Lease Compliance Part 1: Understanding Lease Terms

This article is part one of our three-part series on commercial lease compliance:

Lease Compliance Part 1: Understanding Lease Terms

Lease Compliance Part 2: The Tenant Audit

Lease Compliance Part 3: Audit-proof Your Portfolio

Lease compliance covers many things. For instance, tenant compliance with their lease obligations for rent and upkeep. Not to mention landlord compliance with the building maintenance obligations and general accounting compliance in record keeping and reporting. This series will focus on three main topics: understanding lease terms, what you need to know about tenant audits, and how to audit-proof your portfolio. We are explicitly addressing lease compliance for landlords in commercial property management. You will dig into the lease clauses that cause the most confusion, stress and even fear for tenants and landlords.

Lease terms are about more than just objectives

The simplest approach to writing an agreement is to state the objectives for each party. While that is great for setting the stage, it is useless on its own. The overriding principle you want to encompass in your lease agreement is to set the boundary conditions for acceptable behaviour and performance. Define what constitutes a default and how to remedy that default in a specified period. If you use a lease agreement short form supplied for free by your realtor, it almost certainly just states the objectives and has virtually none of the boundary-setting terms and remedies you will need to resolve issues. You are unlikely to have much luck with that if anything goes wrong.

The basics of lease compliance

Before we get into the technical aspects of commercial leases, let’s review some of the most basic activities you must undertake to offer your services as a property manager to anyone, including yourself.

Be the boss, but use the team

We have covered this before in other articles, but it bears repeating. You don’t have to be the expert in everything. Instead, you need to bring in at least four classes of professionals: your lawyer, accountant, realtor and insurance agent. You may have one of these professional designations, but you need all of them on your team. Your limited experience in the other areas isn’t enough to provide professional services to yourself or others. Just don’t do it!

We see this countless times when onboarding new clients. The team has one or more professionals on it, but other key positions are missing. Often, landlords completely ignore entire business areas. This leads to significant problems that could have been avoided. For example, leases without legal reviews and agreements full of errors and inconsistencies could result in litigation. Contracts missing essential information such as the property address, the premises area and the rental rate mean unenforceable lease clauses and unrecoverable future expenses. Leases that a landlord never reads after signing or lease accounting that’s not done for a decade equal voluntary slippage. Not to mention, poorly negotiated leases result in huge liabilities years down the road. You can avoid all of these problems by ensuring that you have the right people with the right credentials on your team.

Consider a scenario in which a metal fastener supplier applies to be a warehouse tenant. The warehouse use doesn’t seem like an obvious fire hazard. However, the fasteners are coated with a film of oil, placed in plastic baggies in cardboard boxes, inside more cardboard boxes and shipped on plastic pallets. The supplier then stores the packed boxes on open mesh shelving. A lease-use review by fire inspection safety personnel could immediately identify the risk and point out the storage limitations for that combination of packaging with the existing sprinkler fire suppression system.

You are still in charge

Although you need to rely on the expertise of others, remember that your team needs direction and guidance. Do not delegate everything to others without being the boss yourself. You are the glue. You are in charge. Each of your professional team members reports to you—they do not take your place at the helm.

The professionals on your team are valuable. However, it is essential to realize that their perspective is transactional, whereas yours is relational. Your realtor is brokering a deal for you. Once they’ve closed the deal, they won’t be back until close to the lease expiry date. Your relationship with the tenant is just beginning and will continue throughout the lease term. Therefore it is essential to see the difference in perspective. Your team members complement you, but they do not replace you.

Your job is to know enough about each profession to understand the value and services they provide and understand their language. A company without anyone in charge is still chaos. If you don’t know enough about the services they provide, ask them to explain them to you. They will. It’s your job to be a leader, so use your professionals to further your expertise and career.

Use a lease template

A lease template should be the starting point for your commercial leases. This means a professional one, not just the free form your realtor used to submit the lease proposal. Pay your lawyer to provide you with a customized template suited to your business.

Your lease template should include the standard lease fields and terms in the initial section of the lease on the first couple of pages, from the names of all parties to the lease terms and indemnifiers. Together with who gets lease notifications and where they must go. The lease dates and rates. The fixturing and free rent dates and definitions. The deposits. The parking. Anything and everything that you need to fill in and review for every single lease. The rest of the document should then reference the data only by the field name. This creates a record where you can find all essential information, and it will prevent errors throughout the rest of the document.

Stay away from generic forms

Never use a form that requires you to fill in the same data in more than one place or in the middle of a paragraph buried in the document. The information will invariably be missed when you update the form during the lease negotiations or subsequently use the template. Our CRESSblue implementation team comes across these errors often. Instead, use a lease template that includes all the clauses you would expect to need for your entire portfolio of properties. Again, you want to use a cohesive, consistent and complete document.

Use your team to review

Have your insurance agent review the insurance requirements and responsibilities sections. Equally important, have your accountant review the cost allocations to understand the implications of various accounting practices noted or implied in the document. Do you know how to account for the additional rent cap the tenant wants? For example, do you know what it will cost over the lifetime of the lease and its extensions? Bring your team’s expertise into the document template to enhance your lawyer’s work. Going through this process will also increase your ability to negotiate well.

Use document formatting

Your lease agreement describes your ongoing business relationship with your tenant. Make sure it is a well-written, clearly assembled, accurate document that you can use to guide your activity. Write it so that you can be in lease compliance in a practical way without math or accounting gymnastics. The use of document formatting can go a long way to enhancing your lease agreements. To clarify, formatting here means using headers, lists and built-in document formatting available in Microsoft Word.

While there is other document editing software, stick with the industry-dominating Microsoft Office for the simple reason that you won’t be the only one editing the document. Repeatedly transitioning from one format to another rarely turns out well. Niche software products won’t make your leases better if the other party can’t use the output you provide. While on this subject, do everyone a favour and Track Changes so that changes are apparent and it is clear who made them. Digitally provide both a marked-up (changes tracked) and a clean copy (changes accepted) to the other negotiating party. It saves legal reviewing time and prevents a lot of silly mistakes from slipping through.

Cross-referencing will save you from costly mistakes

Use cross-references to link the parts of your document to the appropriate sections, not direct number references or words like “previous” or “next.” Those do not survive insertions and deletions without manual editing with a sharp eye. A cross-referenced article will update its linking automatically, making sure you are still referring to the correct section. If you delete a linked paragraph, you will have a broken link indicating you still need that section or have more editing work to do.

That covers the basics of your documents and formatting. This workflow alone will put you in an excellent position to have accurate records. And onboarding to CRESSblue will be so much quicker if you have your data readily accessible, complete, clear and consistently accurate. Make best practices your default workflow, and your work product will improve substantially as a result.

Lease agreement sections

On to the good stuff! Let’s review the key sections your standard commercial multi-tenant leases should cover and what they mean.

Basic terms and definitions

As stated in the lease template section (see what we did there? We referenced a section title, not a paragraph number or relative placement), all lease terms and definitions should be in the first section of your lease. You need them front and centre so that you do not miss any and so that you review them all for accuracy every single time you use your template.

Review the template for completeness and accuracy. Have you defined all the terms and filled in all the fields? Do they all make sense in the context of this lease?

Put your schedule of base rent payments and deposit information in this section. In addition, if you have any tenant leasehold improvement allowances or other incentives, include them in the definitions and capture all of the variable data.

Demise and term

Key things to include here are a description of the demised premises and the rentable area, what is included and which measurement standard will be applied. Be sure to include language such as “or its replacement” since standards are updated and changed over time. A typical industrial standard area reference is “in accordance with ANSI/BOMA Z65.1 – 2010 Method A (or a subsequent replacement or amended standard).”

Include a plan of the premises and site in the lease schedules with the demised areas and common areas marked out. It’s great to use colour, but remember the document might be printed and sent in black and white. It can be hard to see the area of the premises outlined in red on a black and white copy. So, using patterned fillers to identify different areas in the plan drawings can help define the spaces more clearly.

Other topics you will want to include in this section are:

- Overholding: This is when a tenant stays in the premises after the lease expires and becomes a month-to-month tenancy. This impacts your ability to obtain financing since the tenant isn’t bound to a rent term, and lenders view this as unreliable revenue. As a result, overholding rates are typically set higher to encourage the tenant to sign a lease term extension agreement.

- Delay in Possession: This describes what happens when, if for some reason, the lease commencement date is missed. How do the other dates adjust? Is the fixturing or free rent period guaranteed?

- Fixturing Period: This period allows the tenant to complete outfitting the space for their own purposes. With this in mind, define which costs are their responsibility.

- Free Rent Period: If there is a free rent period to allow the new tenant to ramp up operations, it will be defined here. Like the fixturing period, you must specify which costs are the tenant’s responsibility. Is it base rent-free, additional rent-free or some other combination?

Rent

If the base rent amount was already recorded in the definitions, what goes in this section?

- Lease Type: A covenant to pay, and a description of the lease type: a gross, net or partial net lease.

- Payment Methods: Describe what payment methods you accept.

- Deposits: What the landlord can do with them, and how they need to be replenished, increased, decreased and finally returned to the tenant.

- Rent Past Due: Interest rates and penalties.

- Partial Periods: How to account for partial rent periods.

Basic rent

This section provides straightforward information on commercial net leases. The basic rent refers to rent payments only. All other expenses and costs recoveries are classed as additional rent. Note that basic rent is paid in exchange for an interest in real property, whereas additional rent is paid under the terms of a contract. Therefore, they are treated differently in law. If you want to learn more about this, you can read it here.

Additional rent

There is an overwhelming temptation to try and cover every situation with one long run-on sentence. Resist that urge. Save the definition of capital cost and operating expense for a lease schedule. For this purpose, those terms are too indefinite to use broadly on a practical level.

However, what should be defined is how a landlord will handle operating costs and what administrative or management fees will apply. Remember that adding complexity such as multiple fee rates and lots of categories means more record-keeping and accounting, so choose your level of complexity wisely. Keep it as simple as you can. Landlords often have difficulty complying with the very complicated schemes they invent.

Property taxes are often the most significant component of additional rent. Therefore, make sure to include clauses that cover property tax increases and re-evaluations that may come up mid-term or mid-budget.

Additional rent caps may also come up in this section. They are poor tools to control additional rent, as discussed in-depth in this article. If there is a cap, make sure you capture the initial starting rate. Moreover, clearly define what is capped and how the actual formula works. Remember math class and word problems? Write the formula out with words that describe it. Someone is going to have to understand this to be in lease compliance.

Calculating the additional rent

Multi-tenant properties typically allocate expenses proportionally based on the leased area of the premises. Define the formula, not the number. For multi-building sites, specify for each expense type whether the proportion is based on just that building’s area or the entire site. Leasehold improvements, alterations, appropriation and re-measurements all have the potential to alter the proportionate share numbers. So again, you need to know how to resolve problems that arise when the original number is no longer valid.

Don’t forget to define how gross-ups will work. These are two separate calculations: one for the premises area gross-up to account for the common areas spaces, and another to account for different usage patterns on shared expenses. Usage patterns can vary due to the tenant’s use of the facilities, vacancies and hours of operation. This can cover services as well as utilities.

The most critical point in negotiating the additional rent and operating costs is to make sure it is reasonably possible to make the determinations you agree to. The required data tracking and calculations need to be practical. For example, don’t negotiate a position that requires $1,500 of an accountant’s time to recover $150 worth of additional rent. On the other hand, you could use CRESSblue and have all the math done automatically for you. That’s a reasonable and practical decision.

Utilities and HVAC

This section describes who pays for the utilities on the premises and how to calculate common area cost allocations. We’ll also describe gross-up factors for above-normal utilization here. If there is a high probability of above-normal usage compared to the other expected uses at the property, consider having individual service meters installed for those utilities.

Control and operation by the landlord

Lay out the common areas in addition to broadly defined property operation and repair responsibilities here. Use a repair and maintenance schedule to detail specific types of repairs, responsibilities and who pays for them.

Use of premises

A description of the tenant’s broadly defined permitted use of premises. This covers uses permitted by law, environmental covenants, permits and zoning requirements. Include a list of specific permitted uses and restrictions in the definitions section. Also include any provisions for waste handling and storage, nuisance, noise, discharge or overloading concerns.

Maintenance, repairs and alterations of premises

Record the process and requirements for a tenant to make repairs and alterations to the premises. Don’t include specific work for the leasehold improvements. Instead, that information should go in the lease schedule. This is for ongoing maintenance and future work requests. Items you will want to include are:

- Engineering and architectural drawings and specifications

- Required permits and regulatory approvals

- Inspections and quality control on materials

- Qualified trades

- Certifications

- Liability and responsibilities

- Access control and site security

- Final inspections, reviews and approvals

- Financial clearances for trades, contractors, liens, materials and fees payments

Typically, landlords need to arrange for annual or more frequent inspections of fire and life safety equipment. Include the procedures for tenant notifications and landlord access to have these inspections done. While the landlord can make it the tenant’s responsibility to carry these out, the practicality of getting all tenants to do the required work at or near the same time can be nigh impossible, leaving the landlord responsible to government authorities for the delinquent tenants. It’s often easier to add an inspection contract to the additional rent and have a qualified third party complete the work in one visit.

At the end of the lease term, the tenant will need to leave the premises neat and clean. The departing tenant usually takes trade fixtures, but what about removing improvements and other fixtures on the surrender of the premises? It is hard to determine what condition and desirability some of those improvements may have in the future. Likewise, a tenant will want to know what removal costs they need to budget for. Blanket statements for future work aren’t a reasonable approach; it is much better to deal only with the fixturing included in the tenant’s work now. The future removals condition should be left as part of the negotiation of the landlord’s approval for anything to be done later in the lease term.

Insurance and indemnity

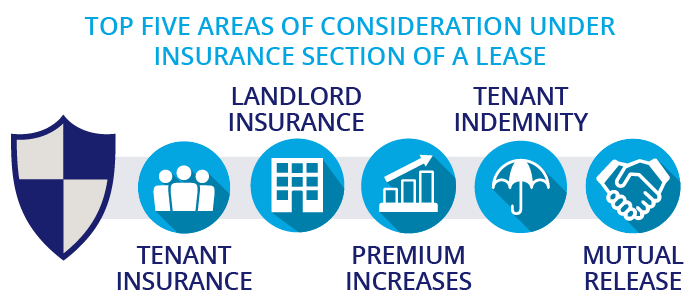

There are five main areas to cover here. They are:

- Insurance for Tenants: Minimum insurance coverage limits for the various classes and the minimum required insurer’s rating.

- Insurance for Landlords: Minimum insurance coverage limits for the various classes and the minimum required insurer’s rating.

- Increase in Premiums: This relates to the tenant’s use of the premises, causing an increase in the landlord’s insurance.

- Tenant Indemnity: This releases the landlord’s responsibility for the tenant’s activities on the site and within the premises.

- Mutual Release: Defines that each party is to carry their own insurance.

Those unfamiliar with the industry may find insurance complicated and unintuitive. If you change or edit this section, get a professional broker or agent to review both the wording and the liability you are assuming. Nothing you write in a lease agreement is going to change the effect of your insurance policy. However, you may find out that your edits have left you with an uninsured liability.

A quick word about tenant’s insurance here: if they need extra insurance coverage, don’t take it out for them for three reasons. One, they need to build their own relationship with their insurance broker. Two, it will cost them the premium plus your management and admin fees and possibly an additional nuisance charge as well. Three, as a landlord, you are disinclined to file a claim on your insurance for their property as it will affect your premiums on the entire portfolio. With this in mind, make them get their own insurance.

Assignment and subletting

Pretty straightforward here. When is subletting permitted? Landlords rarely prevent subletting. However, it is usually dependant on their approval of the new tenant, which cannot be unreasonably withheld or delayed. Key practical points are: under which conditions the original tenant is released or held to their initial obligations, defaults of the sub-tenant and what happens when a sub-tenant pays more rent than the original tenant.

Quiet enjoyment

For the direct and straight-to-the-point people, this is for you! If the tenant pays rent and agrees to everything in the lease, it says right here the landlord agrees to leave them alone in peace and quiet to mind their own business.

Damage and destruction

Contrary to what you might expect, this isn’t about the tenants wrecking the place. Instead, this section is about the significant destruction or appropriation of the property that materially affects the tenant’s ability to use it for its intended uses. The section also covers insurance proceeds. Additionally, details and conditions of lease termination by a tenant or landlord may be included.

Default

This is the first article that tenants refer to when there is a heated tenant-landlord dispute. The first section defines what events constitute a default on the part of the tenant in carrying out its duties as specified by law or in this lease.

The second section details the rights and remedies of the landlord for various defaults. Re-entry, repossession and lease termination are all available. One cautious word here—make sure your remedies are proportionate to the losses and costs as punitive damages are generally unenforceable in court. Furthermore, your lease agreement will not supersede any legal rights your tenant may have.

General

This is the fundamental legal boilerplate. For example, entry to the premises to exhibit them to a prospective new tenant, force majeure, waivers and forbearance, required notices, confidentiality provisions and the like are listed here.

Schedules

Leases should include schedules that are specific to the property and tenant relationship. At a minimum include:

- Plan of Premises: Outlines the location on the site and premises layout.

- Legal Description: Describes the property.

- Rules and Regulations: Applies to general site operations for all the tenants.

- Landlord and Tenant Work: Specific to the lease.

- Indemnity Agreement: Outlines whether the lease has an indemnifier or guarantor. Include in the agreement whether an assignment or transfer includes or releases the indemnifier. Also, consider if the guarantee covers lease term extensions.

- Extension Rights: If the tenant has any lease extension options, include the conditions for the exercise and timelines for those options.

- Tenant Environmental Covenants: These should be site-specific and, if necessary for the tenant’s permitted use, tenant-specific as well.

- Maintenance Schedule: This is an important schedule for commercial net leases.

Maintenance schedule

This schedule is gaining in popularity due to the increase in transparency and clarity it can provide.

For each of the classifications, detail all of the following:

- Description of the asset type

- Type of work: replacement, repairs, maintenance or supply

- Responsibility for the work: who looks after getting it done

- Level of service: how often it will be checked or done

- Chargeback: who pays for it

- It can be the landlord’s responsibility

- The landlord can pass it on to the tenant as additional rent

- The landlord can bill it to the tenant

- It can also be billed to the tenant directly

- Amortized cost recovery only

- Amortization period

Maintenance schedule classifications and sub-classifications

There are two primary classifications and eight sub-classifications:

Repairs and maintenance for grounds

- Hardscaping

- Landscaping

Repairs and maintenance for buildings

- Architectural and Structural

- Foundations

- Superstructures

- Exterior closures

- Roofing

- Interior construction

- Mechanical

- HVAC (building)

- Control systems

- Plumbing (building)

- Wells (if not on public water systems)

- Wastewater treatment (if not on public sewers)

- Special systems (tenant installations)

- Refrigeration

- Fire protection

- Security systems

- Electrical

- Primary electrical (building)

- Secondary electrical (building)

- Electrical service ground (building)

- Lighting fixtures (premises)

- Electrical systems (emergency power and communications systems)

- Special Facilities

- Gates

- Cameras

- Weigh scales

- Monitoring systems

- Utilities

- Electrical

- Gas

- Water

- Other

- Insurance

- Building

- Premises

- Renovations

- Leasehold improvements

- Maintenance on leaseholds

- Management Fees

This schedule is far more comprehensive than a statement about the landlord paying capital cost and the tenant paying for operational expenses.

As you can see, commercial lease compliance can be fairly complex, but using a template, schedules, and standard lease terms and clauses can help make the job easier. And don’t forget to lean on your trusted partners—lawyers, accountants, realtors and insurance agents. As a result, your team will ensure you have the most comprehensive and well-negotiated leases.

This article is part one of our three-part series on commercial lease compliance:

Lease Compliance Part 1: Understanding Lease Terms

Lease Compliance Part 2: The Tenant Audit

Lease Compliance Part 3: Audit-proof Your Portfolio

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.

[…] article is part three of our three-part series on commercial lease compliance:Lease Compliance Part 1: Understanding Lease TermsLease Compliance Part 2: The Tenant AuditLease Compliance Part 3: Audit-proof Your […]

[…] article is part two of our three-part series on commercial lease compliance:Lease Compliance Part 1: Understanding Lease TermsLease Compliance Part 2: What You Need to Know About Tenant AuditsLease Compliance Part 3: […]