Choosing the Right Commercial Property Management Software

Migrating your business to commercial property management software can dramatically improve its efficiency, scalability and profitability. But with so many programs available these days, it can be challenging to know which will intuitively do what you need it to do. Take the time to do your research and carefully evaluate your options to find the best solution for your business and portfolio.

Here are a few things to consider before jumping ahead and selecting a software program.

Which features do you actually need?

It’s easy to get caught up in all the marketed features of software offerings, but it’s essential to determine your needs and then decide which plan provides the best and most robust solution.

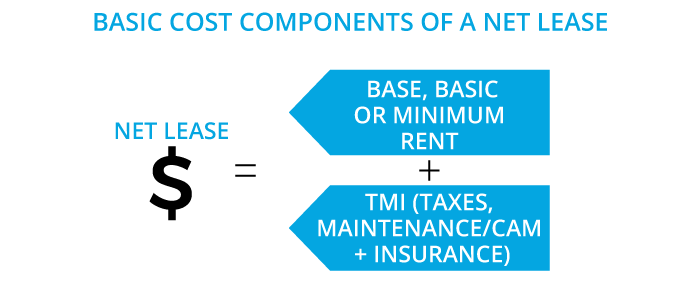

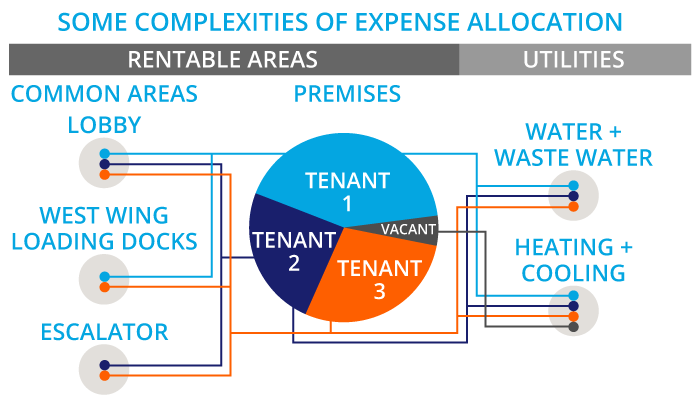

Do you manage net leases on multi-tenant properties? Do you need the capability to budget for and calculate common area maintenance (CAM) instalments? These are integral to any commercial property management business. If you answered yes to any of these questions, you need software specifically designed for commercial (not residential, not generic) property management.

Map out your workflows

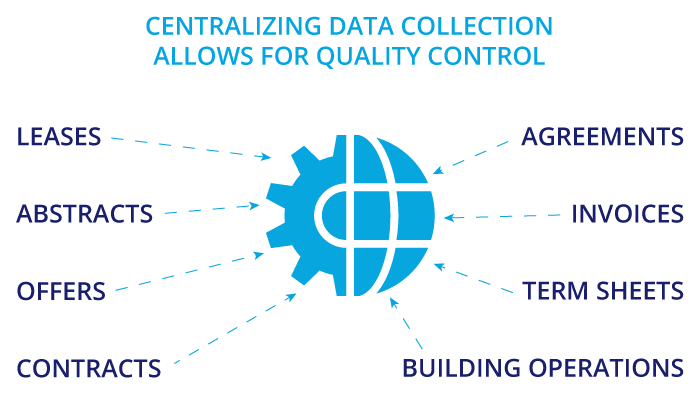

The goal here is to identify what you really need your systems to do. Think about and research effective workflows. How does information travel between people? Who knows the information the best? Who receives it first? And who needs that information to do their work?

Using a lease agreement as an example, we get the following answers:

- The lease negotiator knows the lease agreement the best.

- The leasing agent has the information first.

- The property manager and accountants need that information to do their work.

- The PM needs it to know what the landlord is responsible for maintaining and what the tenant must maintain.

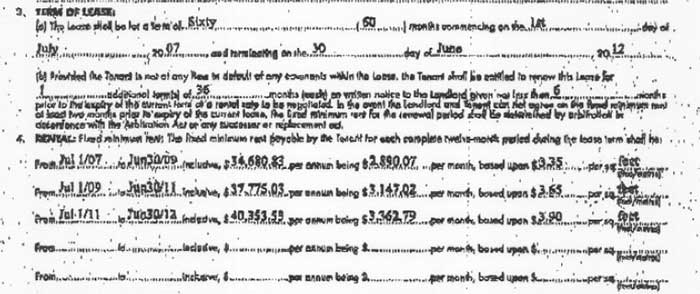

- The accountant needs to know the rental rates, what costs are recoverable from the tenant and what dates apply.

Map workflows to specific positions within your organization. Avoid directing workflows to specific individuals in your company. Doing that makes you susceptible to hostage-takers, i.e. people who threaten to derail your entire improvement process unless they get their way. These people are most easily spotted by their “black box” spreadsheets, the critical part of your current systems that only they understand.

Don’t be blindly pulled into features that already exist elsewhere

For example, it may sound helpful to have the ability to collect rent payments in a tenant portal. But really, no software can improve upon the security and functionality of existing payment services such as bank or credit card pre-authorized payments. Replicating this functionality into another workflow system is redundant and would significantly increase your licensing cost of such software. Similarly, realtors use MLS. Use the platforms where other realtors are looking, rather than using an in-house listing site with no traffic.

Payroll is already processed by external services and accounting software packages, so you don’t need it in your property management software. Instead, look for a solution that provides an interface to integrate the two applications smoothly. QuickBooks provides accounting capabilities and integrates nicely with leading commercial property management software. If one person manages parking lots and revenue, use a parking lot software system for that. Why require people to be trained and use non-standard software systems when there are already reasonable solutions available? As the saying goes, if it isn’t broke, don’t fix it.

Ask for recommendations

Talk to colleagues and find out which systems they use. Ask them if they are happy with what they are using and, if not, why? Post questions in property management forums to get advice from your peers on the topic. Ask your employees to identify workflow bottlenecks or any areas that could improve. They may be able to offer suggestions to improve efficiencies.

Be clear in what you expect your staff to do and be reasonable in what you want them to use. Don’t look for an elusive silver bullet software package that “does everything.” Your property management software should specifically address lease administration and asset management for a commercial property portfolio. Moreover, it should be the best system for handling and automating these functions.

Systems integration versus silver bullets

Once you map out your workflows, start your search for the best solution to each phase of the workflow. All your lease administration should stem from a core solution. There shouldn’t be triple entries in lease administration software, accounting calculation spreadsheets and an accounting app.

Your expectations should also not be to find a magical silver bullet that can do everything internally. That isn’t how the rest of the world works. No one wants to learn your specific payment system in your portal because people already pay bills with their bank or their credit card or existing major payment processor like Paypal. No one wants to see your listing website with only your handful of property listings. They want to see and compare all the listings available to them in that area.

Pay attention to which workflows are dictated by natural processes in the industry (such as lease negotiation, document signing, leasehold improvements, lease administration and accounting) and which are being driven by system deficiencies (such as passing paper invoices around for review and approval signatures). Natural processes are good, so keep those. You will want to research better solutions to address the system deficiencies.

Watch for discontinuities between workflows. For example, land development is its own process and has a distinct separation from ongoing leasing and property management activities. A single solution will not work for those two workflows.

Transactional versus relational processes

Consider the differences between transactional and relational processes. Lease negotiation is transactional. You will no longer require the leasing agent, lawyer or realty listing once the lease is executed. Property management and lease accounting are relational. There is an ongoing relationship between the landlord and the tenant that will exist for many years. The requirements of those types of workflows are too different to be effectively addressed in a single solution.

Your goal is to identify which solutions are already effective with widespread acceptance and see how they integrate into the systems you think will work best for your workflows. Build your processes to meet the requirements of your workflows.

Organize your current business processes

So, you know you need to automate your processes. You know that informal accounting processes, such as relying on stand-alone spreadsheets or using accounting programs that are too generic for net lease administration, hold your business back. Review your current system to understand what you need to do to prepare for a software migration.

The amount of effort to transition to a new system depends mainly on the state of your documentation and business processes. It will take you much longer to prepare for the change if your records are disorganized, duplicated or incomplete. Are your records stored in multiple formats, including Excel spreadsheets, Word documents, off-the-shelf accounting software and paper files? Are your lease agreements contradictory (we see this often) or otherwise unclear? Collect all leases and invoices, find missing information and correct any data inconsistencies and errors. Update them with any addendums and changes that may be required. Cleaning up and streamlining your data is the key to a smooth transition. While you’re at it, update tenant contacts and addresses for notifications and move tenants to online payment systems.

Moving to new property management software can dramatically improve your business systems. But it doesn’t magically happen with the click of a purchase button. It takes a little thought and time to transfer complete data into a database. The result is that inefficient internal processes upgrade to a fully efficient, transparent and accurate workflow. Smart commercial property management software will actually establish or improve your strategic business behaviours and decisions.

Are your timelines realistic?

Now you know that migrating to a new system that improves your business workflow will not be instantaneous and thought-free. Sophisticated and automated processing systems require some data migration and account setup. Block time for data collection and entry. You will need to validate, gather and enter a variety of data. Besides entering the primary business data, your clients’ information also needs to be input into the system.

Schedule in time to set up user roles for staff, owners, tenants and others. Think about your current workflows to identify the staff members who will work on the new system. Review each employee’s position to understand the objective of their work. Is each function assigned to the right person, or does it make sense for other people to be responsible for specific tasks more relevant to their actual job? Plan to provide some instruction on how they can access, use and benefit from the new software. Consider allotting time for employees to receive training on the optimized workflow and software use.

Now you’re ready to consider new commercial property management software

You’ve gathered your files and read through your leases. Your business records are organized. You understand the need for a reasonable setup process and timeline. You are ready to take the leap!

There are three main areas to consider when selecting a new property management software package. Here are some recommendations that can help you decide which is best suited to your business needs.

1. What’s included?

You’ve defined your requirements, so now you can assess your options based on this list of must-haves. Commercial net leasing is relatively similar in scope, regardless of business size. Every commercial property landlord needs to track capital and operating expenses, contracting costs, budgets, reconciliations, cost recoveries and various lease terms. However, each software vendor offers a variety of features.

For example, some key elements of property management software include:

- Lease management

- Document management

- Standardized administration and documentation

- Automated workflows

- CAM allocation and recovery processing

- Expense management

- Searchable records

- Automated notifications

- Budgeting

- Reporting functions

- Digital “sticky notes”

- Customized roles and permissions

- Online service requests

Not all software programs may include these features, so take the time to identify the functionality you need to ensure optimal efficiencies. Also, ask whether the pricing plan provides everything you need. You don’t want to find out that you’ve paid for a basic package, but the functions you need most are only available for an extra fee or in a premium package.

Functionality

One ultimate goal of using a property management software program is to automate your commercial net leasing workflow processes. A program with generalized automation cannot process unique transactions, and it creates more work for your staff. You want to make sure that you leave the Excel spreadsheets and the calculators behind once you migrate to a new system. It should automate the most complex calculations for you in an instant.

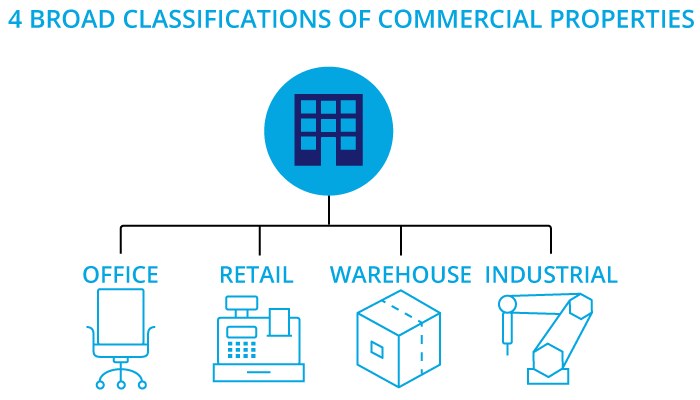

Your software must have capabilities that meet your management and reporting requirements. Otherwise, it’s not worth the investment. The most efficient software will offer automation of property data, leasing, budgeting, rent, CAM fees, reconciliations, property management fees and reporting. It should also support every kind of property in your net lease portfolio, including office, retail, warehouse and industrial. Additionally, it needs to integrate with an existing accounting system to achieve maximum workflow automation.

Cloud-based or desktop installation?

Another decision you will need to make is whether you want to buy software out of a box or move up to a cloud-based system. Cloud-based technology is generally more affordable than desktop software. It also makes it easier for staff to work remotely and keep data centralized and updated with the latest information. But some companies are still reluctant to trust the cloud for security reasons. That said, cloud-based systems typically utilize enterprise-level hosting services such as Microsoft Azure, Amazon or IBM, which provide a much stronger protection level than can be implemented at the local level.

Software installed on a desktop computer does not require an Internet connection and therefore is not affected by connectivity issues. Still, local users are responsible for backing up the data, and not all information updates simultaneously. Furthermore, desktop software can only be used on the computer it’s installed on, whereas cloud-based systems can be accessed from any device, anywhere. While this may be a personal choice for smaller shops, cloud-based solutions are typically more cost-effective and offer essential teamwork flexibility required by growing firms. If you’re still not sold on the benefits of cloud-based computing, this article may help.

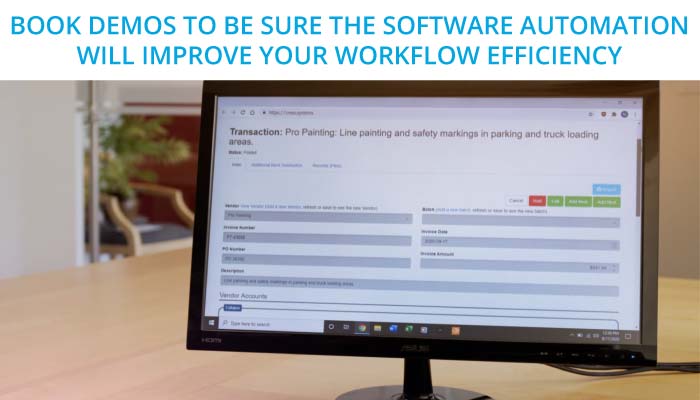

Go for a test drive before you decide

Many vendors offer free demos or trial periods to use their software. Take advantage of this opportunity and choose two or three to evaluate. Demos and trial periods will allow you to see exactly how the software works and give you a feel for the functionality. Note that software that robustly automates your workflow requires some setup. Therefore, sophisticated software companies will offer demos rather than less-helpful trial periods.

During this time, look for clues as to how intuitive the system is. Does it reduce steps, or does it seem more complicated than your existing processes? You want to choose something that makes the workflow as efficient as possible. Make a list of pros and cons for each and compare how each one satisfies your requirements. Doing your research will help you make an educated decision and give you a better sense of which features are most important to your workflow.

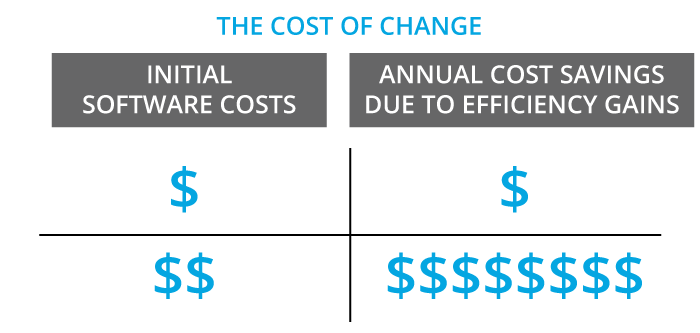

2. What value does it offer you?

Property management software is an investment in your business and should be treated as such. Do some research into property management software’s average cost and develop a realistic budget for software setup and ongoing licensing. Investigate the different plans available and what you get for them. Is the fee a one-time payment, or do you make ongoing monthly or annual payments? Does additional functionality mean additional fees?

Ask whether new versions and upgrades are included or whether your purchased version will get left behind. Does the investment increase team efficiency and make them available to be more productive? Is the software’s cost overshadowed by the financial gains such as eliminated slippage, faster annual audits and increased revenues? Is lease compliance instant and easy to validate? Do the math to make sure you are getting the most for your money.

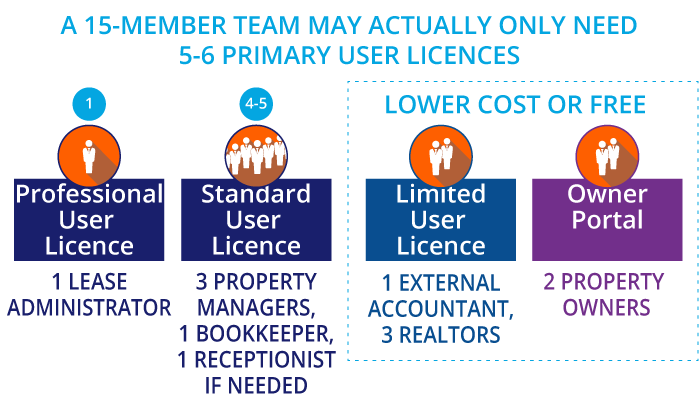

How many licences do you need?

Many programs are licence-based, so knowing exactly how many licences you require will save you money. Make sure you take inventory of how many users need to access the program. Don’t forget external users such as tenants, accountants, lawyers and property managers.

However, bear in mind that it is easy to overestimate how many users need licenced access. For example, let’s consider a property management company that relies on 15 people. Two are property owners who only need access to reporting, one is an external accountant and three are realtors who use MLS and Argus for their daily tasks. Four others are maintenance staff. The remaining team members include three property managers, a lease administrator, a bookkeeper and one receptionist. With CRESSblue, the company actually only needs one professional and four standard licences instead of the 15 they initially assumed. Ask the vendor to break down the level of access provided for each licence type to help you calculate what you need. Investigate how much additional licences will cost if you do take on new employees at a later date.

3. Are training and support available?

No matter which software you choose, the company should stand behind their product and lead your team in the setup and implementation phase. If the company expects you to execute it yourself, be wary. A trustworthy software provider should provide a setup plan for the rollout, and their support staff should be well-versed in the industry. They should also provide documentation, support and training. Do they offer after-hours on-call support for any emergency issues? Find out whether support is included or available for an additional fee.

How is support delivered? Can you access help via options such as online meetings, phone, chat, e-mail, built-in help, videos or one-on-one support? Are in-house training sessions available? The best software companies will offer a wide array of options to support you and your team throughout the transition period and beyond.

Now it’s time to get to work

As you can see, choosing a property management software requires planning and research to ensure that you select the best-suited program for your needs. The right software is the one that does everything you need and does it intuitively, effectively and efficiently. We’ve created a checklist that can help make your decision easier. Download the “How Do I Decide?” worksheet to evaluate the six critical areas to consider when evaluating software for your commercial property management business.

Choosing the right property management software can propel your business to a new level of efficiency and scalability. The long-term benefits—saved time, increased income and enhanced professionalism—far outweigh the time investment to set it up and the annual licensing cost. With a bit of research and careful evaluation of your options, you can find the best solution for your business and portfolio.

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.