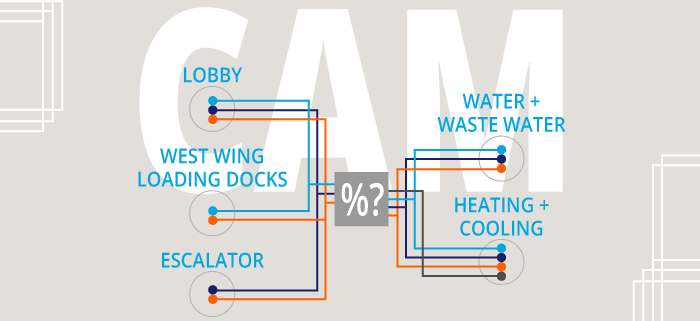

3. Difficult CAM breakdown calculations

While the base rent is a relatively straightforward calculation, the CAM allocations are anything but. We’ve previously covered the complexity in another article. Typical complications are variable expense gross-ups, partial expense periods due to lease commencement and expiry, area gross-ups and rentable area changes.

When the CAM allocations are very complex, property managers often use low-ball estimates to include a “safe” amount of the expense in the CAM statement “that will surely be acceptable” to the tenant as it is obviously below the correct amount.

Solution

Our CRESSblue team finds these types of voluntary slippage decisions frequently. Interestingly, the slippage amount is often more than the annual cost of using software to automatically do the calculations. Your property management software solution should do the math for you without requiring spreadsheets or calculators.

Involuntary reasons you’re suffering from CAM slippage

4. Missed expenses

Simply missing expenses for recovery as additional rent is a type of involuntary slippage. Indeed, this easily occurs when the property management system does not tie invoices to properties. Recurring transactions are relatively easy to track, but one-off expenses are easy to miss in manual spreadsheet-based systems.

Credit card receipts are good candidates for accidentally missed expenses. They typically do not have enough information to identify the items and do not include a service address or a tenant name. The receipts end up being overhead expenses rather than additional rent. Also, they often get lost.

Solution

Firstly, make sure billing is detailed enough to serve as a receipt that can stand up to audit scrutiny. Use commercial vendor accounts that require additional information such as the service address and full descriptions of the items and services purchased. Secondly, use a property management software solution that requires categorizing the expenses at the time of entry. As a result, this makes it impossible to pay a bill and forget to recover the expense. CRESSblue has both a simple-to-use system for allocating costs and an automatic rebilling function for direct expense recovery from a tenant.

5. Lease language

Leases often contain language that lease administrators don’t actually understand. As a result, they never utilize and realize the benefits of many of the lease document’s negotiated terms.

Grossing-up of variable costs

A frequently occurring example of this is when the additional rent allows for the variable costs to be grossed-up to account for disproportionate usage when the subject property is not fully occupied:

| In computing Operating Costs, if less than one hundred percent (100%) of the Rentable Area of the Property is completed or occupied during any period for which a computation must be made, the amount of Operating Costs will be increased by the amount of the additional costs determined by the Landlord, acting reasonably, that would have been incurred had one hundred percent (100%) of the Rentable Area of the Property been completed or occupied during that period, provided that, for greater certainty, it is confirmed that in no event shall the Tenant’s Proportionate Share of Operating Costs be increased pursuant to this section beyond the amount that would be payable if the Property had been fully rented. |

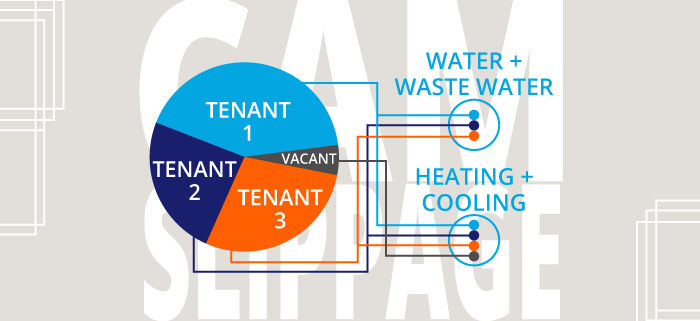

Even though most commercial leases contain similar language for the same effect, administrators often do not separately track the variable expense portions. Moreover, no accounting is made to recover these costs solely from the occupied areas. As a result, they are allocated to unleased portions of the building as vacancy expenses when, in fact, they are legitimately recoverable from the tenants using those services and utilities.

Expense caps

Negotiators often use complicated verbal formulas and expense caps to reach some consensus on what an equitable distribution of costs should look like. Essentially this is a trust issue. The tenant does not believe that clear documentation is available to them to ascertain the costs’ correct calculation. However, very often, the documentation that enables the use of the lease formula is missing. Indeed, consider this example:

| The Tenant’s proportionate share of the operating costs that are under the Landlord’s control shall not exceed 105% of the payment for such costs the previous year. |

This statement requires that the landlord track the operating costs under its control separately from those that are not. One would suppose that those not under the landlord’s control would be realty taxes and property insurance. There are numerous ambiguities with that clause. Does “such cost” include only the similar costs year after year? To put it another way, how do you handle an additional required service that isn’t in the prior year’s basket of costs? Alternatively, what if a union strike unilaterally forces wage increases on the landlord above the 5% increase limit? Are those included in the cap as well?

Solution

Without reservation, negotiate lease terms from a practical standpoint. When the labour to track and calculate the amounts cost more than the additional rent recovered, you may incur losses negotiating for extra rent. Use lease administration software that automatically tracks and recovers, or limits the recoveries. Lease abstracts don’t include boilerplate lease terms. So, they can slip by unnoticed. Your software solution should have the accounting logic and mathematical ability to conform to your lease agreements’ terms.

6. Asset tracking

While similar to the lease language issue, this one deserves a separate mention due to the solution’s scope and the large cost recoveries that it implies. The language included in the typical lease definition of the operating costs look like this:

| … depreciation or amortization of any capital repairs and/or replacements made by the Landlord to the Property and or Premises, … |

What does the inclusion of this language imply? Asset tracking. Capital repairs and replacements are added to the property’s asset value and amortized over that equipment’s expected lifetime. The landlord needs to track those assets and calculate the amortization to add the depreciation and amortization to the tenant’s operating costs recoveries. The tenant in this lease expects charges for capital costs made for or during its own tenancy, but not for those associated with the previous tenants. Are those costs significant enough to warrant the effort to track and calculate the depreciation and amortization expenses? For a rooftop HVAC unit, installed costs of $15,000 over a 15-year lifecycle would amount to a straight-line depreciation cost of $1,000 per year that could be recovered.

Solution

Use a property management software system with asset tracking that can automatically invoice for the amortization expenses permitted in the terms of the lease agreement on the monthly rent invoice.

Property management solutions

Evidently, CAM slippage is easy to incur both voluntarily and involuntarily. Specialized commercial property management software can significantly improve these situations. Is the software expensive to licence? Not at all in comparison to the CAM slippage costs. In fact, using dedicated software can increase profitability. Also, it provides peace-of-mind with clear documentation and accurate calculations.

Likely, active leases are not alterable. However, you can take action to implement the current agreements’ terms. Additionally, understanding how to fully realize lease clauses’ implications enables you to better negotiate for future leases. What is holding you back from being better?

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.