Formalizing Business Processes with Asset Management Software for Maximum Wealth Creation

Small landlords with just a few buildings own most commercial property. Often, these landlords share a similar pathway to becoming landlords. Initially, they purchase real estate assets for their business operations. Over the years, they add a few more properties as their business and personal wealth increases. Their idea is to use real estate assets to diversify their investment portfolio, but their original business operations remain their primary interests. The property acquisitions are of secondary importance, valued as passive investments and loosely managed. They haven’t yet invested in asset management software.

And therein lies an important – and costly – gap.

The fact is, there is a significant difference between real estate and other forms of investing. Financial investments such as stocks, funds and REITs have people that can manage all aspects of the investment independent of the owners. Real estate, on the other hand, is more like a business than a simple financial instrument. Commercial real estate is much more complex and requires active management by a variety of professionals, as well as dedicated asset management software and systems, to achieve full yields. It’s worth it, though, as correctly managed real estate can potentially provide higher returns than the other investment types.

What is an informal landlord?

Let’s get clear on what an “informal” landlord is. It’s not about size. The informal label refers to the management style. For example, a large company might lack formal procedures and comprehensive data management. Meanwhile, a smaller property management company might run with precise data control and efficient vertical integration. In this scenario, the larger company is actually the informal landlord.

Your team of industry professionals is vital

Every business uses industry professionals to meet the need for particular expertise and licensing. Small and even mid-sized companies rarely have all the required professional associations represented internally. Licensed professional agents and brokers assist with securing the best commercial real estate lease opportunities. Lawyers draft and review lease agreements that provide the best protections. Accountants prepare essential financial statements and file the annual corporate taxes. Property owners contract these external specialists when required and often view them as long-term, trusted business associates.

But these industry professionals can’t replace you

These professionals are essential in the success of your property management business. But they can’t provide the kind of central leadership that maximizes your wealth creation. Only the business owner can meet the business responsibility to lead, ensure the use of proper asset management software and processes and bind all these various responsibilities together. If the real estate is being passively owned like an investment rather than a business, the generation of wealth will be limited.

How the informal management style limits your wealth creation

Let’s peek inside the operations of a hypothetical (but very common!) informal landlord. We see that the owner has internal staff that run the primary business. With the acquisition of properties, they inherit the added responsibility of administering the daily operations of the properties. None are specifically trained or experienced in commercial property management.

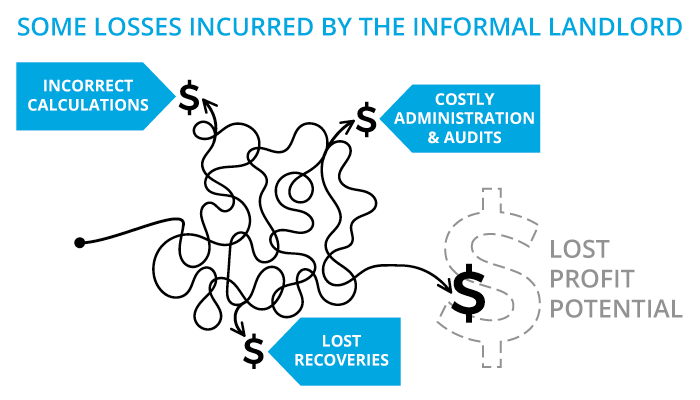

Sure, this has immediate cost savings in terms of paid labour. Unfortunately, it creates far greater losses in other areas, to the point of making the investment neutral or even a loss to own. Moreover, the informal landlord may have no idea how their properties are actually performing. How could they? A line or two in the business annual financial statements contain no relevant information on the state of the property management operations.

So, what are these great losses that the informal landlord is suffering? Let’s now consider each of the key gaps that exist in informal real estate management. (We assume that our readers have some experience with owning commercial property. If you are new to commercial property ownership, you can read about the basics here.)

Let’s talk about CAM slippage

The primary factor in the annual performance of commercial real estate is the handling of the operational costs for the property. For the informal landlord, the problems with recovering costs occur long before the calculations start. The biggest issue is trying to make sure the invoices for the year are all included. Often significant recoverable expenses are simply overlooked. Even some as large as the property taxes – which typically comprise most of the additional rent amount – are missed.

Dedicated asset management software, such as CRESSblue, prevents missed recoveries in two ways. One, the invoices are tagged to the property and tenant when they are entered for payment. That means nothing is overlooked. There is no hunting for the expense documents when it’s time to do the year-end annual reconciliation. There is no mad scramble when lenders or governing bodies request reports. Two, the software automatically performs the calculations. With this kind of professional system, there are no miscalculations or missing expenses that result in slippage.

Knowing who pays

Aside from missing invoices, there are a few other ways legitimate CAM expense recoveries go missing on the statements. Invoices often have poor work descriptions. They also can have mismatched addresses, where the tenant name doesn’t match the unit number. Nearly a year later, can the person doing the reconciliation remember what the invoices were for? What happens to invoices where you cannot figure out whose CAM statement they belong on? They get left out of the calculations to avoid embarrassing questions from the tenants. It feels safer to forget about them rather than respond to questions over poor paperwork.

Knowing which expenses are recoverable

Another common problem in an informal system is the separation between the various parties involved in business operations. The property owner decides on the maintenance work to be done. The company bookkeeper, although skilled in the primary business activities, often has little or no experience in commercial property management.

That person rarely has access to the leases or understands the legal language. Who interprets what expenses are permitted to be recovered based on the lease agreement terms? Small landlords rarely have skilled internal staff that commercial leases require to make this type of decision and effectively manage the business.

Sure, successful property management comes with procedural and document complexity. But the right asset management software makes it much easier. Alternatively, ignoring the entire issue and neglecting proper data management because it just looks too complicated results in significantly reduced potential return on the investment.

Knowing how to split shared costs across multiple tenants

Even if the invoices clearly describe the work and where it was done, further complexity lies ahead. Proportional expense allocations for multi-tenant properties can be complicated, especially when there are renovations, vacancies, tenant changes and a variety of free rent exemptions during the budget period. We won’t get into the details of how to calculate the proportional cost allocations for multi-tenant properties here. We covered that in another article.

The right asset management software makes expense allocation easy

Dedicated asset management software makes a huge difference here. Vendor accounts can be linked to specific property locations. This is especially useful for accounts that never change, such as utility accounts. It also provides significant time savings as well as eliminating the potential for allocation errors. The software can automatically calculate the proportional share of the expenses for each tenant based on the premise’s areas.

Going one step further, CRESSblue software will screen the expense allocations for eligibility as defined in each lease setup. The combination of the linked vendor accounts, automated calculations and lease screening eliminates all losses previously incurred from those sources. These losses alone are often three to four times the annual costs for the software, making the financial decision an easy one.

Keeping track of lease dates

Rental increases

Most commercial leases have provisions for rent increases during the term of the lease, either specified step-up amounts at various intervals or annual adjustments for inflation tied to a consumer price index. These rent increases are often applied late or missed entirely. Without a system to provide notifications about upcoming rent adjustments, the same rental invoice goes out each month without anyone checking the leases left in a filing cabinet. Good luck trying to collect all that missed rent when the lease term has expired, and someone finally notices the initial rent was never changed.

Lease management

Aside from missed rent money, how about letting tenants and realtors know when the lease term is up? What about notifications about upcoming extension options? Proper commercial asset management software has all these features built-in, providing timely lease management notices to landlords and tenants alike.

Knowing where stuff is

Document management is another crucial feature of any professional business software solution. It is easy to add documents to a tenant’s records library, as most documents are exchanged digitally now. Combined with online software services, anyone who needs access to the documents can do it at any time. Property records are handled the same way, with drawings and tenant fit-up specifications available for the realtor listings and maintenance personnel. Online document storage means you no longer need to remember to look something up when you get to the office as you have access anytime and anywhere. You can also send copies to your lawyer, accountant; you get the picture. Documents are there, and they are available.

Letting people know

Of course, good commercial asset management software solutions provide multiple user roles. With CRESSblue, it isn’t one-size-fits-most. The access and editing rights of each role are customizable. A large company can establish access parameters for roles such as building managers, property managers, portfolio managers, regional managers, asset managers, capital expense managers, department managers and division VPs. A smaller company will have most of these positions vertically integrated into a handful of people and can assign accesses accordingly.

Remember those transaction records your accountant wanted to see? You don’t need to send them; they can log in and get what they need. Customization is standard, with specified roles and permissions giving advances in efficiency other methods can never achieve.

Reporting

If only you had professional reports! Perhaps it would save some time on the telephone, trying to explain what you meant on that annual statement you had sent over to your tenants. What is on a “standard” statement anyway? What do other landlords have on theirs? These are common questions, and they indicate that you could use professionally laid out statements and standardized reporting.

Keeping lenders happy

While we are talking about reporting, what about the property rent rolls and operating statements your mortgager asks for every year? Commercial property management systems also instantly generate those. Property reports are also useful for getting insurance quotes.

Say no to avoidable loss

None of the above is news to anyone who has worked in property management. At one time or another, most of us have experienced at least one of those slip-ups. Commercial property leasing involves large sums of money, and any mistake, whether accidental or deliberately taking losses, is costly.

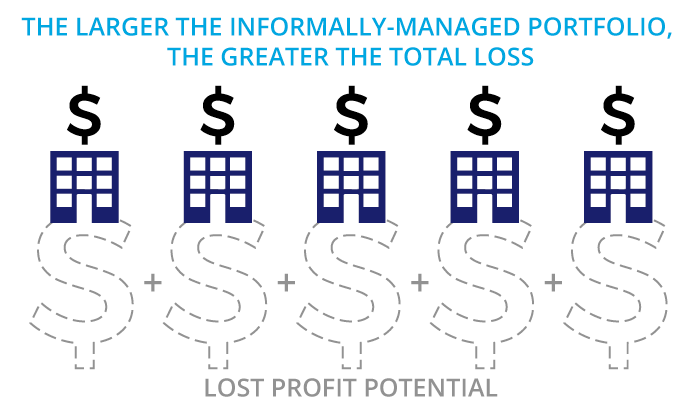

As odd as it seems, informal landlords normally accept recoverable expense losses every single year! Those losses are typically several times more than it would cost to implement a professional commercial software system.

At some point in the decision to purchase commercial real estate, consideration was given to the investment potential of the property. How does an otherwise successful business person end up taking avoidable losses on their real estate investment year after year?

Understanding systems inertia

Small commercial landlords typically acquire their real estate portfolio scale later in life. Understandably, they do not want to invest significant time in learning an entirely new industry at the time they would be expecting to enjoy the rewards of their business growth and investment wealth strategies.

The business systems of their primary business now serve secondary duty as real estate management systems. This is despite the fact that they are clearly inefficient and ineffective for that purpose. Perhaps the landlord doesn’t know the scale of loss. However, the recognition that it isn’t working well is no mystery to anyone.

Effective and efficient enterprise-level business systems able to automate critical business functions require quite extensive initial setup. Any business system looking to provide software services to smaller landlords must also include a significant amount of the initial setup as part of the package deal to ease clients through that transitional period. Look for a software company that is relational rather than transactional in the sales process. The days of boxed asset management software are long gone. Today’s software continually receives upgrades and updates. Your solution provider should be a business partner with an ongoing support relationship.

Professionals want to work with other professionals

Compounding the above-mentioned risks is another significant gap for informal landlords not using professional commercial business systems. As we touched on, your commercial property management company relies on external industry professionals that offer unique expertise. The main three main types are realtors, lawyers and accountants. To be confident in the performance of their responsibilities, each needs specific types of information. Giving them what they need, how they need it, lets them spend their time more efficiently, opens you to better opportunities to which they have access and improves your credibility with them.

What real estate professionals want from landlords

Real estate professionals want their landlord clients to have information available and accessible. They need to know:

- That the landlord has the lease agreements, is familiar with them and adheres to them

- They are getting timely notifications of lease terms expiration, extensions options and new listings

- The policies for the property, such as signage, security, waste handling and package deliveries

- The specifications on the premises, such as:

- Supplied utilities like heating and cooling, electrical power and communications

- Door sizes, numbers and types; and dock levellers

- Zoning, permitted uses and prohibited uses

- Exterior storage

- Hours of operation

- Drawings, space designs, space layouts and finish schedules

Having accurate and current information readily available makes the realtors work much easier. People like to work with other people that reduce stress and required effort. Be one of those people.

Realtors also look at potential landlords’ professional standards to see if they will impact the realtor-tenant relationship. This is especially important if the tenant is a national or multi-national client, and there is an opportunity for repeat business. Landlords that fail to meet professional standards for accuracy, timeliness and reporting create lost opportunity. The tenant account may go to a competitor if the tenant feels the realtor misrepresented its interests in a deal.

Missing out on high-value tenants means the landlord must take higher risk tenants. National and multi-national tenants have good covenants. They are low risk for defaults and pay their rent on time. Missing out on the opportunity to attract these kinds of tenants significantly increases the landlord’s overall default risk. For a landlord with a small portfolio, this can wipe out the returns on the real estate investments for an entire year.

What lawyers want to see

Lawyers like clients that, at the very least, know where their legal documents are. Do you know what is even better? Clients that operate within the scope of their agreements and meet their commitments.

What is the area of highest tension between landlords and tenants? Operating costs. Defaults are rare. So are insurance claims. But everyone constantly deals with operating costs. No one enjoys conflicts over which expenses are legitimately charged back to the tenants.

This is where CRESSblue makes a notable difference. The terms of the operating expense recoveries in the lease agreement exist in a logical framework for processing expenses. The lease moves from being a static document in a filing cabinet to an active system automatically applying and adhering to the commitments made by the landlord. Any changes to the original lease setup automatically trigger a flag for review, so nothing slips by unnoticed.

If you want to avoid conflict over expense recoveries, put a system in place that automatically makes the best practices your default workflow.

What accountants need to know

Of course, all accountants want to see complete and accurate accounting. Rental income and expenses are the core of every financial statement, and CRESSblue links those to the tenant and property. External accountant professionals preparing financial statements under a review engagement commitment for a client will want to see the documentation for anything that creates a significant change to the balance sheet.

CRESSblue has a complete asset management capability with the ability to track assets and associated equipment. It also has fully customizable capital cost allowance functionality to track depreciation per federal and provincial or state regulations.

You create capital assets in the property database. In addition to calculating and tracking depreciation for tax purposes, you can link properties to individual leases. If the lease agreement permits capital cost recovery, the software can automatically add them to the expense recoveries similar to the operating expense recoveries.

Information access is greatly simplified for external accountants. As CRESSblue is an online application, accessing the data live from the server is simple. Depending on the level of service provided, access can be read-only or include full editing rights. Accounting review engagements requiring data verification and validation have never been so easy.

Formalizing property management for maximum wealth creation

Only you can effectively fill the responsibility to lead in the management of your property portfolio. Owning real estate investments is not as simple as holding a stock fund. If you view your real estate as a passive investment rather than a business, your potential wealth generation is lower than it could be. These case studies demonstrate how formalizing property management with better business systems results in significant gains.

Through your leadership, you can upgrade your operations with industry-specific software that delivers business systems and automation that encompass the full scope of commercial property management. This brings incredible efficiency to your business, in addition to control, accuracy and professionalism. Moreover, CRESSblue allows your internal team to manage your business with surprisingly little ongoing input from you. Professional operations and reporting are attainable by any landlord, big or small. Maximizing your wealth creation is within reach. You need only to decide to be professional.

Disclaimer

This article is for informational purposes only and is not intended as professional advice; please consult a competent professional for advice specific to you. This blog is written to stimulate thinking on concepts related to commercial leasing. Please join the discussion with your experiences.

Martin Sommer, CEO, CRESS Inc.

Martin is a founder and the CEO of CRESS Inc., a Canadian SaaS company that automates lease administration and asset management. Martin also manages Karanda Properties Limited industrial portfolio as Director of Operations in all areas of commercial property management, including new development, asset management, capital expenditures, operations, leasing and lease administration of the industrial portfolio. Martin writes about property management workflow and issues. Book Martin to speak at your industry event.

[…] and property maintenance expenses processed and paid for by Widgets Inc. There wasn’t any formal budgeting for the property management. Instead, Tom treated it as building maintenance for Widgets […]

[…] a fantastic approach, but he treated his property as a hobby and not an investment. He needed to formalize his business processes because his informal management style was limiting his wealth […]

[…] The way to overcome this is through self-education and implementing better business systems. You can read more about achieving business systems here and here. […]

[…] a regular review of the leases, these increases may be applied late or missed entirely. Using industry-specific accounting software such as CRESSblue can help you stay on top of potential increases by providing notifications of these increases or […]

[…] It’s impossible to gain all the required skills in a short period of time. If you want to build wealth and manage well, you need to build your personal network of trusted business connections so that you have reliable […]